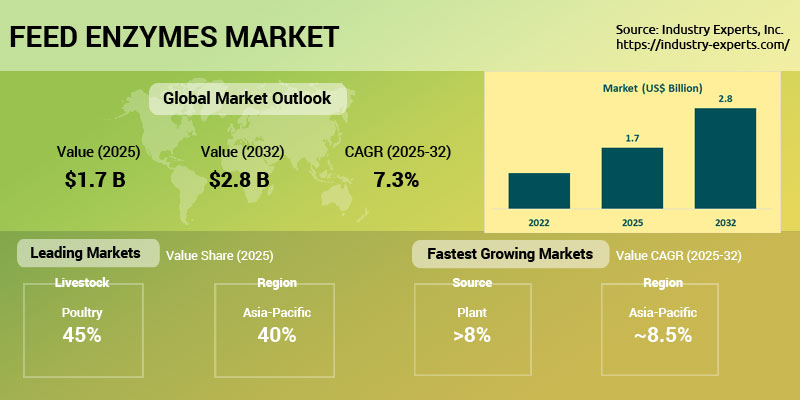

Rising Livestock Production, Sustainable Feed Practices, and Enzyme Innovation Drive Global Feed Enzymes Market to US$2.8 Billion by 2032

Tuesday Nov 25, 2025

Industry Experts, Inc. has unveiled its latest market research publication, "Global Feed Enzymes Market - Product Types, Sources, Livestock and Forms," estimating that worldwide revenues will increase from US$1.7 billion in 2025 to US$2.8 billion by 2032, registering a CAGR of 7.3% during the period 2025-2032. Growth is supported by rising global demand for animal protein, cost-efficient feed production, and heightened emphasis on sustainable livestock systems. Feed enzymes enhance nutrient digestibility, improve feed conversion ratios, and reduce anti-nutritional factors in plant-based ingredients, playing a central role in poultry, swine, ruminant, and aquaculture diets.

Advancements in genetically engineered, thermostable, and multi-enzyme formulations are expanding applicability across diverse feed ingredients and processing environments. The phase-out of antibiotic growth promoters is accelerating adoption of enzymes as natural performance enhancers that support gut health and nutrient absorption. Environmental regulations targeting phosphorus and nitrogen emissions are further strengthening demand, as enzymes lower waste output and improve nutrient utilization. Precision livestock farming, increasing awareness of feed optimization, and government support for sustainable practices continue to reinforce market expansion.

The Asia-Pacific region dominates the global feed enzymes market with a 40.3% share in 2025 and will grow the fastest at an 8.5% CAGR through 2032, driven by large-scale feed manufacturing and intensive poultry and aquaculture production in China, India, Vietnam, and Indonesia. Rising ingredient costs, sustainability mandates, and improved formulation technologies tailored for tropical climates continue to support regional leadership.

By type, Phytase leads with a 44.8% share in 2025, supported by its ability to enhance phosphorus availability, lower feed costs, and reduce environmental discharge. Protease will grow the fastest at an 8.4% CAGR, driven by increased demand for improved protein utilization and reduced nitrogen excretion. By source, Microorganism-derived enzymes dominate with a 75.6% share in 2025, reflecting their superior yield, stability, and scalability, while Plant-based enzymes expand the fastest at an 8.3% CAGR, supported by demand for natural and clean-label feed additives.

By livestock, Poultry holds the largest 45%+ share in 2025, owing to large-scale production volumes and feed efficiency requirements. Aquaculture will post the fastest 8.4% CAGR, driven by rapid fish and shrimp farming expansion and enzyme use to enhance nutrient utilization and water quality. By form, Dry formulations dominate with a 63% share in 2025, while Liquid enzymes grow fastest at 7.8% CAGR, supported by precision dosing and post-pelleting applications in advanced feed mills.

The report analyzes the global Feed Enzymes market by type (phytase, carbohydrase, protease, others), source (microorganism, plant, animal), livestock (poultry, swine, ruminants, aquatic animals, others), and form (dry, liquid) across five major regions. The study includes profiles of 10+ companies, such as AB Enzymes, Adisseo, BASF, ADM, Alltech, Cargill, International Flavors & Fragrances, Kemin, Kerry Group, Novonesis, and Novus International.

For sample pages or purchase options, contact +1-320-497-3787 or visit Feed Enzymes Market Report.

About Industry Experts, Inc.

Industry Experts, Inc. ranks among the leading market research providers globally. The company's off-the-shelf and customized business-intelligence reports offer strategic insights and valuable guidance to enable corporate strategists, analysts, researchers, and startups in obtaining unbiased current and future market data. For more information, contact +1-320-497-3787 or visit https://industry-experts.com.

Subscribe to Research Updates

Subscribe now and start receiving the latest updates from Industry Experts on new market research reports, key industry news and more via email.

Browse Our Reports

- Advanced Technologies

- Automotive & Transportation

- Biotechnology

- Chemicals & Materials

- Clinical Diagnostics

- Construction & Manufacturing

- Eco-Friendly Technologies

- Energy & Utilities

- Electricals & Electronics

- Food & Beverages

- Healthcare & Pharma

- Industrial Machinery

- Information Technology & Media

- Laboratory Equipment & Supplies

- Medical Equipment & Supplies

- Metals & Minerals

- Nutraceuticals

- Packaging Materials