Global Bioburden Testing Market Trends and Outlook

Bioburden refers to the number of viable microorganisms present on a product or material before sterilization. This load can originate from various sources, including raw materials, personnel, environmental conditions, water systems, or handling practices. Bioburden testing measures this contamination by quantifying viable bacteria, fungi, molds, spores, and anaerobes, typically expressed in colony-forming units, to assess microbiological cleanliness and determine the resistance of the microorganisms present. Conducted under standards such as ISO 11737-1 and U.S. FDA regulations, testing often requires cutting, disassembling, or flushing a product to extract microorganisms for culture-based enumeration. Methods include total aerobic microbial count, yeast and mold count, anaerobic count, spore analysis, membrane filtration, direct plating, and most-probable-number techniques. The results guide sterilization-process selection, validate sterilization cycles, and indicate the effectiveness of contamination control during manufacturing. Bioburden testing is routinely applied to raw materials, in-process samples, medical devices, water systems, environmental surfaces, and food and beverage products to ensure safety, regulatory compliance, and consistent product quality.

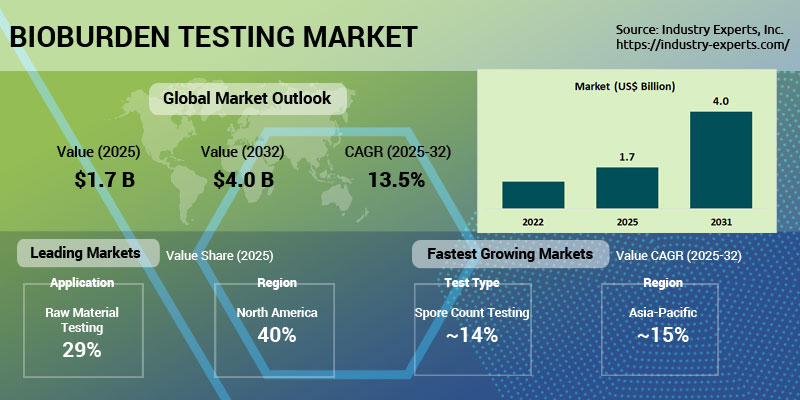

The global market for Bioburden Testing is estimated at US$1.7 billion in 2025 and is projected to reach US$4 billion by 2032, with a CAGR of 13.5% during the forecast period 2025-2032. The global bioburden testing market growth is driven primarily by stringent global regulatory requirements from agencies such as the FDA and EMA, which mandate rigorous microbial contamination control across pharmaceutical, biotechnology, and medical device manufacturing. The growing demand for sterile products, coupled with the rise of biologics and biosimilars, as well as increasing risks of healthcare-associated infections (HAIs), is resulting in a heightened reliance on bioburden testing in manufacturing environments. Advances in rapid microbial detection methods, automation, molecular diagnostics, and PCR-based systems are improving accuracy, reducing turnaround times, and supporting regulatory expectations for faster decision-making. Growing pharmaceutical production in emerging economies, rising outsourcing to CROs, and expanding applications in food, beverage, water, and environmental testing further strengthen market growth. At the same time, heightened quality-assurance standards, frequent audits, and increasing product recalls due to contamination underscore the necessity of robust bioburden monitoring throughout raw materials, in-process stages, and final products. As companies broaden their sterility-assurance programs and adopt advanced testing technologies, demand for reliable bioburden testing solutions continues to accelerate globally.

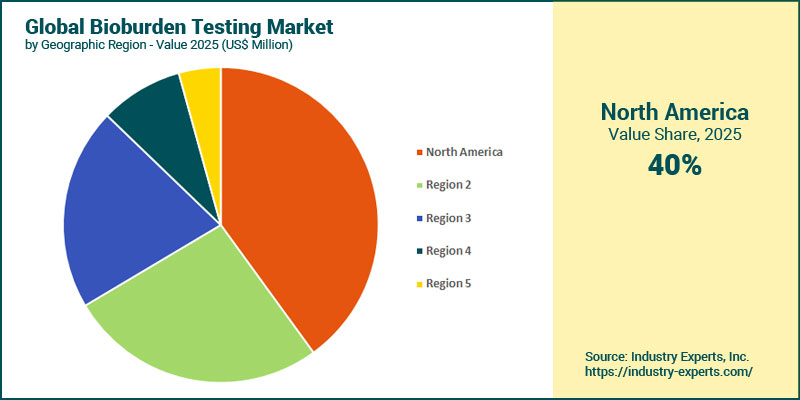

Bioburden Testing Regional Market Analysis

North America dominates the global bioburden testing market, with a share of 40% in 2025. This dominance is driven by its advanced healthcare infrastructure, stringent FDA-led regulatory enforcement, and the strong presence of major pharmaceutical, biotechnology, and medical-device manufacturers that require continuous sterility assurance. The region benefits from high R&D investment, mature cleanroom and quality-control systems, and early adoption of rapid microbiological methods, supported by leading players such as Thermo Fisher Scientific, Charles River Laboratories, and BD. Robust compliance requirements, regular regulatory audits, and the region's substantial biologics and medical device manufacturing volumes further reinforce North America's leadership by sustaining consistently high demand for dependable microbial testing. In contrast, the Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of 14.8% during the forecast period 2025-2032. This growth is driven by rapid advancements in pharmaceutical and medical device manufacturing in China and India, as well as increasing investments in healthcare infrastructure and regulatory harmonization. The region's expanding generics industry, increasing number of CMOs, and growing adoption of microbial testing in food, beverage, and water systems are accelerating demand, while governments intensify quality-control mandates to meet global export standards.

Bioburden Testing Market Analysis by Product

The consumables segment is the largest in the bioburden testing market, accounting for a 67.2% share in 2025. This leadership arises from the ongoing demand for culture media, reagents, filtration membranes, test kits, and other single-use materials necessary for each testing cycle in the pharmaceutical, biotechnology, medical device, and food industries. Their recurring use, cost-effectiveness, and essential role in ensuring microbial detection accuracy reinforce their dominance, particularly as rising biopharmaceutical production, personalized medicine, and strict regulatory standards elevate testing frequency. Expanding cleanroom operations, long-term supply contracts, and investments in advanced culture media by major suppliers further strengthen segment growth. Conversely, the instruments segment is expected to grow at the fastest CAGR of 14.1% from 2025 to 2032, fueled by the rapid adoption of automated microbial detection platforms, PCR systems, and high-throughput identification technologies that enhance speed, accuracy, and laboratory efficiency. As automation increases, the demands for stricter contamination control and reliable, rapid testing in the expanding pharmaceutical and medical device manufacturing sectors continue to drive instrument adoption.

Bioburden Testing Market Analysis by Test Type

Aerobic count testing leads the bioburden testing market with a 37.9% share in 2025, driven by its broad applicability in detecting common aerobic microorganisms that pose contamination risks across pharmaceuticals, medical devices, and food production. Its routine use in GMP environments, cost-effectiveness, and straightforward methodology make it the primary tool for assessing overall microbial load in oxygen-rich conditions. The method supports critical functions such as hygiene monitoring, contamination detection, and sterilization validation, reinforcing its dominance across diverse industrial applications. Meanwhile, Spore count testing is anticipated to record the fastest CAGR of 14% from 2025 to 2032, driven by its critical role in detecting highly resistant spore-forming bacteria such as Bacillus species that challenge sterilization processes. Its importance in validating autoclaves, dry-heat sterilizers, and radiation systems, particularly for injectable drugs and surgical instruments, is accelerating adoption. As industries tighten sterility assurance requirements, spore testing is becoming indispensable for confirming the effectiveness of high-level sterilization protocols.

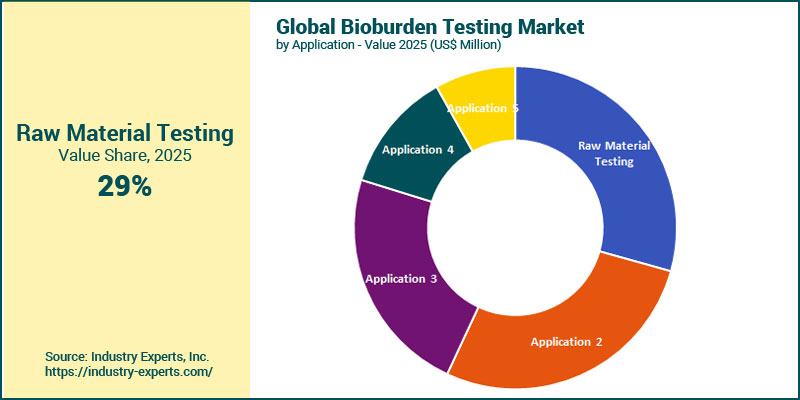

Bioburden Testing Market Analysis by Application

Raw material testing is the largest application in the bioburden testing market with a share of 29.3% in 2025. Its dominance is driven by its foundational role in ensuring microbial safety at the earliest stage of production across pharmaceutical, biotechnology, medical device, food, and cosmetics industries. Contamination in raw inputs can compromise product efficacy, stability, and regulatory compliance. As a result, routine bioburden screening is mandatory under FDA and EMA guidelines and is essential for preventing costly failures downstream. Its dominance is supported by the high testing frequency required, the volume of raw materials processed, and manufacturers' heightened focus on quality assurance and audit readiness. Meanwhile, medical device testing is the fastest-growing segment, expanding at a projected CAGR of 14.2% from 2025 to 2032, supported by rising global demand for implants, catheters, and minimally invasive instruments, all of which require strict pre-sterilization bioburden evaluation. Growth is further accelerated by tightening regulatory standards, the shift to single-use devices, and increased healthcare investment, driving adoption of advanced, automated microbial testing technologies to ensure device safety and performance.

Bioburden Testing Market Analysis by End User

Pharmaceutical & Biotechnology Manufacturers dominate the bioburden testing market with a 39.2% share in 2025, driven by stringent sterility requirements, high testing volumes, and strict FDA and EMA compliance mandates across drug, biologic, and vaccine manufacturing. These companies rely heavily on routine bioburden analysis to ensure product purity, avoid recalls, and maintain manufacturing integrity, particularly as biologics and personalized medicines evolve and increase contamination-control requirements. Their ongoing investments in R&D, rapid microbial methods, and quality-assurance infrastructure further reinforce segment leadership, while large-scale production pipelines create consistent demand for testing solutions. Meanwhile, Contract Manufacturing Organizations (CMOs/CROs) represent the fastest-growing end-user segment, with a projected CAGR of 14.3% from 2025 to 2032, supported by rising outsourcing of microbial testing, cost-efficiency advantages, access to specialized expertise, and expanding global biopharmaceutical manufacturing networks.

Bioburden Testing Market Report Scope

This global report on Bioburden Testing analyzes the market based on product, test type, application, and end user for the period 2022-2032 with projections from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Historical Period: | 2022-2024 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 10 |

Bioburden Testing Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- South America (Brazil, Argentina, and Rest of South America)

- Rest of World

Bioburden Testing Market by Product

- Consumables

- Instruments

Bioburden Testing Market by Test Type

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/ Mold Count Testing

- Spore Count Testing

Bioburden Testing Market by Application

- Raw Material Testing

- In-Process Material Testing

- Medical Device Testing

- Sterilization Validation Testing

- Equipment Cleaning Validation

Bioburden Testing Market by End User

- Pharmaceutical & Biotechnology Manufacturers

- Medical Device Manufacturers

- Contract Manufacturing Organizations (CMOs/CROs)

- Food & Beverage Manufacturers

- Other End Users (Including Microbial Testing, Environmental, Water Labs and others)

Bioburden Testing Market Frequently Asked Questions (FAQs)

The global Bioburden Testing market is likely to grow at a CAGR of 13.5% during the 2025-2032 analysis period.

North America is the largest region in the global Bioburden Testing market, with a 40% share in 2025.

Asia-Pacific is the fastest-growing region in the global Bioburden Testing market, projected to record a CAGR of 14.8% from 2025 to 2032.

Consumables are the leading product segment in the bioburden testing market, holding a 67.2% share in 2025.

Aerobic microbial count testing is the largest test type market in bioburden testing, accounting for 37.9% of the global market in 2025.

The bioburden testing market demand is driven by stringent global regulatory standards, rising sterility and quality-control requirements in pharmaceutical, biotechnology, and medical device manufacturing, increasing risks of microbial contamination, expanding biologics production, and growing adoption of advanced rapid microbial detection technologies.

The global market size for Bioburden Testing is estimated at US$1.7 billion in 2025 and US$4 billion by 2032.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Product Outline

- Bioburden Testing Defined

- Bioburden Testing Products

- Consumables

- Instruments

- Bioburden Testing Types

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/ Mold Count Testing

- Spore Count Testing

- Bioburden Testing Applications

- Raw Material Testing

- In-Process Material Testing

- Medical Device Testing

- Sterilization Validation Testing

- Equipment Cleaning Validation

- Bioburden Testing End Users

- Pharmaceutical & Biotechnology Manufacturers

- Medical Device Manufacturers

- Contract Manufacturing Organizations (CMOs/CROs)

- Food & Beverage Manufacturers

- Other End Users (Including Microbial Testing, Environmental, Water Labs and others)

2. Key Market Trends

3. Key Market Players

- Becton, Dickinson and Company (BD)

- bioMerieux SA

- Charles River Laboratories International, Inc.

- Lonza Group

- Merck KGaA

- Nelson Laboratories, LLC (Sotera Health)

- North American Science Associates Inc.(NAMSA)

- Pacific BioLabs Inc.

- SGS SA

- Thermo Fisher Scientific, Inc.

4. Key Business & Product Trends

5. Global Market Overview

- Global Bioburden Testing Market Overview by Product

- Bioburden Testing Product Market Overview by Global Region

- Consumables

- Instruments

- Global Bioburden Testing Market Overview by Test Type

- Bioburden Testing Type Market Overview by Global Region

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/ Mold Count Testing

- Spore Count Testing

- Global Bioburden Testing Market Overview by Application

- Bioburden Testing Application Market Overview by Global Region

- Raw Material Testing

- In-Process Material Testing

- Medical Device Testing

- Sterilization Validation Testing

- Equipment Cleaning Validation

- Global Bioburden Testing Market Overview by End User

- Bioburden Testing End User Market Overview by Global Region

- Pharmaceutical & Biotechnology Manufacturers

- Medical Device Manufacturers

- Contract Manufacturing Organizations (CMOs/CROs)

- Food & Beverage Manufacturers

- Other End Users

PART B: REGIONAL MARKET PERSPECTIVE

Global Bioburden Testing Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Bioburden Testing Market Overview by Geographic Region

- North American Bioburden Testing Market Overview by Product

- North American Bioburden Testing Market Overview by Test Type

- North American Bioburden Testing Market Overview by Application

- North American Bioburden Testing Market Overview by End User

- Country-Wise Analysis of the North American Bioburden Testing Market

- The United States

- United States Bioburden Testing Market Overview by Product

- United States Bioburden Testing Market Overview by Test Type

- United States Bioburden Testing Market Overview by Application

- United States Bioburden Testing Market Overview by End User

- Canada

- Canadian Bioburden Testing Market Overview by Product

- Canadian Bioburden Testing Market Overview by Test Type

- Canadian Bioburden Testing Market Overview by Application

- Canadian Bioburden Testing Market Overview by End User

- Mexico

- Mexican Bioburden Testing Market Overview by Product

- Mexican Bioburden Testing Market Overview by Test Type

- Mexican Bioburden Testing Market Overview by Application

- Mexican Bioburden Testing Market Overview by End User

7. Europe

- European Bioburden Testing Market Overview by Geographic Region

- European Bioburden Testing Market Overview by Product

- European Bioburden Testing Market Overview by Test Type

- European Bioburden Testing Market Overview by Application

- European Bioburden Testing Market Overview by End User

- Country-Wise Analysis of European Bioburden Testing Market

- Germany

- German Bioburden Testing Market Overview by Product

- German Bioburden Testing Market Overview by Test Type

- German Bioburden Testing Market Overview by Application

- German Bioburden Testing Market Overview by End User

- France

- French Bioburden Testing Market Overview by Product

- French Bioburden Testing Market Overview by Test Type

- French Bioburden Testing Market Overview by Application

- French Bioburden Testing Market Overview by End User

- The United Kingdom

- United Kingdom Bioburden Testing Market Overview by Product

- United Kingdom Bioburden Testing Market Overview by Test Type

- United Kingdom Bioburden Testing Market Overview by Application

- United Kingdom Bioburden Testing Market Overview by End User

- Italy

- Italian Bioburden Testing Market Overview by Product

- Italian Bioburden Testing Market Overview by Test Type

- Italian Bioburden Testing Market Overview by Application

- Italian Bioburden Testing Market Overview by End User

- Spain

- Spanish Bioburden Testing Market Overview by Product

- Spanish Bioburden Testing Market Overview by Test Type

- Spanish Bioburden Testing Market Overview by Application

- Spanish Bioburden Testing Market Overview by End User

- Rest of Europe

- Rest of Europe Bioburden Testing Market Overview by Product

- Rest of Europe Bioburden Testing Market Overview by Test Type

- Rest of Europe Bioburden Testing Market Overview by Application

- Rest of Europe Bioburden Testing Market Overview by End User

8. Asia-Pacific

- Asia-Pacific Bioburden Testing Market Overview by Geographic Region

- Asia-Pacific Bioburden Testing Market Overview by Product

- Asia-Pacific Bioburden Testing Market Overview by Test Type

- Asia-Pacific Bioburden Testing Market Overview by Application

- Asia-Pacific Bioburden Testing Market Overview by End User

- Country-Wise Analysis of the Asia-Pacific Bioburden Testing Market

- Japan

- Japanese Bioburden Testing Market Overview by Product

- Japanese Bioburden Testing Market Overview by Test Type

- Japanese Bioburden Testing Market Overview by Application

- Japanese Bioburden Testing Market Overview by End User

- China

- Chinese Bioburden Testing Market Overview by Product

- Chinese Bioburden Testing Market Overview by Test Type

- Chinese Bioburden Testing Market Overview by Application

- Chinese Bioburden Testing Market Overview by End User

- India

- Indian Bioburden Testing Market Overview by Product

- Indian Bioburden Testing Market Overview by Test Type

- Indian Bioburden Testing Market Overview by Application

- Indian Bioburden Testing Market Overview by End User

- South Korea

- South Korean Bioburden Testing Market Overview by Product

- South Korean Bioburden Testing Market Overview by Test Type

- South Korean Bioburden Testing Market Overview by Application

- South Korean Bioburden Testing Market Overview by End User

- Rest of Asia-Pacific

- Rest of Asia-Pacific Bioburden Testing Market Overview by Product

- Rest of Asia-Pacific Bioburden Testing Market Overview by Test Type

- Rest of Asia-Pacific Bioburden Testing Market Overview by Application

- Rest of Asia-Pacific Bioburden Testing Market Overview by End User

9. South America

- South American Bioburden Testing Market Overview by Geographic Region

- South American Bioburden Testing Market Overview by Product

- South American Bioburden Testing Market Overview by Test Type

- South American Bioburden Testing Market Overview by Application

- South American Bioburden Testing Market Overview by End User

- Country-Wise Analysis of the South American Bioburden Testing Market

- Brazil

- Brazilian Bioburden Testing Market Overview by Product

- Brazilian Bioburden Testing Market Overview by Test Type

- Brazilian Bioburden Testing Market Overview by Application

- Brazilian Bioburden Testing Market Overview by End User

- Argentina

- Argentine Bioburden Testing Market Overview by Product

- Argentine Bioburden Testing Market Overview by Test Type

- Argentine Bioburden Testing Market Overview by Application

- Argentine Bioburden Testing Market Overview by End User

- Rest of South America

- Rest of South American Bioburden Testing Market Overview by Product

- Rest of South American Bioburden Testing Market Overview by Test Type

- Rest of South American Bioburden Testing Market Overview by Application

- Rest of South American Bioburden Testing Market Overview by End User

10. Rest of World

- Rest of World Bioburden Testing Market Overview by Product

- Rest of World Bioburden Testing Market Overview by Test Type

- Rest of World Bioburden Testing Market Overview by Application

- Rest of World Bioburden Testing Market Overview by End User

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Becton, Dickinson and Company (BD)

bioMerieux SA

Charles River Laboratories International, Inc.

Lonza Group

Merck KGaA

Nelson Laboratories, LLC (Sotera Health)

North American Science Associates Inc.(NAMSA)

Pacific BioLabs Inc.

SGS SA

Thermo Fisher Scientific, Inc.

RELATED REPORTS

Global Cancer Biomarkers Market - Types, Applications and Technologies

Report Code: CDG016 | Pages: 326 | Price: $4500

Published

Jan 2026

Global Autoimmune Disease Diagnostics Market - Products, Disease Types and Test Types

Report Code: CDG006 | Pages: 338 | Price: $4500

Published

Nov 2025

Blood Preparations - A Global Market Overview

Report Code: CDG012 | Pages: 307 | Price: $4500

Published

Nov 2025

Blood Culture Test - A Global Market Overview

Report Code: CDG013 | Pages: 405 | Price: $4500

Published

Nov 2025