Stringent Sterility Regulations and Rapid Microbial Detection Propel Global Bioburden Testing Market to US$4 Billion by 2032

Tuesday Jan 06, 2026

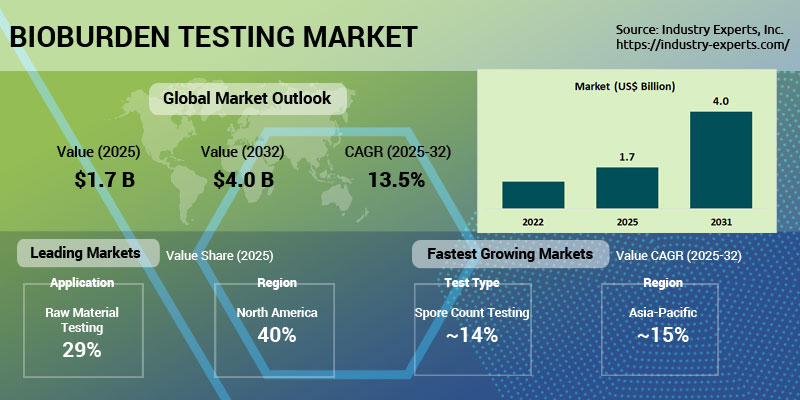

Industry Experts, Inc. has released its latest market research report, "Global Bioburden Testing Market - Products, Types and Applications", estimating that the global bioburden testing market will expand from US$1.7 billion in 2025 to US$4 billion by 2032, registering a strong CAGR of 13.5% during 2025-2032. Growth is being driven by increasingly stringent global regulatory requirements, rising sterility-assurance needs across pharmaceutical and medical device manufacturing, and rapid adoption of advanced microbial detection technologies.

Bioburden testing measures the number of viable microorganisms present on products or materials prior to sterilization and plays a critical role in validating sterilization processes, ensuring regulatory compliance, and maintaining product safety and quality. Rising production of biologics, biosimilars, and sterile injectable drugs, combined with increasing risks of healthcare-associated infections, has intensified reliance on routine bioburden monitoring across raw materials, in-process samples, medical devices, and finished products. Technological advances in automation, PCR-based detection, and rapid microbiological methods are further improving accuracy and reducing turnaround times, supporting faster regulatory decision-making.

Regionally, North America dominates the global bioburden testing market with a 40% share in 2025, representing approximately US$700 million, supported by advanced healthcare infrastructure, stringent FDA-led regulatory enforcement, and a strong concentration of pharmaceutical, biotechnology, and medical device manufacturers. High R&D investments, mature cleanroom ecosystems, and early adoption of rapid microbial detection technologies continue to reinforce the region's leadership. Asia-Pacific is the fastest-growing region, projected to register a 14.8% CAGR during 2025-2032, driven by rapid expansion of pharmaceutical and medical device manufacturing in China and India, increasing regulatory harmonization, and rising adoption of microbial testing across food, beverage, and water systems.

By product, consumables account for the largest share at 67.2% in 2025, equivalent to about US$1.1 billion, reflecting recurring demand for culture media, reagents, filtration membranes, and test kits required for each testing cycle. Their essential role in routine microbial enumeration, combined with rising testing frequency in regulated manufacturing environments, sustains strong demand. Meanwhile, instruments represent the fastest-growing segment, expanding at a 14.1% CAGR, as laboratories increasingly adopt automated microbial detection platforms, PCR systems, and high-throughput technologies to enhance efficiency and compliance.

By test type, aerobic count testing leads the market with a 37.9% share in 2025, valued at roughly US$600 million, owing to its broad applicability, cost-effectiveness, and routine use in GMP environments to assess overall microbial load. In contrast, spore count testing is growing the fastest, with a projected 14% CAGR, reflecting its critical role in validating high-level sterilization processes against highly resistant microorganisms in pharmaceutical and medical device manufacturing.

In terms of application, raw material testing represents the largest segment with a 29.3% share in 2025, driven by mandatory screening requirements under FDA and EMA guidelines to prevent downstream contamination risks. Medical device testing is the fastest-growing application, expanding at a 14.2% CAGR, supported by rising global demand for implants, catheters, and minimally invasive devices, along with tightening regulatory expectations for pre-sterilization bioburden evaluation.

By end user, pharmaceutical and biotechnology manufacturers lead the market with a 39.2% share in 2025, translating to approximately US$700 million, reflecting stringent sterility requirements, high testing volumes, and continuous regulatory oversight across drug, biologic, and vaccine production. Contract manufacturing organizations (CMOs/CROs) are the fastest-growing end-user segment, projected to grow at a 14.3% CAGR, driven by increasing outsourcing of microbial testing, cost-efficiency advantages, and expanding global biopharmaceutical manufacturing networks.

The report segments the global Bioburden Testing market by product (consumables, instruments), test type (aerobic, anaerobic, fungi/mold, spore count), application (raw material testing, in-process material testing, medical device testing, sterilization validation, equipment cleaning validation), and end user (pharmaceutical & biotechnology manufacturers, medical device manufacturers, CMOs/CROs, food & beverage manufacturers, and others). Geographic coverage spans North America, Europe, Asia-Pacific, South America, and Rest of World, with detailed analysis across 14 independent countries, along with profiles of over 10 major companies operating in the market.

For sample pages or purchase options, contact +1-320-497-3787 or visit Bioburden Testing Market Report.

About Industry Experts, Inc.

Industry Experts, Inc. ranks among the leading market research providers globally. The company's off-the-shelf and customized business intelligence reports offer strategic insights and valuable guidance to enable corporate strategists, analysts, researchers, and startups in obtaining unbiased current and future market data. For more information, contact +1-320-497-3787 or visit https://industry-experts.com.

Subscribe to Research Updates

Subscribe now and start receiving the latest updates from Industry Experts on new market research reports, key industry news and more via email.

Browse Our Reports

- Advanced Technologies

- Automotive & Transportation

- Biotechnology

- Chemicals & Materials

- Clinical Diagnostics

- Construction & Manufacturing

- Eco-Friendly Technologies

- Energy & Utilities

- Electricals & Electronics

- Food & Beverages

- Healthcare & Pharma

- Industrial Machinery

- Information Technology & Media

- Laboratory Equipment & Supplies

- Medical Equipment & Supplies

- Metals & Minerals

- Nutraceuticals

- Packaging Materials