Global Feed Enzymes Market Trends and Outlook

Feed enzymes are biologically active proteins added to animal feed to help animals digest nutrients more efficiently and perform better. They act as natural catalysts, breaking down complex nutrients in feed, such as carbohydrates, proteins, and fats, into simpler forms that animals can easily absorb. The most common enzyme groups used in feed include carbohydrases, proteases, and phytases, each targeting specific components of plant-based ingredients. By improving nutrient release and reducing anti-nutritional factors, feed enzymes boost feed conversion, cut down on nutrient waste, and help lower overall feed costs. They also support more sustainable livestock production by reducing phosphorus and nitrogen excretion. Traditionally produced through microbial fermentation using strains like Aspergillus, Bacillus, and Trichoderma, enzymes are now also being explored from plant-based sources. These products are widely used in poultry, swine, ruminant, and aquaculture diets and come in both dry and liquid forms, dry enzymes offering better stability during pelleting and liquid enzymes allowing flexible post-pelleting application.

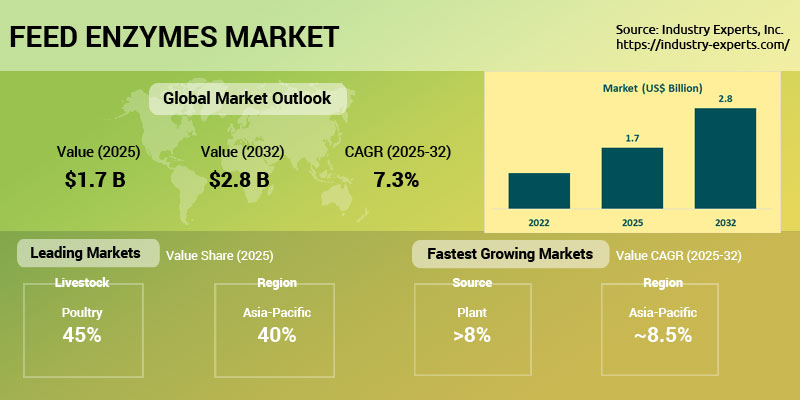

The global feed enzymes market is valued at about US$1.7 billion in 2025 and is expected to reach nearly US$2.8 billion by 2032, growing at a CAGR of 7.3% between 2025 and 2032. Growth is being fueled by rising global demand for animal protein, the need for cost-effective feed solutions, and increasing pressure to make livestock farming more sustainable. With feed accounting for the majority of production costs, enzymes have become an essential tool for improving feed efficiency and reducing expenses. Their role has grown even more important as the industry moves away from antibiotic growth promoters and seeks natural ways to support gut health. In regions like Asia-Pacific, where meat, dairy, and aquaculture consumption is rising quickly, demand for advanced feed solutions is especially strong. Innovations such as genetically engineered, thermostable enzymes and customized multi-enzyme blends are expanding their use across species and feed types. Combined with supportive government policies and greater awareness of animal nutrition, these trends position feed enzymes as a key enabler of efficient, environmentally responsible, and profitable livestock production.

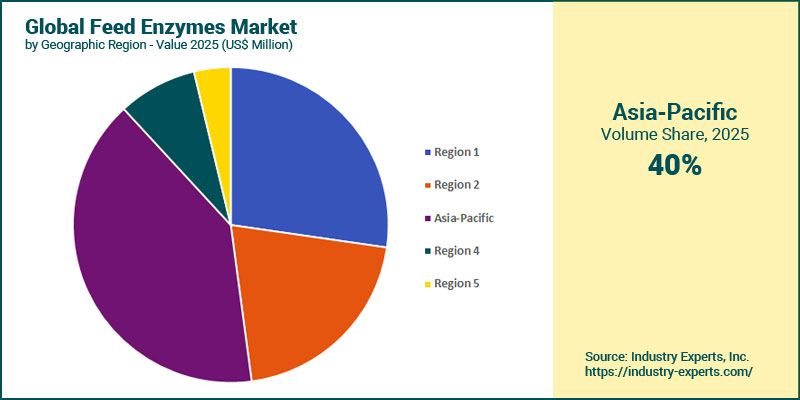

Feed Enzymes Regional Market Analysis

The Asia-Pacific region dominates the global feed enzymes market, accounting for a 40.3% share in 2025 and is projected to record the fastest CAGR of 8.5% during the forecast period of 2025-2032. The region's leadership is driven by its large-scale feed production, particularly in China, India, Vietnam, and Indonesia, where rapid industrialization of poultry and aquaculture sectors has intensified enzyme adoption. Rising feed ingredient costs and sustainability mandates have accelerated the use of enzymes to improve nutrient utilization and reduce phosphate emissions. Governments and feed producers are actively promoting the use of enzymes to improve feed conversion efficiency and reduce environmental impact. Advancements in enzyme formulation, adapted for high-temperature and humid climates, are improving product performance in tropical markets. Growth in integrated feed mills and collaborations enhances access to enzymes. The shift toward high-efficiency livestock systems and greater awareness of feed optimization benefits continue to strengthen market demand.

Feed Enzymes Market Analysis by Type

Phytases lead the global feed enzymes market with a 44.8% share in 2025, owing to its ability to enhance phosphorus digestibility, reduce feed costs, and lower environmental phosphorus discharge. It breaks down phytic acid in plant-based feed, improving the absorption of phosphorus, calcium, and amino acids, making it indispensable in poultry and swine nutrition. The emphasis on sustainable livestock production is growing, especially in Europe and Asia. Technological advancements have enhanced the stability and effectiveness of phytase across diverse feed processing conditions, enabling broader applications. Its economic and environmental benefits have made phytase a standard component in commercial feed formulations worldwide. Meanwhile, the protease segment is expected to record the fastest growth rate at a CAGR of 8.4% from 2025 to 2032. This growth is fueled by increasing demand for better protein utilization and reduced nitrogen excretion. Protease enhances amino acid availability, improving growth performance and feed conversion, especially in poultry and aquaculture. Continued innovation in enzyme engineering and multi-enzyme complexes is expanding their role in cost-efficient and sustainable livestock production.

Feed Enzymes Market Analysis by Source

Microorganism-based enzymes dominate the global feed enzymes market, accounting for 75.6% of the market share in 2025, due to their superior yield, stability, and cost-effectiveness. Enzymes derived from bacteria, fungi, and yeasts through industrial fermentation provide consistent quality and scalability, making them the preferred choice for large-scale feed production. Microbial fermentation enables genetic optimization for specific substrate breakdown, improving nutrient utilization and feed efficiency across poultry, swine, and aquaculture. These enzymes exhibit high thermal and pH stability, ensuring compatibility with pelleted feeds. The scalability and adaptability of fermentation sustain this segment's dominance, especially in high-growth regions such as the Asia-Pacific. In contrast, the plant-based enzymes segment is the fastest-growing, expected to expand at an 8.3% CAGR during 2025-2032. This growth is driven by the demand for natural, clean-label, and sustainable feed additives, plant enzymes such as papain and bromelain are gaining traction in poultry and aquaculture diets. Biotechnology advancements improving yield and stability, along with lower extraction costs, are accelerating their adoption as eco-friendly alternatives to microbial enzymes.

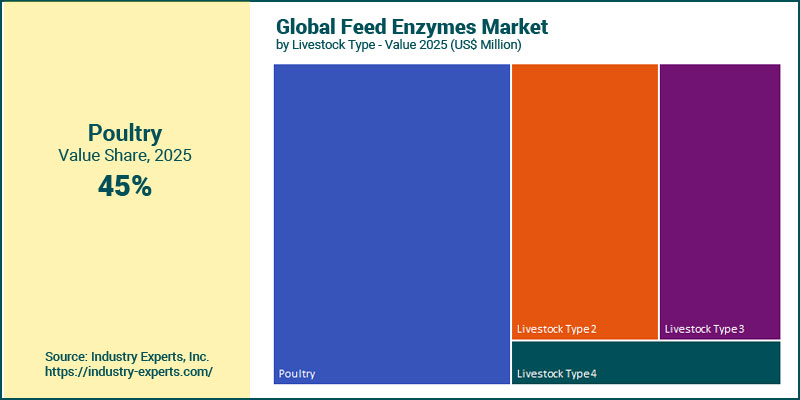

Feed Enzymes Market Analysis by Livestock

Poultry holds the largest share of over 45% in the global feed enzymes market in 2025, driven by the sector's massive scale and high feed demand. Enzyme supplementation has become standard in poultry diets to enhance nutrient digestibility, improve feed conversion ratios, and reduce production costs. Rising global demand for poultry meat and eggs, particularly in the Asia-Pacific and Latin America, is driving greater adoption of feed enzymes to enhance production efficiency and feed utilization. Large-scale commercial farms increasingly rely on enzyme technology to replace antibiotic growth promoters and optimize nutrient absorption. The cost efficiency and proven performance of enzyme-supplemented feed strengthen poultry's market dominance. Conversely, the aquaculture segment is projected to grow at the fastest CAGR of 8.4% from 2025 to 2032, driven by the rapid expansion of fish and shrimp farming in the Asia-Pacific. Enzymes improve the digestibility of plant-based proteins, enhance nutrient utilization, and reduce waste output in aquatic systems. Increased focus on sustainable aquaculture and better water quality supports the inclusion of enzymes in aquafeed formulations.

Feed Enzymes Market Analysis by Form

The Dry form segment dominates the global feed enzymes market, accounting for an estimated 63.0% share in 2025. Its dominance driven by its superior stability, ease of handling, and compatibility with pelleted feed formulations, which are standard in large-scale feed production. Dry enzymes are highly resistant to environmental variations, offering longer shelf life and minimal activity loss during high-temperature processing. Feed mills favor dry forms due to simplified logistics, reduced contamination risks, and efficient blending capabilities. Advances in microencapsulation and granulation technologies further enhance stability and uniformity in distribution. Major producers continue to refine dry enzyme formulations to meet the operational requirements of industrial feed mills across diverse climates. Their smooth integration into automated bulk feed systems enhances their leading position in the market. In contrast, the Liquid segment is anticipated to register the fastest CAGR of 7.8% from 2025 to 2032, supported by growing use in aquaculture and precision feeding systems. Liquid enzymes allow precise dosing, effortless mixing, and post-pelleting application, making them well-suited for advanced automated feed mills in Europe and North America. Ongoing innovations in enzyme stability and delivery technologies are driving the segment's rapid expansion.

Feed Enzymes Market Report Scope

This global report on Feed Enzymes analyzes the market based on type, source, livestock, and form for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Historical Period: | 2022-2024 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 10+ |

Feed Enzymes Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- South America (Brazil, Argentina, and Rest of South America)

- Rest of World

Feed Enzymes Market by Type

- Phytase

- Carbohydrase

- Protease

- Other Types (Including Lipase, Esterase, Catalase, and Other Specialty Enzymes)

Feed Enzymes Market by Source

- Microorganism

- Plant

- Animal

Feed Enzymes Market by Livestock

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Others (Including Equine, Pet Food, and Specialty livestock)

Feed Enzymes Market by Form

- Dry

- Liquid

Feed Enzymes Market Frequently Asked Questions (FAQs)

The global Feed Enzymes market is likely to grow at a CAGR of 7.3% during the 2025-2032 analysis period.

Asia-Pacific is the largest region in the global feed enzymes market, accounting for 40.3% of the share in 2025.

Asia-Pacific is also the fastest-growing region in the global feed enzymes market, projected to register an 8.5% CAGR from 2025 to 2032.

Phytase is the leading type in the feed enzymes market, holding a dominant share of 44.8% in 2025.

Microorganisms represent the largest source segment, capturing 75.6% of the global feed enzymes market in 2025.

The demand for feed enzymes is driven by rising livestock and poultry production, increasing feed costs, stringent environmental regulations, growing adoption of sustainable feed practices, and advancements in enzyme engineering and formulation technologies.

The global market size for Feed Enzymes is estimated at US$1.7 billion in 2025 and US$2.8 billion by 2032.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Product Outline

- Feed Enzymes Defined

- Feed Enzyme Types

- Phytase

- Carbohydrase

- Protease

- Other Types (Including Lipase, Esterase, Catalase, and Other Specialty Enzymes)

- Feed Enzyme Technologies

- Microorganism

- Plant

- Animal

- Feed Enzyme Livestock

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Others (Including Equine, Pet Food, and Specialty livestock)

- Feed Enzyme Form

- Dry

- Liquid

2. Key Market Trends

3. Key Market Players

- AB Enzymes GmbH

- Adisseo France SAS

- Advanced Enzyme Technologies

- Alltech Inc.

- Archer Daniels Midland (ADM)

- BASF SE

- Cargill, Incorporated

- International Flavors and Fragrances Inc.

- Kemin Industries, Inc.

- Kerry Group plc

- Novonesis Group

- Novus International, Inc.

4. Key Business & Type Trends

5. Global Market Overview

- Global Feed Enzymes Market Overview by Type

- Feed Enzymes Type Market Overview by Global Region

- Phytase

- Carbohydrase

- Protease

- Other Types

- Global Feed Enzymes Market Overview by Source

- Feed Enzymes Source Market Overview by Global Region

- Microorganism

- Plant

- Animal

- Global Feed Enzymes Market Overview by Livestock

- Feed Enzymes Livestock Market Overview by Global Region

- Poultry

- Swine

- Ruminants

- Aquatic Animals

- Others (Including Equine, Pet Food, and Specialty livestock)

- Global Feed Enzymes Market Overview by Form

- Feed Enzymes Form Market Overview by Global Region

- Dry

- Liquid

PART B: REGIONAL MARKET PERSPECTIVE

- Global Feed Enzymes Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Feed Enzymes Market Overview by Geographic Region

- North American Feed Enzymes Market Overview by Type

- North American Feed Enzymes Market Overview by Source

- North American Feed Enzymes Market Overview by Livestock

- North American Feed Enzymes Market Overview by Form

- Country-Wise Analysis of the North American Feed Enzymes Market

- The United States

- United States Feed Enzymes Market Overview by Type

- United States Feed Enzymes Market Overview by Source

- United States Feed Enzymes Market Overview by Livestock

- United States Feed Enzymes Market Overview by Form

- Canada

- Canadian Feed Enzymes Market Overview by Type

- Canadian Feed Enzymes Market Overview by Source

- Canadian Feed Enzymes Market Overview by Livestock

- Canadian Feed Enzymes Market Overview by Form

- Mexico

- Mexican Feed Enzymes Market Overview by Type

- Mexican Feed Enzymes Market Overview by Source

- Mexican Feed Enzymes Market Overview by Livestock

- Mexican Feed Enzymes Market Overview by Form

7. Europe

- European Feed Enzymes Market Overview by Geographic Region

- European Feed Enzymes Market Overview by Type

- European Feed Enzymes Market Overview by Source

- European Feed Enzymes Market Overview by Livestock

- European Feed Enzymes Market Overview by Form

- Country-Wise Analysis of European Feed Enzymes Market

- Germany

- German Feed Enzymes Market Overview by Type

- German Feed Enzymes Market Overview by Source

- German Feed Enzymes Market Overview by Livestock

- German Feed Enzymes Market Overview by Form

- France

- French Feed Enzymes Market Overview by Type

- French Feed Enzymes Market Overview by Source

- French Feed Enzymes Market Overview by Livestock

- French Feed Enzymes Market Overview by Form

- The United Kingdom

- United Kingdom Feed Enzymes Market Overview by Type

- United Kingdom Feed Enzymes Market Overview by Source

- United Kingdom Feed Enzymes Market Overview by Livestock

- United Kingdom Feed Enzymes Market Overview by Form

- Italy

- Italian Feed Enzymes Market Overview by Type

- Italian Feed Enzymes Market Overview by Source

- Italian Feed Enzymes Market Overview by Livestock

- Italian States Feed Enzymes Market Overview by Form

- Spain

- Spanish Feed Enzymes Market Overview by Type

- Spanish Feed Enzymes Market Overview by Source

- Spanish Feed Enzymes Market Overview by Livestock

- Spanish Feed Enzymes Market Overview by Form

- Rest of Europe

- Rest of Europe Feed Enzymes Market Overview by Type

- Rest of Europe Feed Enzymes Market Overview by Source

- Rest of Europe Feed Enzymes Market Overview by Livestock

- Rest of Europe Feed Enzymes Market Overview by Form

8. Asia-Pacific

- Asia-Pacific Feed Enzymes Market Overview by Geographic Region

- Asia-Pacific Feed Enzymes Market Overview by Type

- Asia-Pacific Feed Enzymes Market Overview by Source

- Asia-Pacific Feed Enzymes Market Overview by Livestock

- Asia-Pacific Feed Enzymes Market Overview by Form

- -Wise Analysis of the Asia-Pacific Feed Enzymes Market

- Japan

- Japanese Feed Enzymes Market Overview by Type

- Japanese Feed Enzymes Market Overview by Source

- Japanese Feed Enzymes Market Overview by Livestock

- Japanese Feed Enzymes Market Overview by Form

- China

- Chinese Feed Enzymes Market Overview by Type

- Chinese Feed Enzymes Market Overview by Source

- Chinese Feed Enzymes Market Overview by Livestock

- Chinese Feed Enzymes Market Overview by Form

- India

- Indian Feed Enzymes Market Overview by Type

- Indian Feed Enzymes Market Overview by Source

- Indian Feed Enzymes Market Overview by Livestock

- Indian Feed Enzymes Market Overview by Form

- South Korea

- South Korean Feed Enzymes Market Overview by Type

- South Korean Feed Enzymes Market Overview by Source

- South Korean Feed Enzymes Market Overview by Livestock

- South Korean Feed Enzymes Market Overview by Form

- Rest of Asia-Pacific

- Rest of Asia-Pacific Feed Enzymes Market Overview by Type

- Rest of Asia-Pacific Feed Enzymes Market Overview by Source

- Rest of Asia-Pacific Feed Enzymes Market Overview by Livestock

- Rest of Asia-Pacific Feed Enzymes Market Overview by Form

9. South America

- South American Feed Enzymes Market Overview by Geographic Region

- South American Feed Enzymes Market Overview by Type

- South American Feed Enzymes Market Overview by Source

- South American Feed Enzymes Market Overview by Livestock

- South American Feed Enzymes Market Overview by Form

- Country-Wise Analysis of the South American Feed Enzymes Market

- Brazil

- Brazilian Feed Enzymes Market Overview by Type

- Brazilian Feed Enzymes Market Overview by Source

- Brazilian Feed Enzymes Market Overview by Livestock

- Brazilian Feed Enzymes Market Overview by Form

- Argentina

- Argentine Feed Enzymes Market Overview by Type

- Argentine Feed Enzymes Market Overview by Source

- Argentine Feed Enzymes Market Overview by Livestock

- Argentine Feed Enzymes Market Overview by Form

- Rest of South America

- Rest of South American Feed Enzymes Market Overview by Type

- Rest of South American Feed Enzymes Market Overview by Source

- Rest of South American Feed Enzymes Market Overview by Livestock

- Rest of South American Feed Enzymes Market Overview by Form

10. Rest of World

- Rest of World Feed Enzymes Market Overview by Type

- Rest of World Feed Enzymes Market Overview by Source

- Rest of World Feed Enzymes Market Overview by Livestock

- Rest of World Feed Enzymes Market Overview by Form

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

AB Enzymes GmbH

Adisseo France SAS

Advanced Enzyme Technologies

Alltech Inc.

Archer Daniels Midland (ADM)

BASF SE

Cargill, Incorporated

DSM-Firmenich

International Flavors and Fragrances Inc.

Kemin Industries, Inc.

Kerry Group plc

Novonesis Group

Novus International, Inc.

RELATED REPORTS

Feed Acidulants - A Global Market Overview

Report Code: AGR023 | Pages: 391 | Price: $4500

Published

Jan 2026

Global Seed Coating Market - Additives, Processes and Crop Types

Report Code: AGR044 | Pages: 262 | Price: $4500

Published

Nov 2025

Global Potash Fertilizers Market - Product Types, Applications, Forms and Crop Types

Report Code: AGR041 | Pages: 306 | Price: $4500

Published

Nov 2025

Global Biological Seed Treatment Market - Sources, Functions and Crop Types

Report Code: AGR015 | Pages: 251 | Price: $4500

Published

Oct 2025