Published Date: Mar 2019

Report Code: FB024

Pages: 662

Charts: 363

Report Synopsis

Growth in the global hydrocolloids demand is mainly anticipated to driven by increasing demand from food & beverages and oil & gas sectors. Food additives are becoming a necessary part of food and beverages industry and natural clean label food additives such as hydrocolloids penetration is on the rise. The hydrocolloids industry is forecast to receive an impetus from this booming demand. Increasing health consciousness and changing eating habits of consumers, especially in developing regions, are also the driving factors for hydrocolloids growth in the food and beverage sector. Increasing oil drilling activities in the United States and Canada, and continued usage of hydrocolloids in Middle Eastern oil producing nations is driving the demand for hydrocolloids such as guar gum, xanthan gum and carboxymethyl cellulose.

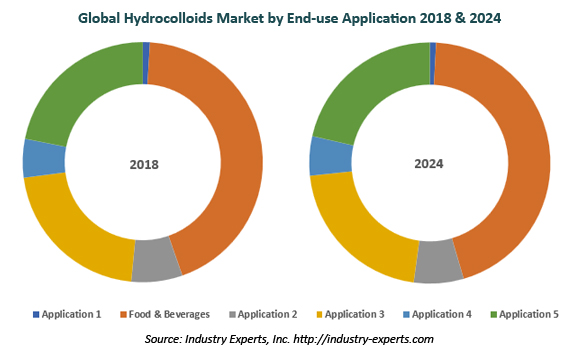

Food & Beverages form the largest application for Hydrocolloids on a global basis in terms of value, the market for which is estimated at US$5.4 billion (43.7% share) in 2018 and is projected to reach US$7.1 billion by 2024 to reflect the fastest 2018-2024 CAGR of 4.9%. in terms of volume, the global market for Hydrocolloids is estimated at 2.2 million metric tons in 2018.

Research Findings & Coverage

- Global market for hydrocolloids is analyzed in this report with respect to raw material sources, product types and end-use applications

- The study exclusively analyzes the market size for hydrocolloid raw material source by product type and end-use application globally and in all major regions. The report also analyzes the market for hydrocolloids by raw material source, product type and application in each major country across the globe

- Demand for Hydrocolloids in Food & Beverages Being Driven by Clean Label and Non-GMO Trends

- Hydrocolloids Offer Potential for Making Edible Coatings and Films

- Growth in Low-pH Dairy Beverages to Drive Pectin Demand

- Restrained Demand for Select Hydrocolloids Due to Tighter Raw Material Supply in the Offing

- Key business trends focusing on product innovations/developments, M&As, JVs and other recent industry developments

- Major companies profiled – 245

- The industry guide includes the contact details for 500 companies

Product Outline

The following Hydrocolloids raw material sources are analyzed in this report:

- Animal-derived (Gelatin)

- Microbial-fermented

- Plant-derived

- Seaweed-derived

- Cellulose-based

The report analyzes the following keyproduct types of Hydrocolloids:

- Gelatin

- Xanthan Gum

- Gellan Gum

- Guar Gum

- Gum Arabic

- LBG

- Tara Gum

- Pectin

- Agar-Agar

- Alginates

- Carrageenan

- CMC

- MC & HPMC

- MCC

The studyexplores the following major applications of Hydrocolloids:

- Animal Feed

- Food & Beverages

- Cosmetics & Personal Care

- Pharma & Healthcare

- Oil & Gas

- Industrial/Technical

Analysis Period, Units and Growth Rates

- The report reviews, analyzes and projects the global market for Hydrocolloids for the period 2015-2024 in terms of volume in Metric Tons and value in US$ and the compound annual growth rates (CAGRs) projected from 2018 through 2024

Geographic Coverage

- North America (The United States, Canada and Mexico)

- Europe (France, Germany, Italy, Poland, Russia, Spain, The United Kingdom and Rest of Europe)

- Asia-Pacific (China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Rest of Asia-Pacific)

- South America (Brazil, Argentina and Rest of South America)

- Rest of World (South Africa, Turkey, and Other Rest of World for all hydrocolloids; Oman, Saudi Arabia and United Arab Emirates for select hydrocolloids)

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

1.1 Product Outline

1.1.1 Hydrocolloids

1.1.1.1 Types of Hydrocolloids

1.1.1.1.1 Animal-derived Hydrocolloids

1.1.1.1.1.1 Gelatin

1.1.1.1.1.1.1 Applications

1.1.1.1.1.2 Casein/Caseinates

1.1.1.1.1.3 Chitin and Chitosan

1.1.1.1.2 Cellulose-derived Hydrocolloids

1.1.1.1.2.1 Carboxymethyl Cellulose (CMC)

1.1.1.1.2.1.1 Applications

1.1.1.1.2.2 Methyl Cellulose (MC) and Hydroxypropylmethyl Cellulose (HPMC)

1.1.1.1.2.2.1 Applications

1.1.1.1.2.3 Microcrystalline Cellulose (MCC)

1.1.1.1.2.3.1 Applications

1.1.1.1.2.4 Other Cellulose Ethers

1.1.1.1.3 Microbial-fermented Hydrocolloids

1.1.1.1.3.1 Xanthan Gum

1.1.1.1.3.1.1 Applications

1.1.1.1.3.2 Gellan Gum

1.1.1.1.3.2.1 Applications

1.1.1.1.3.3 Dextran

1.1.1.1.3.4 Curdlan

1.1.1.1.3.5 Pullulan

1.1.1.1.4 Plant-derived Hydrocolloids

1.1.1.1.4.1 Exudate Gums

1.1.1.1.4.1.1 Gum Arabic (Acacia Gum)

Applications

1.1.1.1.4.1.2 Gum Tragacanth

1.1.1.1.4.1.3 Karaya Gum

1.1.1.1.4.1.4 Gum Ghatti

1.1.1.1.4.2 Seed Extracts

1.1.1.1.4.2.1 Guar Gum

Applications

1.1.1.1.4.2.2 Locust Bean Gum (LBG)

Applications

1.1.1.1.4.2.3 Cassia gum

1.1.1.1.4.2.4 Tara Gum

Applications

1.1.1.1.4.2.5 Other Seed Extracts

1.1.1.1.4.3 Pectins

1.1.1.1.4.3.1 Types of Pectins

High Methylated Ester Pectins

Low Methylated Ester pectins

Amidated Pectin

1.1.1.1.4.3.2 Applications

1.1.1.1.5 Seaweed-derived Hydrocolloids

1.1.1.1.5.1 Types of Seaweed-derived Hydrocolloids

1.1.1.1.5.1.1 Agar-Agar

Applications

1.1.1.1.5.1.2 Alginates

Applications

1.1.1.1.5.1.3 Carrageenans

Applications

2. KEY MARKET TRENDS

2.1 Demand for Hydrocolloids in Food & Beverages Being Driven by Clean Label and Non-GMO Trends

2.2 Hydrocolloids Offer Potential for Making Edible Coatings and Films

2.3 Growth in Low-pH Dairy Beverages to Drive Pectin Demand

2.4 Mixed Opportunities for Seaweed Hydrocolloids

2.5 Restrained Demand for Select Hydrocolloids Due to Tighter Raw Material Supply in the Offing

2.6 Demand for Hydrocolloids Propelled by Trends in Fat and Sugar Reduction

2.7 Xanthan Gum’s Potential in the Oil & Gas Sector on an Upswing

2.8 Gelatin’s Application in Food & Beverages being Hindered by Alternatives

2.9 Capsule Production with Plant-Derived HPMC Gaining Ground

2.10 Demand for Hydrocolloids to be Bolstered by Firm Growth in Oil Drilling Activities

3. KEY GLOBAL PLAYERS

Accel Carrageenan Corporation (Philippines)

Algaia S.A. (France)

Alland& Robert (France)

Andi-Johnson Group (China)

Archer-Daniels-Midland Company (United States)

Asahi Kasei Corporation (Japan)

Ashland Global Holdings Inc. (United States)

Cargill, Inc. (United States)

CAROB S.A. (Spain)

Compania Espanola de Algas Marinas, S.A. (CEAMSA) (Spain)

CP Kelco U.S., Inc. (United States)

DSM Hydrocolloids (China)

DuPont Nutrition & Health (Denmark)

Fufeng Group Limited (China)

GelatinesWeishardt S.A. (France)

GELITA AG (Germany)

GELNEX (Brazil)

Gelymar S.A. (Chile)

Hebei Xinhe Biochemical Co., Ltd (China)

Herbstreith& Fox KG (Germany)

Hindustan Gum & Chemicals Ltd. (India)

Hispanagar, S.A. (Spain)

Industrias Roko, S.A. (Spain)

Jai Bharat Gum & Chemicals Ltd (India)

Jellice Corporation (Japan)

Jungbunzlauer Suisse AG (Switzerland)

KIMICA Corporation (Japan)

Lamberti SpA (Italy)

Marcel Trading Corporation (Philippines)

MeiHua Holdings Group Co., Ltd (China)

MSC Co., Ltd. (South Korea)

Nexira SAS (France)

Nitta Gelatin Inc. (Japan)

Nouryon (Netherlands)

PB Leiner (Belgium)

QuimicaAmtex S.A. (Columbia)

Rousselot BV (Darling Ingredients) (Netherlands)

Shandong Head Co., Ltd. (China)

Shandong Jiejing Group Corporation (China)

Shanghai Brilliant Gum Co., Ltd. (BLG) (China)

Shin-Etsu Chemical Co., Ltd. (Japan)

Silvateam S.p.A. (Italy)

Solvay SA (Belgium)

Sterling Gelatin (India)

The Dow Chemical Company (United States)

TIC Gums, Inc. (United States)

Vikas WSP Limited (India)

W Hydrocolloids, Inc. (RICO Carrageenan) (Philippines)

Yantai Sheli Hydrocolloids Co., Ltd. (China)

Zhenpai Hydrocolloids Co., Ltd. (China)

Zibo Zhongxuan Biochemical Co., Ltd. (Deosen Biochemical Co., Ltd.) (China)

4. KEY BUSINESS AND PRODUCT TRENDS

Ingredion Adds Single Hydrocolloids to Reinforce its Portfolio

Cambrian Solutions, CEAMSA's Exclusive Distributor of Hydrocolloids in Canada

DSM to Purchase an Additional 46% Stake in Andre Pectin

Cornelius Selected as Distributor of Algaia's Alginate Portfolio in the UK and Ireland

CP Kelco's Carboxymethyl Cellulose Plant for Sale in China

Launch of New Brand Identities for DSM's Gellan Gum and Xanthan Gum

Algaia and Gelymar Form New Long-term Commercial and Development Pact

Solvay's Hydrocolloid Product Line Acquired by PMC Group International

CP Kelco’s GENU® Pectin Products Receive Non-GMO Project Verification

Accent Microcell Private Limited is EXCiPACT Certified

Expansion of Dow's Methyl Cellulose Capacity in Germany

Ashland Increases its Hydroxyethylcellulose Production Capacity

AIDP, Distributor Partner in North America for Gelymar's Carrageenan Products

CP Kelco to Expand Danish Pectin Plant’s Production Capacity by 15%

Distribution Partners Selected by Cargill for Sustainable Growth of its Food Ingredients and Applications Business in North America

Ceamsa and Palmer Holland Inks Hydrocolloids Distribution Deal

CP Kelco Launches Label-Friendly GENU® Explorer Pectin ND-200 for Neutral Desserts

NOP Organic Certification for Java Biocolloid's Seaweed GracilariaVerrucosa Extracts

PB Leiner is the New Company Brand Name of PB Gelatins/PB Leiner

Joint Venture Formed by Alland& Robert and Sayaji for Spray Dried Acacia Gum Production

Nouryon is the New Name for AkzoNobel Specialty Chemicals

Frutarom Acquired by IFF

CP Kelco's 30 CEKOL® Cellulose Gum products Verified by Non-GMO Project

Naturex SA is Acquired by Swiss based Givaudan Group

ISC Gums chose HORN as Specialty Distributor of Gum Acacia in the Western US

Jellice Pioneer Expands the Most Modern Gelatin Factory in Europe

DuPont™ Danisco® Lactogel® FC 5200 Recognized by Fi South America Innovation Awards

New Non-GMO Project Verified Hydrocolloids added to TIC Gums' Ingredients

Range of Carrageenans and Blends for Cosmetic Applications Introduced by Algaia

ADM Opens New Technical Innovation Centre, Regional Office in Shanghai

Herbstreith& Fox Develops LM Pectins for Organic Applications

Silvateam Selects Brenntag as its Pectin Distribution Partner in North America

Cargill Plans to Construct $150 million HM Pectin Plant in Brazil

DSM Hydrocolloids Opens DSM Zhongken Biotechnology to Broaden Biogum Innovation Capability

AkzoNobel and Renmatix Partner to Create a New Form of Crystalline Cellulose

Cargill Partners with BioHope and Sanrise China for the Cosmetics Ingredients Distribution in China

Cargill Expands its Seabrid™ Portfolio of Carrageenans for Creamy Dairy Desserts

TIC Gums to Introduce Simplistica™ line of ingredient systems at IFT 2018

Mitsubishi Corporation Consolidates its Life Sciences Business

Rousselot to Display Clean Label Gelatin Solutions at IFT 2018 in Chicago

TICOrganic® Tara Gum HV added to hydrocolloids portfolio of TIC Gums

Majority of Jungbunzlauer Products Obtains Non-GMO Project Verification

Marcel Trading Corporation Acquired CP Kelco’s Philippines Carrageenan Plant

DuPont Nutrition & Health Divests Alginates Business to JRS Group

Quick Shell37 Allows for a Fast Use of Sugar Layers in Making Pan Coated Products

Rousselot Launches X-Pure® Medical Grade Gelatin Range for In-Body Usage

Majority of Jungbunzlauer Products Received Non-GMO Project Verification

Algaia and Arles Agroalimentaire Inks Distribution Pact for Alginates in France

CP Kelco’s Xanthan Gum Products Receives Non-GMO Project Verification

CP Kelco to Enter Indonesian Distribution Partnership with Azelis

TIC Gums Offers US-Produced GuarNT® USA for Pet Food and Treat Applications

Non-GMO Project Verification for CP Kelco's Four New KELCOGEL® Gellan Gum Products

PT. Azelis Indonesia Distribusi Selected as CP Kelco's Exclusive Distributor in Indonesia

Ukraine based T.B.Fruit Constructs Pectin Production Line

DRG Gelatin, Nitta Gelatin's New Pharmaceutical Gelatin

DuPont Nutrition & Health Launches Pectin for Reduced Sugar Fruit Spreads

Unipex to Distribute Algaia’s Hydrocolloids for Personal Care Markets

Algaia Introduces Satialgine DVA Alginate for Low-Fat Desserts

Java Biocolloid Establishes an Operative Branch in Trieste

United States to Import Gum Arabic Directly from Sudan

DSM and Haixing to Acquire Inner Mongolia Rainbow Biotechnology

DowDuPont Completes FMC Corporation’s Health & Nutrition Business Acquisition

Shin-Etsu Chemical Invests to Strengthen its Cellulose Derivatives Business

Gelnex to Build New Gelatin Production Unit in Brazil

AkzoNobel Increases EHEC Cellulosic Ethers Production

SE Tylose Starts New Technical Centre at the Science Park II in Singapore

Launch of TIC Gums' New Hydrocolloid Solutions at SupplySide West 2017

Successful Completion of the Merger between Dow and DuPont

Gelymar Moves its Headquarters to Santiago

Launch of Syndeo Range of Hydrocolloids

Algia Expands in North America with a Distribution Pact with AIDP Inc.

Cargill Introduced New Seabrid™ Carrageenans for Gelled Dairy Desserts

First Acquisition of Roquette in the Pharmaceutical Excipients Market

GELITA's $22-Million Project Received Official Go-Ahead from Woodbury County Board of Supervisors

CP Kelco's KELCOGEL® Gellan Gum Production Capacity Increased to Meet the Growing Market Demand

Ingredion Acquires TIC Gums

Cargill’s Alginates Business is Acquired by Algaia

GELITA to Construct Ultra-Modern Facilities in Eberbach

Inauguration of Ashland's New Pharmaceutical Excipient Manufacturing Unit in China

Introduction of DuPont's New Range of GRINDSTED® JU Systems for the South Asia Market

W Hydrocolloids Acquired Kerry Group’s Seaweed Processing Facility in Philippines

Launch of Ticaloid® Ultrasmooth NGMO Original by TIC Gums

Nexira Becomes an Independent Company

Vegan Xanthan Gum Grades Introduced by Jungbunzlauer

Eviagenics is now Algaia

Samsung Group's Chemical Businesses Acquired by Lotte Chemical Group

Addition of Gellan Gum to TIC Gums' Portfolio of Hydrocolloids

Magnus Union Plans to Built Pectin Production Plant in Belgorod, Russia

CP Kelco to Increase Pectin Production Capacity in Europe

Asahi Kasei and SPI Pharma Form Pharmaceutical Additives Reciprocal Sales Pact

CP Kelco Aims to Construct a New Production Plant in North America for Gellan Gum and Specialty Xanthan Gum

Nexira'sFibregum™ Acacia Fiber and Instantgum™ Acacia Gum Ingredients Verified by the Non-GMO Project

Cargill Acquires FMC’s Pectin Operations

CP Kelco to Expand Distribution Partnership with L.V. Lomas into the United States

CP Kelco Expands Specialty Biogums Production Capacity

Certified Organic Tara Gum Products Offered by Exandal

TIC Gums Launches Pretested Apple Pectin

CP Kelco Plans to Build New Citrus Peel Plant in Latin America

5. GLOBAL MARKET OVERVIEW

5.1 Global Hydrocolloids Market Overview by Raw Material Source

5.1.1 Hydrocolloids Raw Material Source Market Overview by Global Region

5.1.1.1 Animal-derived Hydrocolloid (Gelatin)

5.1.1.2 Microbial-fermented Hydrocolloids

5.1.1.3 Plant-derived Hydrocolloids

5.1.1.4 Seaweed-derived Hydrocolloids

5.1.1.5 Cellulose-based Hydrocolloids

5.1.2 Global Hydrocolloids Raw Material Source Market Overview by Product Type

5.1.2.1 Microbial-fermented Hydrocolloids

5.1.2.2 Plant-derived Hydrocolloids

5.1.2.3 Seaweed-derived Hydrocolloids

5.1.2.4 Cellulose-based Hydrocolloids

5.2 Global Hydrocolloids Market Overview by End-use Application

5.2.1 Hydrocolloids End-use Application Market Overview by Global Region

5.2.1.1 Animal Feed

5.2.1.2 Food & Beverages

5.2.1.3 Cosmetics & Personal Care

5.2.1.4 Pharmaceuticals & Healthcare

5.2.1.5 Oil & Gas Applications

5.2.1.6 Industrial/Technical Applications

PART B: REGIONAL MARKET PERSPECTIVE

Global Hydrocolloids Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

6.1 North American Hydrocolloids Market Overview by Geographic Region

6.2 North American Hydrocolloids Market Overview by End-use Application

6.3 North American Hydrocolloids Market Overview by Raw Material Source

6.3.1 Animal-derived Hydrocolloids (Gelatin)

6.3.1.1 North American Gelatin Market Overview by End-use Application

6.3.2 Microbial-fermented Hydrocolloids

6.3.2.1 North American Microbial-fermented Hydrocolloids Market Overview by Product Type

6.3.2.2 North American Microbial-fermented Hydrocolloids Market Overview by End-use Application

6.3.3 Plant-derived Hydrocolloids

6.3.3.1 North American Plant-derived Hydrocolloids Market Overview by Product Type

6.3.3.2 North American Plant-derived Hydrocolloids Market Overview by End-use Application

6.3.4 Seaweed-derived Hydrocolloids

6.3.4.1 North American Seaweed Hydrocolloids Market Overview by Product Type

6.3.4.2 North American Seaweed Hydrocolloids Market Overview by End-use Application

6.3.5 Cellulose-based Hydrocolloids

6.3.5.1 North American Cellulose-based Hydrocolloids Market Overview by Product Type

6.3.5.2 North American Cellulose-based Hydrocolloids Market Overview by End-use Application

6.4 Major Market Players

AEP Colloids, div. of Sarcom Inc. (United States)

Agarmex, S.A. De C.V. (Mexico)

Archer-Daniels-Midland Company (United States)

Ashland Global Holdings Inc. (United States)

Cargill, Inc. (United States)

CP Kelco U.S., Inc. (United States)

Darling Ingredients, Inc. (United States)

DuPont Nutrition and Health (Mexico)

Exandal Corp. (United States)

GELITA USA Inc. (United States)

Guar Resources, LLC. (United States)

Ingredients Solutions, Inc. (United States)

ISC Gums (Importers Service Corp) (United States)

J.F. Hydrocolloids, Inc. (United States)

Kenney & Ross Limited (Canada)

Nitta Gelatin NA Inc. (United States)

Pacific Pectin, Inc. (United States)

PB Leiner USA (United States)

QuimicaAmtex, S.A. De C.V. (Mexico)

Rayonier Advanced Materials, Inc. (United States)

SE Tylose USA, Inc.

The Dow Chemical Company (United States)

TIC Gums, Inc. (United States)

Vanderbilt Minerals, LLC (United States)

Wego Chemical Group (United States)

Weishardt International NA (Canada)

7. EUROPE

7.1 European Hydrocolloids Market Overview by Geographic Region

7.2 European Hydrocolloids Market Overview by End-use Application

7.3 European Hydrocolloids Market Overview by Raw Material Source

7.3.1 Animal-derived Hydrocolloids (Gelatin)

7.3.1.1 European Gelatin Market Overview by End-use Application

7.3.2 Microbial-fermented Hydrocolloids

7.3.2.1 European Microbial-fermented Hydrocolloids Market Overview by Product Type

7.3.2.2 European Microbial-fermented Hydrocolloids Market Overview by End-use Application

7.3.3 Plant-derived Hydrocolloids

7.3.3.1 European Plant-derived Hydrocolloids Market Overview by Product Type

7.3.3.2 European Plant-derived Hydrocolloids Market Overview by End-use Application

7.3.4 Seaweed-derived Hydrocolloids

7.3.4.1 European Seaweed Hydrocolloids Market Overview by Product Type

7.3.4.2 European Seaweed Hydrocolloids Market Overview by End-use Application

7.3.5 Cellulose-based Hydrocolloids

7.3.5.1 European Cellulose-based Hydrocolloids Market Overview by Product Type

7.3.5.2 European Cellulose-based Hydrocolloids Market Overview by End-use Application

7.4 Major Market Players

Agrigum International Ltd (United Kingdom)

Algaia S.A. (France)

Alland& Robert (France)

Arthur Branwell& Co Ltd (United Kingdom)

B&V srl (Italy)

Cargill Europe

CAROB S.A. (Spain)

Compania Espanola de Algas Marinas, S.A. (CEAMSA) (Spain)

COPALIS (France)

CP Kelco Europe

DFE Pharma GmbH & Co.KG (Germany)

Dow Deutschland AnlagengesellschaftmbH (Germany)

DuPont Nutrition & Health (Denmark)

Ewald-Gelatine GmbH (Germany)

GelatinesWeishardt S.A. (France)

GELITA AG (Germany)

Herbstreith& Fox KG (Germany)

Hispanagar, S.A. (Spain)

Iberagar S.A. (Portugal)

Industrias Roko, S.A. (Spain)

Italgelatine S.p.A. (Italy)

J. Rettenmaier&Sohne GmbH & Co KG (Germany)

Jellice Pioneer Europe B.V. (Netherlands)

JuncaGelatines, S.L. (Spain)

Jungbunzlauer Suisse AG (Switzerland)

Kerry Group (Ireland)

Lamberti SpA (Italy)

LapiGelatine S.p.A (Italy)

LBG Sicilia srl (Italy)

Mare S.p.A (Italy)

Mikro-Technik GmbH & Co. KG (Germany)

Naturex SA (France)

Nexira SAS (France)

Norevo GmbH (Germany)

Nouryon (Netherlands)

PB Leiner (Belgium)

Pectcof B.V. (Netherlands)

Phrikolat Drilling Specialties GmbH (Germany)

Polygal AG (Switzerland)

REINERT GRUPPE Ingredients GmbH (Germany)

Roquette Freres (France)

Rousselot BV (Darling Ingredients) (Netherlands)

SE Tylose GmbH & Co. KG (Germany)

SEPPIC S.A. (France)

SilvateamS.p.a. (Italy)

Sobigel S.A. (France)

Solvay SA (Belgium)

Tate & Lyle PLC (United Kingdom)

TrobasGelatine B.V. (Netherlands)

UNIPEKTIN Ingredients AG (Switzerland)

8. ASIA-PACIFIC

8.1 Asia-Pacific Hydrocolloids Market Overview by Geographic Region

8.2 Asia-Pacific Hydrocolloids Market Overview by End-use Application

8.3 Asia-Pacific Hydrocolloids Market Overview by Raw Material Source

8.3.1 Animal-derived Hydrocolloids (Gelatin)

8.3.1.1 Asia-Pacific Gelatin Market Overview by End-use Application

8.3.2 Microbial-fermented Hydrocolloids

8.3.2.1 Asia-Pacific Microbial-fermented Hydrocolloids Market Overview by Product Type

8.3.2.2 Asia-Pacific Microbial-fermented Hydrocolloids Market Overview by End-use Application

8.3.3 Plant-derived Hydrocolloids

8.3.3.1 Asia-Pacific Plant-derived Hydrocolloids Market Overview by Product Type

8.3.3.2 Asia-Pacific Plant-derived Hydrocolloids Market Overview by End-use Application

8.3.4 Seaweed-derived Hydrocolloids

8.3.4.1 Asia-Pacific Seaweed Hydrocolloids Market Overview by Product Type

8.3.4.2 Asia-Pacific Seaweed Hydrocolloids Market Overview by End-use Application

8.3.5 Cellulose-based Hydrocolloids

8.3.5.1 Asia-Pacific Cellulose-based Hydrocolloids Market Overview by Product Type

8.3.5.2 Asia-Pacific Cellulose-based Hydrocolloids Market Overview by End-use Application

8.4 Major Market Players

Abdullahbhai Abdul Kader Group (India)

Accel Carrageenan Corporation (formerly RICO Philippines) (Philippines)

Accent Microcell Pvt. Ltd. (India)

Agro Gums (India)

Altrafine Gums (India)

Amar Cellulose Industries (India)

Andi-Johnson Group (China)

Anqiu Eagle Cellulose Co., Ltd (China)

Asahi Gelatine Industrial Co., Ltd. (Japan)

Asahi Kasei Corporation (Japan)

Baotou Dongbao Bio-Tech Co., Ltd. (China)

CEAMSA Asia Inc. (Philippines)

Cellulose Solutions Private Limited (India)

Changshu Wealthy Science and Technology Co., Ltd. (China)

CP Kelco (Shandong) Biological Co., Ltd.

Daicel FineChem Ltd. (Japan)

Daiichi-Kasei Co., Ltd. (Japan)

Dancheng CAIXIN Sugar Industry Co., Ltd. (China)

Devson Impex Private Limited (India)

DFE Pharma India LLP (India)

Dipti Cellulose Pvt. Ltd. (India)

DKS Co. Ltd. (Japan)

Drytech Processes (I) Pvt. Ltd. (India)

DSM Hydrocolloids (China)

Yantai Andre Pectin Co., Ltd. (China)

DSM Zhongken Biotechnology Co., Ltd. (China)

DSM Rainbow (Inner Mongolia) Biotechnology Co., Ltd. (China)

Fufeng Group Limited (China)

Fujian Global Ocean Biotechnology Co., Ltd. (China)

GELITA Australia Pty. Ltd. (Australia)

GELITA China (China)

Geltech Co., Ltd. (South Korea)

Godavari Biorefineries Ltd. (India)

GuangraoLiuhe Chemical Co., Ltd. (China)

Haji DossaNutralgum (Pvt) Ltd. (Pakistan)

Hangzhou Gellan Solutions Biotec Co., Ltd. (China)

Hebei Xinhe Biochemical Co., Ltd (China)

Hindustan Gum & Chemicals Ltd. (India)

Ina Food Industry Co., Ltd. (Japan)

India Gelatine& Chemicals Ltd (India)

India Glycols Limited (India)

Indian Hydrocolloids (IHC) (India)

Inter Chemical (Shijiazhuang) Co., Ltd. (China)

IRO Alginate Industry Co., Ltd. (China)

Jai Bharat Gum & Chemicals Ltd (India)

Java Biocolloid (Indonesia)

Jellice Corporation (Japan)

JianLong Biotechnology Co., LTD. (China)

Kantilal Brothers (India)

Kapadia Gum Industries Pvt. Ltd. (India)

Karagen Indonesia, CV (Indonesia)

KIMICA Corporation (Japan)

Koei Chemical Co., Ltd. (Japan)

Krishna Pectins Pvt. Ltd. (India)

Lamberti Hydrocolloids Private Ltd (India)

Lianyungang Zhongda Seaweed Industrial Co., Ltd. (China)

Lotus Gums & Chemicals (India)

Lucid Colloids Ltd. (India)

Madhu Hydrocolloids Pvt. Ltd. (India)

Marcel Trading Corporation (Philippines)

Marine Science Co., Ltd. (Japan)

MC Food Specialties Inc. (Japan)

MCPI Corporation (Philippines)

MeiHua Holdings Group Co., Ltd (China)

Meron Group (India)

Mingtai Chemical Co., Ltd. (Taiwan)

MSC Co., Ltd. (South Korea)

Nanjing Laienda Biotechnology Co., Ltd. (Lauta) (China)

Narmada Gelatines Ltd. (India)

NB Entrepreneurs (India)

Neelkanth Polymers (India)

New Zealand Seaweeds Limited (New Zealand)

Nippi, Inc. (Japan)

Nippon Paper Industries Co., Ltd. (Japan)

Nitta Gelatin Inc. (Japan)

Nitta Gelatin India Ltd. (India)

OPAL Biotech Ltd. (China)

Patel Industries (India)

PB Gelatins Heilongjiang Co., Ltd. (China)

Philippine Bio Industries, Inc. (Philippines)

Prasmo Agri (India)

Premcem Gums Pvt. Ltd (India)

PT. Agar Swallow (Indonesia)

PT. AgarindoBogatama (Indonesia)

PT. Algalindo Perdana (Indonesia)

PT. Amarta Carrageenan Indonesia (Indonesia)

PT. ArbeChemindo (Indonesia)

PT. CahayaCemerlang (Indonesia)

PT. Dunia Bintang Walet (Indonesia)

PT. GalicArtabahari (Indonesia)

PT. Gumindo Perkasa Industri (Indogum) (Indonesia)

PT. Hydrocolloid Indonesia (Indonesia)

PT. Indo Seaweed (Indonesia)

PT. Indoking Aneka Agar-Agar Industri (Indonesia)

PT. Kappa Carrageenan Nusantara (Indonesia)

PT. Surya Indoalgas (Indonesia)

PT. Wahyu Putra Bimasakti (Indonesia)

Puning Huey Shyang Seaweed Industrial Co., Ltd. (China)

Qingdao Bright Moon Seaweed Group Co., Ltd. (China)

Qingdao Fengrun Seaweed Co., Ltd. (China)

Qingdao Gather Great Ocean Algae Industry Group (China)

Qingdao Great Chemical Inc. (China)

Qingdao Hyzlin Biology Development Co., Ltd. (China)

Qingdao Unichem International Trade Co., Ltd. (China)

Qingdao Zoranoc Oilfield Chemical Co., Ltd. (China)

Quzhou Pectin Co., Ltd. (China)

Rama Gum Industries (India) Ltd (India)

Sammi Industry Co., Ltd. (South Korea)

Shandong Head Co., Ltd. (China)

Shandong Jiejing Group Corporation (China)

Shanghai Brilliant Gum Co., Ltd. (BLG) (China)

Shanghai ShenGuang Edible Chemicals Co., Ltd. (China)

Shemberg Corporation (Philippines)

Shin-Etsu Chemical Co., Ltd. (Japan)

Shree Ram Gum and Chemicals (India)

Shubhlaxmi Industries (India)

Sichuan Longrun-Newstar Group Co., Ltd. (China)

Sidley Chemical Co., Ltd. (China)

Sigachi Industries Pvt. Ltd. (India)

SNAP Natural & Alginate Products Pvt. Ltd. (India)

SOMAR Corporation (Japan)

Sterling Gelatin (India)

Sunita Hydrocolloids Private Limited (India)

Supreme Gums Pvt. Ltd. (India)

TacaraSdnBhd (Malaysia)

TBK Manufacturing Corporation (Philippines)

Urakami Kasei Limited (Japan)

Vasundhara Industries (India)

Vikas WSP Limited (India)

W Hydrocolloids, Inc. (RICO Carrageenan) (Philippines)

Xiamen Gelken Gelatin Co., Ltd. (China)

Xuzhou Liyuan Cellulose Technology Co. Ltd. (China)

Yantai Sheli Hydrocolloids Co., Ltd. (China)

Yantai Xinwang Seaweed Co., Ltd. (China)

Yasu Chemical Inc. (Japan)

Yixing Tongda Chemical Co., Ltd. (China)

Zhejiang Chuangfeng Chemical Co., Ltd. (China)

Zhenpai Hydrocolloids Co., Ltd. (China)

Zibo Zhongxuan Biochemical Co., Ltd. (Deosen Biochemical Co., Ltd.) (China)

9. SOUTH AMERICA

9.1 South American Hydrocolloids Market Overview by Geographic Region

9.2 South American Hydrocolloids Market Overview by End-use Application

9.3 South American Hydrocolloids Market Overview by Raw Material Source

9.3.1 Animal-derived Hydrocolloids (Gelatin)

9.3.1.1 South America Gelatin Market Overview by End-use Application

9.3.2 Microbial-fermented Hydrocolloids

9.3.2.1 South American Microbial-fermented Hydrocolloids Market Overview by Product Type

9.3.2.2 South American Microbial-fermented Hydrocolloids Market Overview by End-use Application

9.3.3 Plant-derived Hydrocolloids

9.3.3.1 South American Plant-derived Hydrocolloids Market Overview by Product Type

9.3.3.2 South American Plant-derived Hydrocolloids Market Overview by End-use Application

9.3.4 Seaweed-derived Hydrocolloids

9.3.4.1 South American Seaweed Hydrocolloids Market Overview by Product Type

9.3.4.2 South American Seaweed Hydrocolloids Market Overview by End-use Application

9.3.5 Cellulose-based Hydrocolloids

9.3.5.1 South American Cellulose-based Hydrocolloids Market Overview by Product Type

9.3.5.2 South American Cellulose-based Hydrocolloids Market Overview by End-use Application

9.4 Major Market Players

Agar BrasileiroIndustria e Comercio Ltda. (AgarGel) (Brazil)

Agar Del Pacifico S.A. (Agarpac) (Chile)

Alginatos Chile S.A. (Chile)

Argos Export S.A. (Peru)

CP KelcoBrasil (Brazil)

Denver EspecialidadesQuimicas ltda. (Brazil)

Gelco Gelatinas Do Brasil Ltda. (Brazil)

GELITA Do Brasil Ltda. (Brazil)

GELNEX (Brazil)

Gelymar S.A. (Chile)

Gomas y Taninos S.A.C. (Peru)

PB Leiner Argentina S.A (Argentina)

PB LeinerBrasilLtda (Brazil)

Prodoctora DE Agar S.A. (Proagar S.A.) (Chile)

QuimicaAmtex S.A. (Columbia)

Roquette Brazil (Brazil)

10. REST OF WORLD

10.1 Rest of World Hydrocolloids Market Overview by Geographic Region

10.2 Rest of World Hydrocolloids Market Overview by End-use Application

10.3 Rest of World Hydrocolloids Market Overview by Raw Material Source

10.3.1 Animal-derived Hydrocolloids (Gelatin)

10.3.1.1 Rest of World Gelatin Market Overview by End-use Application

10.3.2 Microbial-fermented Hydrocolloids

10.3.2.1 Rest of World Microbial-fermented Hydrocolloids Market Overview by Product Type

10.3.2.2 Rest of World Microbial-fermented Hydrocolloids Market Overview by End-use Application

10.3.3 Plant-derived Hydrocolloids

10.3.3.1 Rest of World Plant-derived Hydrocolloids Market Overview by Product Type

10.3.3.2 Rest of World Plant-derived Hydrocolloids Market Overview by End-use Application

10.3.4 Seaweed-derived Hydrocolloids

10.3.4.1 Rest of World Seaweed Hydrocolloids Market Overview by Product Type

10.3.4.2 Rest of World Seaweed Hydrocolloids Market Overview by End-use Application

10.3.5 Cellulose-based Hydrocolloids

10.3.5.1 Rest of World Cellulose-based Hydrocolloids Market Overview by Product Type

10.3.5.2 Rest of World Cellulose-based Hydrocolloids Market Overview by End-use Application

10.4 Select Hydrocolloids Market Overview by Rest of World Region

10.4.1 Xanthan Gum

10.4.2 Guar Gum

10.4.3 Carboxymethyl Cellulose (CMC)

10.4.4 Methyl Cellulose & Hydroxypropylmethyl Cellulose (MC & HPMC)

10.5 Major Market Players

Aciselsan, AcipayamSeluloz Sanayi veTicaret (Turkey)

Carst and Walker (Pty) Ltd (South Africa)

Denkim, DenizliKimya Sanayi veTicaret A.S. (Turkey)

GELITA South Africa Pty. Ltd (South Africa)

GKM Food and Food Additives Company (Turkey)

Halavet Gida Sanayi veTicaret A.S. (Turkey)

Incom AS (Turkey)

JSC Mogelit (Belarus)

Lisichansk Gelatin Plant ALC (Ukraine)

PatisanKimya Sanayi A.S. (Turkey)

SELKIM SelulozKimya A.S. (Turkey)

Selt Marine Group (Tunisia)

Setexam S.A. (Morocco)

USK Kimya A.S. (Turkey)

PART C: GUIDE TO THE INDUSTRY

1. NORTH AMERICA

2. EUROPE

3. ASIA-PACIFIC

4. SOUTH AMERICA

5. REST OF WORLD

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

Chart 1: Global Hydrocolloids Market (2018 & 2024) by Geographic Region

Chart 2: Global Hydrocolloids Market (2018 & 2024) by Raw Material Source

Chart 3: Global Hydrocolloids Market (2018 & 2024) by Product Type

Chart 4: Global Hydrocolloids Market (2018 & 2024) by End-use Application

Chart 5: Global Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 6: Global Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in Metric Tons

Chart 7: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 8: Global Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in USD Million

Chart 9: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 10: Global Gelatin Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 11: Glance at 2015, 2018 and 2024 Global Gelatin Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 12: Global Gelatin Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 13: Glance at 2015, 2018 and 2024 Global Gelatin Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 14: Global Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 15: Glance at 2015, 2018 and 2024 Global Microbial-fermented Hydrocolloids Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 16: Global Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 17: Glance at 2015, 2018 and 2024 Global Microbial-fermented Hydrocolloids Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 18: Global Plant-derived Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 19: Glance at 2015, 2018 and 2024 Global Plant-derived Hydrocolloids Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 20: Global Plant-derived Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 21: Glance at 2015, 2018 and 2024 Global Plant-derived Hydrocolloids Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 22: Global Seaweed Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 23: Glance at 2015, 2018 and 2024 Global Seaweed Hydrocolloids Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 24: Global Seaweed Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 25: Glance at 2015, 2018 and 2024 Global Seaweed Hydrocolloids Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 26: Global Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 27: Glance at 2015, 2018 and 2024 Global Cellulose-based Hydrocolloids Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 28: Global Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 29: Glance at 2015, 2018 and 2024 Global Cellulose-based Hydrocolloids Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 30: Global Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in Metric Tons

Chart 31: Glance at 2015, 2018 and 2024 Global Microbial-fermented Hydrocolloids Volume Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 32: Global Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in USD Million

Chart 33: Glance at 2015, 2018 and 2024 Global Microbial-fermented Hydrocolloids Value Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 34: Global Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in Metric Tons

Chart 35: Glance at 2015, 2018 and 2024 Global Plant-derived Hydrocolloids Volume Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 36: Global Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in USD Million

Chart 37: Glance at 2015, 2018 and 2024 Global Plant-derived Hydrocolloids Value Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 38: Global Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in Metric Tons

Chart 39: Glance at 2015, 2018 and 2024 Global Seaweed Hydrocolloids Volume Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 40: Global Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in USD Million

Chart 41: Glance at 2015, 2018 and 2024 Global Seaweed Hydrocolloids Value Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 42: Global Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in Metric Tons

Chart 43: Glance at 2015, 2018 and 2024 Global Cellulose-based Hydrocolloids Volume Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 44: Global Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in USD Million

Chart 45: Glance at 2015, 2018 and 2024 Global Cellulose-based Hydrocolloids Value Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 46: Global Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in Metric Tons

Chart 47: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 48: Global Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in USD Million

Chart 49: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 50: Global Hydrocolloids Market Analysis (2015-2024) in Animal Feed by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 51: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Animal Feed by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 52: Global Hydrocolloids Market Analysis (2015-2024) in Animal Feed by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 53: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Animal Feed by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 54: Global Hydrocolloids Market Analysis (2015-2024) in Food & Beverages by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 55: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Food & Beverages by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 56: Global Hydrocolloids Market Analysis (2015-2024) in Food & Beverages by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 57: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Food & Beverages by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 58: Global Hydrocolloids Market Analysis (2015-2024) in Cosmetics & Personal Care by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 59: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Cosmetics & Personal Care by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 60: Global Hydrocolloids Market Analysis (2015-2024) in Cosmetics & Personal Care by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 61: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Cosmetics & Personal Care by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 62: Global Hydrocolloids Market Analysis (2015-2024) in Pharma & Healthcare by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 63: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Pharma & Healthcare by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 64: Global Hydrocolloids Market Analysis (2015-2024) in Pharma & Healthcare by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 65: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Pharma & Healthcare by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 66: Global Hydrocolloids Market Analysis (2015-2024) in Oil & Gas Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 67: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Oil & Gas Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 68: Global Hydrocolloids Market Analysis (2015-2024) in Oil & Gas Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 69: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Oil & Gas Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 70: Global Hydrocolloids Market Analysis (2015-2024) in Industrial/Technical Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 71: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) in Industrial/Technical Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 72: Global Hydrocolloids Market Analysis (2015-2024) in Industrial/Technical Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 73: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) in Industrial/Technical Applications by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

PART B: REGIONAL MARKET PERSPECTIVE

Chart 74: Global Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in Metric Tons

Chart 75: Glance at 2015, 2018 and 2024 Global Hydrocolloids Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

Chart 76: Global Hydrocolloids Market Analysis (2015-2024) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World in USD Million

Chart 77: Glance at 2015, 2018 and 2024 Global Hydrocolloids Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific, South America and Rest of World

REGIONAL MARKET OVERVIEW

NORTH AMERICA

Chart 78: North American Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 79: North American Hydrocolloids Market Analysis (2015-2024) by Geographic Region – United States, Canada and Mexico in Metric Tons

Chart 80: Glance at 2015, 2018 and 2024 North American Hydrocolloids Volume Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 81: North American Hydrocolloids Market Analysis (2015-2024) by Geographic Region – United States, Canada and Mexico in USD Million

Chart 82: Glance at 2015, 2018 and 2024 North American Hydrocolloids Value Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 83: North American Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in Metric Tons

Chart 84: Glance at 2015, 2018 and 2024 North American Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 85: North American Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in USD Million

Chart 86: Glance at 2015, 2018 and 2024 North American Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 87: North American Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in Metric Tons

Chart 88: Glance at 2015, 2018 and 2024 North American Hydrocolloids Volume Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 89: North American Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in USD Million

Chart 90: Glance at 2015, 2018 and 2024 North American Hydrocolloids Value Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 91: North American Gelatin Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 92: North American Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in Metric Tons

Chart 93: Glance at 2015, 2018 and 2024 North American Gelatin Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 94: North American Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in USD Million

Chart 95: Glance at 2015, 2018 and 2024 North American Gelatin Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 96: North American Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 97: North American Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in Metric Tons

Chart 98: Glance at 2015, 2018 and 2024 North American Microbial-fermented Hydrocolloids Volume Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 99: North American Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in USD Million

Chart 100: Glance at 2015, 2018 and 2024 North American Microbial-fermented Hydrocolloids Value Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 101: North American Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 102: Glance at 2015, 2018 and 2024 North American Microbial-fermented Hydrocolloids Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 103: North American Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in USD Million

Chart 104: Glance at 2015, 2018 and 2024 North American Microbial-fermented Hydrocolloids Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 105: North American Plant-derived Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 106: North American Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in Metric Tons

Chart 107: Glance at 2015, 2018 and 2024 North American Plant-derived Hydrocolloids Volume Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 108: North American Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in USD Million

Chart 109: Glance at 2015, 2018 and 2024 North American Plant-derived Hydrocolloids Value Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 110: North American Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 111: Glance at 2015, 2018 and 2024 North American Plant-derived Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 112: North American Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in USD Million

Chart 113: Glance at 2015, 2018 and 2024 North American Plant-derived Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 114: North American Seaweed Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 115: North American Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in Metric Tons

Chart 116: Glance at 2015, 2018 and 2024 North American Seaweed Hydrocolloids Volume Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 117: North American Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in USD Million

Chart 118: Glance at 2015, 2018 and 2024 North American Seaweed Hydrocolloids Value Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 119: North American Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in Metric Tons

Chart 120: Glance at 2015, 2018 and 2024 North American Seaweed Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical

Chart 121: North American Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in USD Million

Chart 122: Glance at 2015, 2018 and 2024 North American Seaweed Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical

Chart 123: North American Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 124: North American Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in Metric Tons

Chart 125: Glance at 2015, 2018 and 2024 North American Cellulose-based Hydrocolloids Volume Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 126: North American Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in USD Million

Chart 127: Glance at 2015, 2018 and 2024 North American Cellulose-based Hydrocolloids Value Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 128: North American Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 129: Glance at 2015, 2018 and 2024 North American Cellulose-based Hydrocolloids Volume Market Share (%) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical

Chart 130: North American Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in USD Million

Chart 131: Glance at 2015, 2018 and 2024 North American Cellulose-based Hydrocolloids Value Market Share (%) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical

EUROPE

Chart 132: European Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 133: European Hydrocolloids Market Analysis (2015-2024) by Geographic Region – France, Germany, Italy, Poland, Russia, Spain, The United Kingdom and Rest of Europe in Metric Tons

Chart 134: Glance at 2015, 2018 and 2024 European Hydrocolloids Volume Market Share (%) by Geographic Region – France, Germany, Italy, Poland, Russia, Spain, The United Kingdom and Rest of Europe

Chart 135: European Hydrocolloids Market Analysis (2015-2024) by Geographic Region – France, Germany, Italy, Poland, Russia, Spain, The United Kingdom and Rest of Europe in USD Million

Chart 136: Glance at 2015, 2018 and 2024 European Hydrocolloids Value Market Share (%) by Geographic Region – France, Germany, Italy, Poland, Russia, Spain, The United Kingdom and Rest of Europe

Chart 137: European Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in Metric Tons

Chart 138: Glance at 2015, 2018 and 2024 European Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 139: European Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in USD Million

Chart 140: Glance at 2015, 2018 and 2024 European Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 141: European Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in Metric Tons

Chart 142: Glance at 2015, 2018 and 2024 European Hydrocolloids Volume Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 143: European Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in USD Million

Chart 144: Glance at 2015, 2018 and 2024 European Hydrocolloids Value Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 145: European Gelatin Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 146: European Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in Metric Tons

Chart 147: Glance at 2015, 2018 and 2024 European Gelatin Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 148: European Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in USD Million

Chart 149: Glance at 2015, 2018 and 2024 European Gelatin Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 150: European Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 151: European Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in Metric Tons

Chart 152: Glance at 2015, 2018 and 2024 European Microbial-fermented Hydrocolloids Volume Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 153: European Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in USD Million

Chart 154: Glance at 2015, 2018 and 2024 European Microbial-fermented Hydrocolloids Value Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 155: European Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 156: Glance at 2015, 2018 and 2024 European Microbial-fermented Hydrocolloids Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 157: European Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in USD Million

Chart 158: Glance at 2015, 2018 and 2024 European Microbial-fermented Hydrocolloids Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 159: European Plant-derived Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 160: European Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in Metric Tons

Chart 161: Glance at 2015, 2018 and 2024 European Plant-derived Hydrocolloids Volume Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 162: European Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in USD Million

Chart 163: Glance at 2015, 2018 and 2024 European Plant-derived Hydrocolloids Value Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 164: European Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 165: Glance at 2015, 2018 and 2024 European Plant-derived Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 166: European Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in USD Million

Chart 167: Glance at 2015, 2018 and 2024 European Plant-derived Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 168: European Seaweed Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 169: European Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in Metric Tons

Chart 170: Glance at 2015, 2018 and 2024 European Seaweed Hydrocolloids Volume Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 171: European Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in USD Million

Chart 172: Glance at 2015, 2018 and 2024 European Seaweed Hydrocolloids Value Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 173: European Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in Metric Tons

Chart 174: Glance at 2015, 2018 and 2024 European Seaweed Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical

Chart 175: European Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in USD Million

Chart 176: Glance at 2015, 2018 and 2024 European Seaweed Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical

Chart 177: European Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 178: European Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in Metric Tons

Chart 179: Glance at 2015, 2018 and 2024 European Cellulose-based Hydrocolloids Volume Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 180: European Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in USD Million

Chart 181: Glance at 2015, 2018 and 2024 European Cellulose-based Hydrocolloids Value Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 182: European Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 183: Glance at 2015, 2018 and 2024 European Cellulose-based Hydrocolloids Volume Market Share (%) by End-use Application – Construction, Food & Beverages, Cosmetics &Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical

Chart 184: European Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in USD Million

Chart 185: Glance at 2015, 2018 and 2024 European Cellulose-based Hydrocolloids Value Market Share (%) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical

ASIA-PACIFIC

Chart 186: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 187: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by Geographic Region – China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Rest of Asia-Pacific in Metric Tons

Chart 188: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Volume Market Share (%) by Geographic Region – China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Rest of Asia-Pacific

Chart 189: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by Geographic Region – China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Rest of Asia-Pacific in USD Million

Chart 190: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Value Market Share (%) by Geographic Region – China, India, Indonesia, Japan, South Korea, Malaysia, Thailand and Rest of Asia-Pacific

Chart 191: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in Metric Tons

Chart 192: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 193: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical in USD Million

Chart 194: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Industrial/Technical

Chart 195: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in Metric Tons

Chart 196: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Volume Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 197: Asia-Pacific Hydrocolloids Market Analysis (2015-2024) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based in USD Million

Chart 198: Glance at 2015, 2018 and 2024 Asia-Pacific Hydrocolloids Value Market Share (%) by Raw Material Source – Animal-derived (Gelatin), Microbial-fermented, Plant-derived, Seaweed-derived and Cellulose-based

Chart 199: Asia-Pacific Gelatin Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 200: Asia-Pacific Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in Metric Tons

Chart 201: Glance at 2015, 2018 and 2024 Asia-Pacific Gelatin Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 202: Asia-Pacific Gelatin Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed in USD Million

Chart 203: Glance at 2015, 2018 and 2024 Asia-Pacific Gelatin Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharmaceuticals, Nutraceuticals, Technical and Animal Feed

Chart 204: Asia-Pacific Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 205: Asia-Pacific Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in Metric Tons

Chart 206: Glance at 2015, 2018 and 2024 Asia-Pacific Microbial-fermented Hydrocolloids Volume Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 207: Asia-Pacific Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by Product Type – Xanthan Gum and Gellan Gum in USD Million

Chart 208: Glance at 2015, 2018 and 2024 Asia-Pacific Microbial-fermented Hydrocolloids Value Market Share (%) by Product Type – Xanthan Gum and Gellan Gum

Chart 209: Asia-Pacific Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 210: Glance at 2015, 2018 and 2024 Asia-Pacific Microbial-fermented Hydrocolloids Volume Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 211: Asia-Pacific Microbial-fermented Hydrocolloids Market Analysis (2015-2024) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical in USD Million

Chart 212: Glance at 2015, 2018 and 2024 Asia-Pacific Microbial-fermented Hydrocolloids Value Market Share (%) by End-use Application – Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care, Oil & Gas and Other Industrial/Technical

Chart 213: Asia-Pacific Plant-derived Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 214: Asia-Pacific Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in Metric Tons

Chart 215: Glance at 2015, 2018 and 2024 Asia-Pacific Plant-derived Hydrocolloids Volume Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 216: Asia-Pacific Plant-derived Hydrocolloids Market Analysis (2015-2024) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin in USD Million

Chart 217: Glance at 2015, 2018 and 2024 Asia-Pacific Plant-derived Hydrocolloids Value Market Share (%) by Product Type – Guar Gum, Gum Arabic, LBG, Tara Gum and Pectin

Chart 218: Asia-Pacific Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 219: Glance at 2015, 2018 and 2024 Asia-Pacific Plant-derived Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 220: Asia-Pacific Plant-derived Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical in USD Million

Chart 221: Glance at 2015, 2018 and 2024 Asia-Pacific Plant-derived Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Healthcare, Oil & Gas and Other Industrial/Technical

Chart 222: Asia-Pacific Seaweed Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 223: Asia-Pacific Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in Metric Tons

Chart 224: Glance at 2015, 2018 and 2024 Asia-Pacific Seaweed Hydrocolloids Volume Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 225: Asia-Pacific Seaweed Hydrocolloids Market Analysis (2015-2024) by Product Type – Agar-Agar, Alginates and Carrageenan in USD Million

Chart 226: Glance at 2015, 2018 and 2024 Asia-Pacific Seaweed Hydrocolloids Value Market Share (%) by Product Type – Agar-Agar, Alginates and Carrageenan

Chart 227: Asia-Pacific Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in Metric Tons

Chart 228: Glance at 2015, 2018 and 2024 Asia-Pacific Seaweed Hydrocolloids Volume Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical

Chart 229: Asia-Pacific Seaweed Hydrocolloids Market Analysis (2015-2024) by End-use Application – Animal Feed, Food & Beverages, Cosmetics & Personal Care, Pharma & Health Care and Industrial/Technical in USD Million

Chart 230: Glance at 2015, 2018 and 2024 Asia-Pacific Seaweed Hydrocolloids Value Market Share (%) by End-use Application – Animal Feed, Food & Beverages, Cosmetics &Personal Care, Pharma & Health Care and Industrial/Technical

Chart 231: Asia-Pacific Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Volume in Metric Tons and Value in USD Million

Chart 232: Asia-Pacific Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in Metric Tons

Chart 233: Glance at 2015, 2018 and 2024 Asia-Pacific Cellulose-based Hydrocolloids Volume Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 234: Asia-Pacific Cellulose-based Hydrocolloids Market Analysis (2015-2024) by Product Type – CMC, MC/HPMC and MCC in USD Million

Chart 235: Glance at 2015, 2018 and 2024 Asia-Pacific Cellulose-based Hydrocolloids Value Market Share (%) by Product Type – CMC, MC/HPMC and MCC

Chart 236: Asia-Pacific Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in Metric Tons

Chart 237: Glance at 2015, 2018 and 2024 Asia-Pacific Cellulose-based Hydrocolloids Volume Market Share (%) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical

Chart 238: Asia-Pacific Cellulose-based Hydrocolloids Market Analysis (2015-2024) by End-use Application – Construction, Food & Beverages, Cosmetics & Personal Care, Pharma & Nutraceuticals, Oil & Gas and Other Industrial/Technical in USD Million