Published Date: Apr 2017

Report Code: FB010

Pages: 452

Charts: 417

Increased consumer awareness about obesity, diabetes and other health concerns have paved the way for the consumption and usage of alternative sweeteners worldwide. Alternative sweeteners are used as substitute to sugar in foods and beverages to personal care to pharmaceuticals as they contain low to zero calories thus reducing the risk of obesity and diabetes. Alternative sweeteners analyzed in this report include high intensity sweeteners and polyols (also called as sugar alcohols).

Alternative sweeteners´ demand is anticipated to increase in the coming years is also buoyed by approvals of high intensity sweeteners and polyols in food and beverage applications by majority of the countries across the globe. Most of the alternative sweeteners are approved in North America, Europe and Asia-Pacific while very few of them are either banned or approved for restricted usage.

This report analyzes the alternative sweeteners global markets including North America, Europe, Asia-Pacific and Rest of World in terms of both volume in metric tons and value in USD for the 2014-2022 analysis period. The regional markets further analyzed for 13 independent countries across North America – the United States, Canada and Mexico; Europe – France, Germany, Italy, Spain, the United Kingdom and Russia; Asia-Pacific – China, India, Japan and South Korea; and Rest of World – South America, Middle East & Africa and CIS Countries (Excl. Russia).The market is analyzed in all of these major regions by alternative sweeteners product category (HIS and Polyols), key countries and by major end-use applications in terms of both volume and value. This report also explores the market by product category and major application sector for each major country. The global key market trends are illustrated along with the recent major business trends such as product innovations/launches, mergers and acquisitions etc.

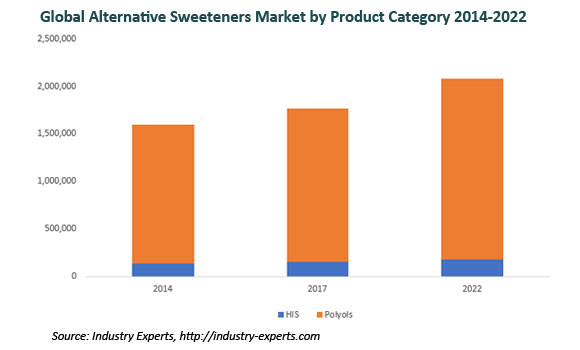

Polyols dominate the global market for Alternative Sweeteners by product category, forecast to be 1.6 million metric tons in 2017 accounting for over 90%, which is projected to reach 1.9 million metric tons by 2022 growing at a CAGR of 3.4% between the two years. High Intensity Sweeteners accounts for the remaining market share of Alternative Sweeteners and expected to witness the growth rate of 3% during the same period.

High intensity sweeteners (HIS) analyzed in this global market report is segmented by HIS category – Artificial HIS and Natural HIS. These HIS categories further segmented in to Artificial HIS – Acesulfame-K, Aspartame, Cyclamate, Neotame, Saccharin and Sucralose; and Natural HIS – Steviol Glycosides (stevia extracts), Glycyrrhizin (licorice root extracts) and Mogroside V (monk fruit extracts). The study also explores the key end-use applications of high intensity sweeteners including Beverages, Confectionary, Foods, Tabletop and Others (personal care, pharmaceuticals and nutraceuticals etc.).

Polyols analyzed in this report comprise sorbitol, xylitol, mannitol, maltitol, erythritol, isomalt and lactitol. The polyols´ end-use application markets analyzed include Confectionary, Food & Beverages, Personal Care and Others (Pharmaceuticals and nutraceuticals). Sorbitol market estimated in this report does not include sorbitol used as an intermediate in manufacturing Vitamin C.

This 452 page global alternative sweeteners market report comprises 417 charts (includes a data table and graphical representation for each chart), supported with meaningful and easy to understand graphical presentation, of market numbers. The study discusses the regulatory framework of polyols and high intense sweeteners market in all major regions of the world. This report profiles 39 global players and 135 overall major players across North America – 25; Europe – 13; Asia-Pacific – 95; and Rest of World – 2. The research also provides the listing of the companies engaged in manufacturing and supply of alternative sweeteners. The global list of companies covers the address, contact numbers and the website addresses of 260 companies.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

High Intensity Sweeteners

Polyols (Sugar Alcohols)

1.1 Product Outline

1.1.1 Categorization of Sweeteners

1.1.1.1 Caloric Sweeteners

1.1.1.2 High Intensity Sweeteners (HIS)

1.1.1.2.1 Potential Health Benefits Offered by High Intensity Sweeteners

1.1.1.2.2 Potential Health Issues Associated with Artificial High Intensity Sweeteners

1.1.1.2.3 Applications for High Intensity Sweeteners

1.1.1.2.4 Types of High Intensity Sweeteners

1.1.1.2.4.1 Artificial High Intensity Sweeteners

1.1.1.2.4.1.1 Acesulfame Potassium (Acesulfame K)

1.1.1.2.4.1.2 Aspartame

1.1.1.2.4.1.3 Cyclamates

1.1.1.2.4.1.4 Neotame

1.1.1.2.4.1.5 Saccharin

1.1.1.2.4.1.6 Sucralose

1.1.1.2.4.2 Natural High Intensity Sweeteners

1.1.1.2.4.2.1 Steviol Glycosides

1.1.1.2.4.2.2 Mogroside V (Luo Han Guo/Monk Fruit Extract)

1.1.1.2.4.2.3 Glycyrrhizin (Licorice Root Extract)

1.1.1.3 Polyols (Sugar Alcohols)

1.1.1.3.1 Potential Health Benefits Offered by Polyols/Sugar Alcohols

1.1.1.3.2 Potential Health Concerns Associated with Polyols/Sugar Alcohols

1.1.1.3.3 Polyols and Gastrointestinal (GI) Effects

1.1.1.3.4 Applications of Polyols/Sugar Alcohols

1.1.1.3.5 Types of Polyols/Sugar Alcohols

1.1.1.3.5.1 Sorbitol

1.1.1.3.5.2 Mannitol

1.1.1.3.5.3 Maltitol

1.1.1.3.5.4 Xylitol

1.1.1.3.5.5 Erythritol

1.1.1.3.5.6 Isomalt

1.1.1.3.5.7 Lactitol

2. KEY MARKET TRENDS

2.1 Prospects for Low-Calorie Sweeteners Brightened by Escalating Incidences of Obesity and Diabetes

2.1.1 Overweight and Obesity: Some Statistics of Prevalence

2.1.2 Burden of Diabetes and Impaired Glucose Tolerance (IGT) on a Global Level

2.1.3 To Conclude

2.2 Erythritol Demand is Expected to Surge as The European Commission Approves Usage of Erythritol in Beverages

2.3 Stevia Sales to Drive Demand for Erythritol

2.4 Demand for Monk Fruit Extract Mogroside V Emerging from the Shadows

2.5 Stevia: The Shining Star on Natural Sweeteners´ Horizon

2.6 Stevia´s Bitterness Gets Sweeter

2.7 Regulation on Steviol Glycosides Sweeteners Amended by the European Commission

2.8 Next Generation Steviol Glycosides Evolving Beyond Reb A

2.8.1 Advancements in Agronomy

2.8.2 Enzymatic Modification Sweetens Stevia Market

2.8.3 Fermentation Production of Steviol Glycosides to Tap Rarer Glycosides

3. REGULATORY LANDSCAPE

3.1 Polyols and High Intense Sweetener Regulations around the Globe

3.1.1 European Union

3.1.2 The United States

3.1.3 Japan

3.1.4 India

3.1.5 China

4. KEY GLOBAL PLAYERS

Ajinomoto Co., Inc. (Japan)

Anhui Jinhe Industrial Co., Ltd. (China)

Archer Daniels Midland Company (United States)

B Food Science Co., Ltd. (Japan)

Beijing Vitasweet Co., Ltd. (China)

BENEO GmbH (Germany)

Cargill, Inc (United States)

Celanese Corporation (United States)

Changzhou Niutang Chemical Plant Co., Ltd. (China)

Dupont Nutrition & Health (Danisco)

Gansu Fanzhi Biotech Co., Ltd. (China)

GLG Life Tech Corporation (Canada)

Golden Time Chemical (Jiangsu) Co., Ltd. (China)

Guilin GFS Monk Fruit Corp. (China)

Hill Pharmaceutical Co., Ltd. (China)

Ingredion Incorporated (United States)

Jiangsu SinoSweet Co., Ltd. (China)

JK Sucralose, Inc. (China)

Jungbunzlauer Suisse AG (Switzerland)

Kaifeng Xinghua Fine Chemical Ltd. (China)

MAFCO Worldwide LLC (United States)

Merisant Company (United States)

Mitsubishi Shoji Foodtech Co., Ltd. (Japan)

Mitsubishi-Kagaku Foods Corporation (Japan)

Morita Kagaku Kogyo Co., Ltd. (Japan)

NutraSweet Company (United States)

PMC Specialties Group, Inc (United States)

PureCircle Limited (Malaysia)

Roquette Fr?res S.A. (France)

Shandong Futaste Co., Ltd. (China)

Shandong Longlive Bio-Technology Co., Ltd. (China)

Shandong Tianli Pharmaceutical Co., Ltd. (China)

Suzhou Hope Technology Co., Ltd. (China)

Tate & Lyle PLC (United Kingdom)

Tereos Starch & Sweeteners s.a.s. (Tereos Syral) (France)

Tianjin North Food Co., Ltd. (China)

Wuhan Huasweet Co., Ltd. (China)

Zhejiang Sanhe Food Science & Technology Co., Ltd. (China)

Zhong Hua Fang Da (H.K.) Limited (Hong Kong)

5. KEY BUSINESS AND PRODUCT TRENDS

PureCircle Doubled Stevia Leaf Extract Production Capacity in Malaysia

Commercialization of SweeGen´s Bestevia Reb-M

Product of the Year in the Sweetener Category for 2017 Won by SPLENDA® Naturals Stevia Sweetener

Evolva to Introduce EverSweet™ in 2018

US Customs and Border Protection Issue Clearance for PureCircle Shipments

S&W´s Unique Stevia Lines Marketed Under the Brand Name ´Kandi Leaf´ Stevia

US Notice of Allowance for a Crucial Evolva Patent Protection Application Related to Steviol Glycosides Production

Ingredion, Only Global Distributor of SweeGen´s Stevia Sweeteners in All Markets except China

Sigma-Beverage, PureCircle´s Latest Breakthrough Stevia Ingredient for Beverage Formulations

DSM Submitted Application to Food Safety Regulators in Europe for Approving the Use of its Fermentation-based Stevia in The Netherlands

S2G Biochemicals and Mondelez International Collaborated to Build Xylitol Plant in the USA

Haigen Collaborated with Viachem to Introduce its Stevia Products to the North American Market

Updated European Commission Legislation Opened Door for European Food and Beverage Companies Needing Low-Calorie, Best-Tasting Sweeteners

GLG´s EMS95 Received Letter of No Objection from the US FDA

GLG Produced New Reb C Varietal with Unprecedented Levels of Reb C at Over 79%

Jinhe Industrial Invested 460 Million Yuan for Constructing a New 1,500 Mt/Yr Sucralose Project

Unveiling of Zevia´s New Non-GMO Project Verified Stevia Blend

Saccharin Received Approval from the Canadian Government

Anti-Caries Effect of Xylitol Confirmed by DuPont Study

DFI Corp and Mitr Phol Group Inks Strategic Investment and Partnership Deal to Produce Erythritol and Xylitol

Cargill´s EverSweet™ Sweetener Received Letter of No Objection from US FDA

Xylitol Sweetener Can Kill or Poison Dogs – FDA Warns

PureCircle Stevia Agronomy Program in India

New Stevia Leaf Seedling with Over 1000% Rise in Reb M Glycosides Produced by GLG

BENEO Introduces New Isomalt Translucent Gum Coating Technology

New Decree Passed in Brazil Allow Beverage Producers to Use a Mix of Stevia and Sugar

GLG Join Forces with MycoTech to Enhance the Taste of Natural Sweeteners

EFSA Approves the Use of PureCircle´s Reb M as a Stevia Sweetener in Europe

Launch of PureCircle´s Zeta™ Family of Stevia Ingredients

USPTO Issues New Reb D Stevia Glycoside Patent to Sweet Green Fields

Sweet Green Fields Co., Ltd., One of the World´s Largest, Privately Held, and Fully-Integrated Stevia Ingredient Companies

European Commission Approves Usage of Erythritol in Beverages

GLG´s New Stevia Leaf with Enhanced Levels of Reb D and Reb M

Acquisition of Johnson & Johnson´s Splenda® Brand Complements Heartland´s Product Line

GLG´s Natural Zero-Calorie Sweetener Product Line Receives Non-GMO Project Verification

HYET Purchased ASE from Ajinomoto Co.

Launch of Cargill´s New Truvia® Brown Sugar Blend in Canada

New Sugar Substitute, ERYLITE® Bronze Launched by Jungbunzlauer

Launch of Cargill´s New Truvia® Brown Sugar Blend in Canada

DOLCIA PRIMA™ Low-Calorie Sugar Unveiled by Tate & Lyle

US FDA Issued Letter of No Objection for GLG´s High-Purity Reb C Blends

BENEO Presents New Sugar-free Hard Candy Solutions at ISM 2015

DOLCIA PRIMA™ Low-Calorie Sugar Unveiled by Tate & Lyle

US FDA Issued Letter of No Objection for GLG´s High-Purity Reb C Blends

Production of NutraSweet® Aspartame to Stop by the end of 2014

Study Reveals Zerose® Erythritol Tastes Great and Better for Teeth

Merisant and Whole Earth to Pay $1.65 M and Overhaul its Pure Via Label

Cargill and Evolva Announce Publication of Patent Application on the Process of Fermentation-based Steviol Glycosides

Unique Fermentation-based Sweetener Platform Announced by DSM at the International Food Technology Expo in New Orleans

GLG´s Rebsweet™ and AnySweetPLUS™ Stevia Extracts Received GRAS Letter of No Objection from US FDA

Reapproval of Saccharin as a Food Additive in Canada

GLG Submitted a GRAS Notification with US FDA for its High Purity Reb M Stevia Extract

Unveiling of Tate & Lyle´s TASTEVA® Stevia Sweetener at Engredea Trade Show in Anaheim

Kasyap Sweeteners Limited, India Expands Sorbitol Capacity

6. GLOBAL MARKET OVERVIEW

6.1 Global Alternative Sweeteners Market Overview by Product Category

6.1.1 High Intensity Sweeteners

6.1.1.1 Global High Intensity Sweeteners Market Overview by HIS Category

6.1.1.2 Global High Intensity Sweeteners Market Overview by HIS Type

6.1.1.3 Global High Intensity Sweeteners Market Overview by End-Use Application

6.1.2 Polyols (Sugar Alcohols)

6.1.2.1 Global Polyols (Sugar Alcohols) Market Overview by Polyol Type

6.1.2.2 Global Polyols (Sugar Alcohols) Market Overview by End-Use Application

PART B: REGIONAL MARKET PERSPECTIVE

Global Alternative Sweeteners Market Overview by Geographic Region

Global High Intensity Sweeteners Market Overview by Geographic Region

Global Artificial High Intensity Sweeteners Market Overview by Geographic Region

Global Natural High Intensity Sweeteners Market Overview by Geographic Region

Global Polyols (Sugar Alcohols) Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

1. NORTH AMERICA

1.1 North American Alternative Sweeteners Market Overview by Geographic Region

1.2 North American Alternative Sweeteners Market Overview by Product Category

1.2.1 High Intensity Sweeteners

1.2.1.1 North American High Intensity Sweeteners Market Overview by Geographic Region

1.2.1.2 North American High Intensity Sweeteners Market Overview by End-Use Application

1.2.1.3 North American High Intensity Sweeteners Market Overview by HIS Category

1.2.2 Polyols (Sugar Alcohols)

1.2.2.1 North American Polyols (Sugar Alcohols) Market Overview by Geographic Region

1.2.2.2 North American Polyols (Sugar Alcohols) Market Overview by End-Use Application

1.3 Major Market Players

Amax NutraSource, Inc (United States)

Archer Daniels Midland Company (United States)

Arnhem Group, The (United States)

Cargill, Inc (United States)

Celanese Corporation (United States)

Cumberland Packing Corporation (United States)

DFI Corporation (United States)

Dupont Nutrition & Health (Danisco) (United States)

GLG Life Tech Corporation (Canada)

Heartland Food Products Group (United States)

Ingredion Incorporated (United States)

MAFCO Worldwide LLC (United States)

Merisant Company (United States)

Whole Earth Sweetener Co. (United States)

Novagreen Inc. (Canada)

NutraSweet Company (United States)

PMC Specialties Group, Inc (United States)

Pyure Brands LLC (United States)

S2G Biochem, Inc (Canada)

Sugar Foods Corporation (United States)

Sweegen, Inc. (United States)

Sweet Green Fields LLC (United States)

Wisdom Natural Brands (United American Industries, Inc.) (United States)

Xylitol Canada, Inc. (Canada)

Zuchem Inc. (United States)

1.4 Country-wise Analsysis of North American Alternative Sweeteners Market

1.4.1 The United States

1.4.1.1 United States Alternative Sweeteners Market Overview by Product Category

1.4.1.1.1 High Intensity Sweeteners

1.4.1.1.1.1 United States High Intensity Sweeteners Market Overview by End-Use Application

1.4.1.1.2 Polyols (Sugar alcohols)

1.4.1.1.2.1 United States Polyols (Sugar Alcohols) Market Overview by End-Use Application

1.4.2 Canada

1.4.2.1 Canadian Alternative Sweeteners Market Overview by Product Category

1.4.2.1.1 High Intensity Sweeteners

1.4.2.1.1.1 Canadian High Intensity Sweeteners Market Overview by End-Use Application

1.4.2.1.2 Polyols (Sugar Alcohols)

1.4.2.1.2.1 Canadian Polyols (Sugar Alcohols) Market Overview by End-Use Application

1.4.3 Mexico

1.4.3.1 Mexican Alternative Sweeteners Market Overview by Product Category

1.4.3.1.1 High Intensity Sweeteners

1.4.3.1.1.1 Mexican High Intensity Sweeteners Market Overview by End-Use Application

1.4.3.1.2 Polyols (Sugar Alcohols)

1.4.3.1.2.1 Mexican Polyols (Sugar Alcohols) Market Overview by End-Use Application

2. EUROPE

2.1 European Alternative Sweeteners Market Overview by Geographic Region

2.2 European Alternative Sweeteners Market Overview by Product Category

2.2.1 High Intensity Sweeteners

2.2.1.1 European High Intensity Sweeteners Market Overview by Geographic Region

2.2.1.2 European High Intensity Sweeteners Market Overview by End-Use Application

2.2.1.3 European High Intensity Sweeteners Market Overview by HIS Category

2.2.2 Polyols (Sugar Alcohols)

2.2.2.1 European Polyols (Sugar Alcohols) Market Overview by Geographic Region

2.2.2.2 European Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.3 Major Market Players

BENEO GmbH (Germany)

DHW Deutsche Hydrierwerke GmbH (Germany)

Evolva SA (Switzerland)

Extraits V?g?taux et D?riv?s (EVD) (France)

Granular AB (DBA The Real Stevia Company) (Sweden)

Hermes Sweeteners Ltd. (Switzerland)

HYET Sweet B.V. (Netherlands)

Jungbunzlauer Suisse AG (Switzerland)

Productos Aditivos S.A. (Spain)

Roquette Fr?res S.A. (France)

Stevia Natura SAS (France)

Tate & Lyle PLC (United Kingdom)

Tereos Starch & Sweeteners S.A.S. (Tereos Syral) (France)

2.4 Country-wise Analysis of European Alternative Sweeteners Market

2.4.1 France

2.4.1.1 French Alternative Sweeteners Market Overview by Product Category

2.4.1.1.1 High Intensity Sweeteners

2.4.1.1.1.1 French High Intensity Sweeteners Market Overview by End-Use Application

2.4.1.1.2 Polyols (Sugar Alcohols)

2.4.1.1.2.1 French Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.2 Germany

2.4.2.1 German Alternative Sweeteners Market Overview by Product Category

2.4.2.1.1 High Intensity Sweeteners

2.4.2.1.1.1 German High Intensity Sweeteners Market Overview by End-Use Application

2.4.2.1.2 Polyols (Sugar Alcohols)

2.4.2.1.2.1 German Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.3 Italy

2.4.3.1 Italian Alternative Sweeteners Market Overview by Product Category

2.4.3.1.1 High Intensity Sweeteners

2.4.3.1.1.1 Italian High Intensity Sweeteners Market Overview by End-Use Application

2.4.3.1.2 Polyols (Sugar Alcohols)

2.4.3.1.2.1 Italian Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.4 Spain

2.4.4.1 Spanish Alternative Sweeteners Market Overview by Product Category

2.4.4.1.1 High Intensity Sweeteners

2.4.4.1.1.1 Spanish High Intensity Sweeteners Market Overview by End-Use Application

2.4.4.1.2 Polyols (Sugar Alcohols)

2.4.4.1.2.1 Spanish Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.5 The United Kingdom

2.4.5.1 United Kingdom Alternative Sweeteners Market Overview by Product Category

2.4.5.1.1 High Intensity Sweeteners

2.4.5.1.1.1 United Kingdom High Intensity Sweeteners Market Overview by End-Use Application

2.4.5.1.2 Polyols (Sugar Alcohols)

2.4.5.1.2.1 United Kingdom Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.6 Russia

2.4.6.1 Russian Alternative Sweeteners Market Overview by Product Category

2.4.6.1.1 High Intensity Sweeteners

2.4.6.1.1.1 Russian High Intensity Sweeteners Market Overview by End-Use Application

2.4.6.1.2 Polyols (Sugar Alcohols)

2.4.6.1.2.1 Russian Polyols (Sugar Alcohols) Market Overview by End-Use Application

2.4.7 Rest of Europe

2.4.7.1 Rest of Europe Alternative Sweeteners Market Overview by Product Category

2.4.7.1.1 High Intensity Sweeteners

2.4.7.1.1.1 Rest of Europe High Intensity Sweeteners Market Overview by End-Use Application

2.4.7.1.2 Polyols (Sugar Alcohols)

2.4.7.1.2.1 Rest of Europe Polyols (Sugar Alcohols) Market Overview by End-Use Application

3. ASIA-PACIFIC

3.1 Asia-Pacific Alternative Sweeteners Market Overview by Geographic Region

3.2 Asia-Pacific Alternative Sweeteners Market Overview by Product Category

3.2.1 High Intensity Sweeteners

3.2.1.1 Asia-Pacific High Intensity Sweeteners Market Overview by Geographic Region

3.2.1.2 Asia-Pacific High Intensity Sweeteners Market Overview by End-Use Application

3.2.1.3 Asia-Pacific High Intensity Sweeteners Market Overview by HIS Category

3.2.2 Polyols (Sugar Alcohols)

3.2.2.1 Asia-Pacific Polyols (Sugar Alcohols) Market Overview by Geographic Region

3.2.2.2 Asia-Pacific Polyols (Sugar Alcohols) Market Overview by End-Use Application

3.3 Major Market Players

Ajinomoto Co., Inc. (Japan)

Almendra (Thailand) Ltd. (Thailand)

Anhui Jinhe Industrial Co., Ltd. (China)

B Food Science Co., Ltd. (Japan)

Baolingbao Biology Co. Ltd (china)

Beijing Gingko Group (China)

Beijing Vitasweet Co., Ltd. (China)

BioPlus Life Sciences Pvt Ltd (India)

Changmao Biochemical Engineering Co., Ltd (China)

Changzhou Guanghui Biotechnology Co., Ltd. (China)

Changzhou Niutang Chemical Plant Co., Ltd. (China)

Chengdu Wagott Pharmaceutical Co., Ltd. (China)

China Chem Source (HK) Co., Ltd. (China)

CSPC Shengxue Glucose Co., Ltd. (china)

Daepyung Co., Ltd (South Korea)

Daesang Corporation (South Korea)

Ecogreen Oleochemicals (Singapore) Pte., Ltd. (Singapore)

EPC Natural Products Co., Ltd. (China)

Gansu Fanzhi Biotech Co., Ltd. (China)

Golden Time Chemical (Jiangsu) Co., Ltd. (China)

Guangxi Khalista (Liuzhou) Chemical Industries Ltd. (China)

Guilin GFS Monk Fruit Corp. (China)

Guilin Layn Natural Ingredients Corp. (China)

Gulshan Polyols Limited (India)

Hebei Huaxu Pharmaceutical Co., Ltd. (China)

Hill Pharmaceutical Co., Ltd. (China)

Ikeda Tohka Industries Co., Ltd. (Japan)

Jiangsu Jubang Pharmaceutical Co., Ltd (China)

Jiangsu SinoSweet Co., Ltd. (China)

Jiangsu Suzhou Peacock Food Additive Co., Ltd (China)

Jinan Prosweet Biotechnology Co., Ltd (China)

Jining Aoxing Stevia Products Co., Ltd (China)

Jinyao Ruida (Xuchang) Biology Technology Co., Ltd. (China)

JK Sucralose, Inc. (China)

JMC Corporation (South Korea)

Kaifeng Xinghua Fine Chemical Ltd. (China)

Kasyap Sweetners Ltd. (India)

Luzhou Bio-Chem Technology Co., Ltd (China)

Maize Products Ltd. (INdia)

Maruzen Pharmaceuticals Co., Ltd. (Japan)

MC-Towa International Sweeteners Co., Ltd. (Thailand)

Mitsubishi Shoji Foodtech Co., Ltd. (Japan)

Mitsubishi-Kagaku Foods Corporation (Japan)

Morita Kagaku Kogyo Co., Ltd. (Japan)

NichinohSeiken Co., Ltd. (Japan)

Nippon Paper Industries Co., Ltd. (Japan)

O´Laughlin Industries Co., Ltd. (Hong Kong)

PT. Batang Alum Industrie (Indonesia)

PT. Chemical Industry Tonggorejo (Indonesia)

PT. Golden Sari (Indonesia)

PT. Sorini Towa Berlian Corporindo (Indonesia)

PureCircle Limited (Malaysia)

Qualipride International Ltd. (China)

Qufu Xiangzhou Stevia Products Co., Ltd (China)

Salvi Chemical Industries Ltd. (India)

Shandong (Binzhou) Sanyuan Biotechnology Co., Ltd. (China)

Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. (china)

Shandong Fullsail Biotechnology Co. Ltd. (China)

Shandong Futaste Co., Ltd. (China)

Shandong Haigen Biotechnology Co., Ltd. (China)

Shandong Huaxian Stevia Co., Ltd. (China)

Shandong Jinshunda Group Co. Ltd (China)

Shandong Kanbo Biochemical Technology Co., Ltd (China)

Shandong Longlive Bio-Technology Co., Ltd. (China)

Shandong Lujian Biological Technology Co. Ltd. (China)

Shandong Minghui Food Co., Ltd. (China)

Shandong Tianli Pharmaceutical Co., Ltd. (China)

Shouguang Tianwei Chemicals Co., Ltd (China)

Shanghai Fanzhi Pharmaceutical Co., Ltd. (China)

Shanghai Fortune Chemical Co., Ltd. (China)

Shaoxing Yamei Biotechnology Co., Ltd. (China)

Shenzhen Newtrend International Co., Ltd. (China)

Shree Vardayini Chemical Industries Pvt. Ltd (India)

Sukhjit Starch & Chemicals Ltd. (India)

Sunwin Stevia International, Inc. (China)

Suzhou Hope Technology Co., Ltd. (China)

Techno (Fujian) Food Ingredients Co., Ltd. (China)

Thomson Biotech (Xiamen) Co., Ltd. (China)

Tianjin Changjie Chemical Co., Ltd. (China)

Tianjin North Food Co., Ltd. (China)

Tokiwa Phytochemical Co., Ltd. (Japan)

Toyo Sugar Refining Co., Ltd. (Japan)

Triveni Chemicals (India)

Tsuruya Chemical Industries Co., Ltd. (Japan)

Unisweet (Shandong) Sucralose Manufacturing Co., Ltd. (China)

Vishnu Chemicals Limited (India)

Wuhan Huasweet Co., Ltd. (China)

Xinghua GL Stevia Co., Ltd. (China)

ZFTZ Mafco Biotech Co., Ltd. (China)

Zhejiang Huakang Pharmaceutical Co., Ltd. (China)

Zhejiang Sanhe Food Science & Technology Co., Ltd. (China)

Zhong Hua Fang Da (H.K.) Limited (Hong Kong)

Zhucheng Dongxiao Biotechnology Co., Ltd. (China)

Zhucheng Haotian Pharm Co., Ltd. (China)

Zibo Zhongshi Green Biotech Co., Ltd. (China)

3.4 Country-wise Analysis of Asia-Pacific Alternative Sweeteners Market

3.4.1 China

3.4.1.1 Chinese Alternative Sweeteners Market Overview by Product Category

3.4.1.1.1 High Intensity Sweeteners

3.4.1.1.1.1 Chinese High Intensity Sweeteners Market Overview by End-Use Application

3.4.1.1.2 Polyols (Sugar Alcohols)

3.4.1.1.2.1 Chinese Polyols (Sugar Alcohols) Market Overview by End-Use Application

3.4.2 India

3.4.2.1 Indian Alternative Sweeteners Market Overview by Product Category

3.4.2.1.1 High Intensity Sweeteners

3.4.2.1.1.1 Indian High Intensity Sweeteners Market Overview by End-Use Application

3.4.2.1.2 Polyols (Sugar Alcohols)

3.4.2.1.2.1 Indian Polyols (Sugar Alcohols) Market Overview by End-Use Application

3.4.3 Indonesia

3.4.3.1 High Intensity Sweeteners

3.4.3.1.1 Indonesian High Intensity Sweeteners Market Overview by End-Use Application

3.4.4 Japan

3.4.4.1 Japanese Alternative Sweeteners Market Overview by Product Category

3.4.4.1.1 High Intensity Sweeteners

3.4.4.1.1.1 Japanese High Intensity Sweeteners Market Overview by End-Use Application

3.4.4.1.2 Polyols (Sugar Alcohols)

3.4.4.1.2.1 Japanese Polyols (Sugar Alcohols) Market Overview by End-Use Application

3.4.5 South Korea

3.4.5.1 South Korean Alternative Sweeteners Market Overview by Product Category

3.4.5.1.1 High Intensity Sweeteners

3.4.5.1.1.1 South Korean High Intensity Sweeteners Market Overview by End-Use Application

3.4.5.1.2 Polyols (Sugar Alcohols)

3.4.5.1.2.1 South Korean Polyols (Sugar Alcohols) Market Overview by End-Use Application

3.4.6 Rest of Asia-Pacific

3.4.6.1 Rest of Asia-Pacific Alternative Sweeteners Market Overview by Product Category

3.4.6.1.1 High Intensity Sweeteners

3.4.6.1.1.1 Rest of Asia-Pacific High Intensity Sweeteners Market Overview by End-Use Application

3.4.6.1.2 Polyols (Sugar Alcohols)

3.4.6.1.2.1 Rest of Asia-Pacific Polyols (Sugar Alcohols) Market Overview by End-Use Application

4. REST OF WORLD

4.1 Rest of World Alternative Sweeteners Market Overview by Geographic Region

4.2 Rest of World Alternative Sweeteners Market Overview by Product Category

4.2.1 High Intensity Sweeteners

4.2.1.1 Rest of World High Intensity Sweeteners Market Overview by Geographic Region

4.2.1.2 Rest of World High Intensity Sweeteners Market Overview by End-Use Application

4.2.1.3 Rest of World High Intensity Sweeteners Market Overview by HIS Type

4.2.2 Polyols (Sugar Alcohols)

4.2.2.1 Rest of World Polyols (Sugar Alcohols) Market Overview by Geographic Region

4.2.2.2 Rest of World Polyols (Sugar Alcohols) Market Overview by End-Use Application

4.3 Major Market Players

NL Stevia S.A. (Paraguay)

Stevia One Peru S.A.C. (Peru)

PART C: GUIDE TO THE INDUSTRY

1. NORTH AMERICA

2. EUROPE

3. ASIA-PACIFIC

4. REST OF WORLD

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

Chart 1: Global Alternative Sweeteners Market 2014, 2017 and 2022

Chart 2: Global Alternative Sweeteners Market 2014, 2017 and 2022 by Geographic Region

Chart 3: Global Alternative Sweeteners Market 2014, 2017 and 2022 by Product Category

Chart 4: Global High Intensity Sweeteners Market 2014, 2017 and 2022

Chart 5: Global High Intensity Sweeteners Market 2014, 2017 and 2022 by HIS Category

Chart 6: Global High Intensity Sweeteners Market 2014, 2017 and 2022 by HIS Type

Chart 7: Global High Intensity Sweeteners Market 2014, 2017 and 2022 by Geographic Region

Chart 8: Global Polyols (Sugar Alcohols) Market 2014, 2017 and 2022

Chart 9: Global Polyols (Sugar Alcohols) Market 2014, 2017 and 2022 by Polyol Type

Chart 10: Global Polyols (Sugar Alcohols) Market 2014, 2017 and 2022 by Geographic Region

Chart 11: Global Alternative Sweeteners Market by Product Category – A 2016 Snapshot

Chart 12: Global High Intensity Sweeteners Market by End-Use Application – A 2016 Snapshot

Chart 13: Global High Intensity Sweeteners Market by HIS Category – A 2016 Snapshot

Chart 14: Global High Intensity Sweeteners Market by HIS Type – A 2016 Snapshot

Chart 15: Global Polyols (Sugar Alcohols) Market by Polyol Type – A 2016 Snapshot

Chart 16: Global Polyols (Sugar Alcohols) Market by End-Use Application – A 2016 Snapshot

Chart 17: Global Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 18: Global Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS)

Chart 19: Glance at 2014, 2017 and 2022 Global Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 20: Global Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 21: Glance at 2014, 2017 and 2022 Global Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 22: Global High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 23: Global High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in Metric Tons

Chart 24: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Volume Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 25: Global High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in USD Million

Chart 26: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Value Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 27: Global High Intensity Sweeteners Market Analysis (2014-2022) by HIS Type – Acesulfame-K, Aspartame, Cyclamate, Neotame, Saccharin, Sucralose, Steviol Glycosides, Glycyrrhizin and Mogroside V in Metric Tons

Chart 28: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Volume Market Share (%) by HIS Type – Acesulfame-K, Aspartame, Cyclamate, Neotame, Saccharin, Sucralose, Steviol Glycosides, Glycyrrhizin and Mogroside V

Chart 29: Global High Intensity Sweeteners Market Analysis (2014-2022) by HIS Type – Acesulfame-K, Aspartame, Cyclamate, Neotame, Saccharin, Sucralose, Steviol Glycosides, Glycyrrhizin and Mogroside V in USD Million

Chart 30: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Value Market Share (%) by HIS Type – Acesulfame-K, Aspartame, Cyclamate, Neotame, Saccharin, Sucralose, Steviol Glycosides, Glycyrrhizin and Mogroside V

Chart 31: Global High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 32: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 33: Global High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 34: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 35: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 36: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Product Type – Sorbitol, Mannitol, Maltitol, Xylitol, Erythritol, Isomalt and Lactitol in Metric Tons

Chart 37: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Volume Market Share (%) by Product Type – Sorbitol, Mannitol, Maltitol, Xylitol, Erythritol, Isomalt and Lactitol

Chart 38: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Product Type – Sorbitol, Mannitol, Maltitol, Xylitol, Erythritol, Isomalt and Lactitol in USD Million

Chart 39: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Value Market Share (%) by Product Type – Sorbitol, Mannitol, Maltitol, Xylitol, Erythritol, Isomalt and Lactitol

Chart 40: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 41: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 42: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 43: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

PART B: REGIONAL MARKET PERSPECTIVE

Chart 44: Global Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in Metric Tons

Chart 45: Glance at 2014, 2017 and 2022 Global Alternative Sweeteners Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 46: Global Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in USD Million

Chart 47: Glance at 2014, 2017 and 2022 Global Alternative Sweeteners Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 48: Global High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in Metric Tons

Chart 49: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 50: Global High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in USD Million

Chart 51: Glance at 2014, 2017 and 2022 Global High Intensity Sweeteners Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 52: Global Artificial High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in Metric Tons

Chart 53: Glance at 2014, 2017 and 2022 Global Artificial High Intensity Sweeteners Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 54: Global Artificial High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in USD Million

Chart 55: Glance at 2014, 2017 and 2022 Global Artificial High Intensity Sweeteners Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 56: Global Natural High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in Metric Tons

Chart 57: Glance at 2014, 2017 and 2022 Global Natural High Intensity Sweeteners Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 58: Global Natural High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in USD Million

Chart 59: Glance at 2014, 2017 and 2022 Global Natural High Intensity Sweeteners Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 60: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in Metric Tons

Chart 61: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Volume Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

Chart 62: Global Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World in USD Million

Chart 63: Glance at 2014, 2017 and 2022 Global Polyols (Sugar Alcohols) Value Market Share (%) by Geographic Region – North America, Europe, Asia-Pacific and Rest of World

REGIONAL MARKET OVERVIEW

NORTH AMERICA

Chart 64: North American Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 65: North American Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in Metric Tons

Chart 66: Glance at 2014, 2017 and 2022 North American Alternative Sweeteners Volume Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 67: North American Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in USD Million

Chart 68: Glance at 2014, 2017 and 2022 North American Alternative Sweeteners Value Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 69: North American Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 70: Glance at 2014, 2017 and 2022 North American Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 71: North American Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 72: Glance at 2014, 2017 and 2022 North American Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 73: North American High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 74: North American High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in Metric Tons

Chart 75: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Volume Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 76: North American High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in USD Million

Chart 77: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Value Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 78: North American High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in Metric Tons

Chart 79: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 80: North American High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in USD Million

Chart 81: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 82: North American High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in Metric Tons

Chart 83: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Volume Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 84: North American High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in USD Million

Chart 85: Glance at 2014, 2017 and 2022 North American High Intensity Sweeteners Value Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 86: North American Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 87: North American Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in Metric Tons

Chart 88: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Volume Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 89: North American Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – United States, Canada and Mexico in USD Million

Chart 90: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Value Market Share (%) by Geographic Region – United States, Canada and Mexico

Chart 91: North American Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 92: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 93: North American Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 94: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

The United States

Chart 95: United States Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 96: United States Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 97: Glance at 2014, 2017 and 2022 United States Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 98: United States Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 99: Glance at 2014, 2017 and 2022 United States Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 100: United States High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 101: United States High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in Metric Tons

Chart 102: Glance at 2014, 2017 and 2022 United States High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 103: United States High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in USD Million

Chart 104: Glance at 2014, 2017 and 2022 United States High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 105: United States Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 106: United States Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 107: Glance at 2014, 2017 and 2022 United States Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 108: United States Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 109: Glance at 2014, 2017 and 2022 United States Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Canada

Chart 110: Canadian Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 111: Canadian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 112: Glance at 2014, 2017 and 2022 Canadian Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 113: Canadian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 114: Glance at 2014, 2017 and 2022 Canadian Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 115: Canadian High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 116: Canadian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in Metric Tons

Chart 117: Glance at 2014, 2017 and 2022 Canadian High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 118: Canadian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in USD Million

Chart 119: Glance at 2014, 2017 and 2022 Canadian High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 120: Canadian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 121: Canadian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 122: Glance at 2014, 2017 and 2022 Canadian Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 123: Canadian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 124: Glance at 2014, 2017 and 2022 Canadian Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Mexico

Chart 125: Mexican Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 126: Mexican Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 127: Glance at 2014, 2017 and 2022 Mexican Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 128: Mexican Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 129: Glance at 2014, 2017 and 2022 Mexican Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 130: Mexican High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 131: Mexican High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in Metric Tons

Chart 132: Glance at 2014, 2017 and 2022 Mexican High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 133: Mexican High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others in USD Million

Chart 134: Glance at 2014, 2017 and 2022 Mexican High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionary, Foods, Tabletop and Others

Chart 135: Mexican Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 136: Mexican Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 137: Glance at 2014, 2017 and 2022 Mexican Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 138: Mexican Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 139: Glance at 2014, 2017 and 2022 Mexican Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

EUROPE

Chart 140: European Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 141: European Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in Metric Tons

Chart 142: Glance at 2014, 2017 and 2022 European Alternative Sweeteners Volume Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 143: European Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in USD Million

Chart 144: Glance at 2014, 2017 and 2022 European Alternative Sweeteners Value Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 145: European Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 146: Glance at 2014, 2017 and 2022 European Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 147: European Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 148: Glance at 2014, 2017 and 2022 European Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 149: European High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 150: European High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in Metric Tons

Chart 151: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Volume Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 152: European High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in USD Million

Chart 153: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Value Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 154: European High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 155: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 156: European High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 157: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 158: European High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in Metric Tons

Chart 159: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Volume Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 160: European High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in USD Million

Chart 161: Glance at 2014, 2017 and 2022 European High Intensity Sweeteners Value Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 162: European Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 163: European Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in Metric Tons

Chart 164: Glance at 2014, 2017 and 2022 European Polyols (Sugar Alcohols) Volume Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 165: European Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe in USD Million

Chart 166: Glance at 2014, 2017 and 2022 European Polyols (Sugar Alcohols) Value Market Share (%) by Geographic Region – France, Germany, Italy, Spain, UK, Russia and Rest of Europe

Chart 167: European Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 168: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 169: European Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 170: Glance at 2014, 2017 and 2022 North American Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

France

Chart 171: French Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 172: French Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 173: Glance at 2014, 2017 and 2022 French Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 174: French Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 175: Glance at 2014, 2017 and 2022 French Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 176: French High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 177: French High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 178: Glance at 2014, 2017 and 2022 French High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 179: French High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 180: Glance at 2014, 2017 and 2022 French High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 181: French Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 182: French Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 183: Glance at 2014, 2017 and 2022 French Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 184: French Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 185: Glance at 2014, 2017 and 2022 French Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Germany

Chart 186: German Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 187: German Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 188: Glance at 2014, 2017 and 2022 German Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 189: German Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 190: Glance at 2014, 2017 and 2022 German Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 191: German High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 192: German High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 193: Glance at 2014, 2017 and 2022 German High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 194: German High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 195: Glance at 2014, 2017 and 2022 German High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 196: German Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 197: German Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 198: Glance at 2014, 2017 and 2022 German Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 199: German Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 200: Glance at 2014, 2017 and 2022 German Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Italy

Chart 201: Italian Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 202: Italian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 203: Glance at 2014, 2017 and 2022 Italian Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 204: Italian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 205: Glance at 2014, 2017 and 2022 Italian Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 206: Italian High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 207: Italian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 208: Glance at 2014, 2017 and 2022 Italian High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 209: Italian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 210: Glance at 2014, 2017 and 2022 Italian High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 211: Italian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 212: Italian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 213: Glance at 2014, 2017 and 2022 Italian Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 214: Italian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 215: Glance at 2014, 2017 and 2022 Italian Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Spain

Chart 216: Spanish Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 217: Spanish Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 218: Glance at 2014, 2017 and 2022 Spanish Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 219: Spanish Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 220: Glance at 2014, 2017 and 2022 Spanish Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 221: Spanish High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 222: Spanish High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 223: Glance at 2014, 2017 and 2022 Spanish High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 224: Spanish High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 225: Glance at 2014, 2017 and 2022 Spanish High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 226: Spanish Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 227: Spanish Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 228: Glance at 2014, 2017 and 2022 Spanish Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 229: Spanish Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 230: Glance at 2014, 2017 and 2022 Spanish Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

The United Kingdom

Chart 231: United Kingdom Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 232: United Kingdom Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 233: Glance at 2014, 2017 and 2022 United Kingdom Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 234: United Kingdom Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 235: Glance at 2014, 2017 and 2022 United Kingdom Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 236: United Kingdom High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 237: United Kingdom High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 238: Glance at 2014, 2017 and 2022 United Kingdom High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 239: United Kingdom High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 240: Glance at 2014, 2017 and 2022 United Kingdom High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 241: United Kingdom Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 242: United Kingdom Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 243: Glance at 2014, 2017 and 2022 United Kingdom Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 244: United Kingdom Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 245: Glance at 2014, 2017 and 2022 United Kingdom Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Russia

Chart 246: Russian Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 247: Russian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 248: Glance at 2014, 2017 and 2022 Russian Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 249: Russian Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 250: Glance at 2014, 2017 and 2022 Russian Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 251: Russian High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 252: Russian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 253: Glance at 2014, 2017 and 2022 Russian High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 254: Russian High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 255: Glance at 2014, 2017 and 2022 Russian High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 256: Russian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 257: Russian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 258: Glance at 2014, 2017 and 2022 Russian Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 259: Russian Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 260: Glance at 2014, 2017 and 2022 Russian Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Rest of Europe

Chart 261: Rest of Europe Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 262: Rest of Europe Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 263: Glance at 2014, 2017 and 2022 Rest of Europe Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 264: Rest of Europe Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 265: Glance at 2014, 2017 and 2022 Rest of Europe Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 266: Rest of Europe High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 267: Rest of Europe High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 268: Glance at 2014, 2017 and 2022 Rest of Europe High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 269: Rest of Europe High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 270: Glance at 2014, 2017 and 2022 Rest of Europe High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 271: Rest of Europe Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 272: Rest of Europe Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 273: Glance at 2014, 2017 and 2022 Rest of Europe Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

Chart 274: Rest of Europe Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in USD Million

Chart 275: Glance at 2014, 2017 and 2022 Rest of Europe Polyols (Sugar Alcohols) Value Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others

ASIA-PACIFIC

Chart 276: Asia-Pacific Alternative Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 277: Asia-Pacific Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific in Metric Tons

Chart 278: Glance at 2014, 2017 and 2022 Asia-Pacific Alternative Sweeteners Volume Market Share (%) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific

Chart 279: Asia-Pacific Alternative Sweeteners Market Analysis (2014-2022) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific in USD Million

Chart 280: Glance at 2014, 2017 and 2022 Asia-Pacific Alternative Sweeteners Value Market Share (%) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific

Chart 281: Asia-Pacific Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in Metric Tons

Chart 282: Glance at 2014, 2017 and 2022 Asia-Pacific Alternative Sweeteners Volume Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 283: Asia-Pacific Alternative Sweeteners Market Analysis (2014-2022) by Product Category – High Intensity Sweeteners (HIS) and Polyols in USD Million

Chart 284: Glance at 2014, 2017 and 2022 Asia-Pacific Alternative Sweeteners Value Market Share (%) by Product Category – High Intensity Sweeteners (HIS) and Polyols

Chart 285: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 286: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – China, India, Indonesia, Japan, South Korea and Rest of Asia-Pacific in Metric Tons

Chart 287: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Volume Market Share (%) by Geographic Region – China, India, Indonesia, Japan, South Korea and Rest of Asia-Pacific

Chart 288: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by Geographic Region – China, India, Indonesia, Japan, South Korea and Rest of Asia-Pacific in USD Million

Chart 289: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Value Market Share (%) by Geographic Region – China, India, Indonesia, Japan, South Korea and Rest of Asia-Pacific

Chart 290: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in Metric Tons

Chart 291: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Volume Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 292: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others in USD Million

Chart 293: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Value Market Share (%) by End-Use Application – Beverages, Confectionery, Foods, Tabletop and Others

Chart 294: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in Metric Tons

Chart 295: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Volume Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 296: Asia-Pacific High Intensity Sweeteners Market Analysis (2014-2022) by HIS Category – Artificial HIS and Natural HIS in USD Million

Chart 297: Glance at 2014, 2017 and 2022 Asia-Pacific High Intensity Sweeteners Value Market Share (%) by HIS Category – Artificial HIS and Natural HIS

Chart 298: Asia-Pacific Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Volume (Metric Tons) and Value (USD Million)

Chart 299: Asia-Pacific Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific in Metric Tons

Chart 300: Glance at 2014, 2017 and 2022 Asia-Pacific Polyols (Sugar Alcohols) Volume Market Share (%) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific

Chart 301: Asia-Pacific Polyols (Sugar Alcohols) Market Analysis (2014-2022) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific in USD Million

Chart 302: Glance at 2014, 2017 and 2022 Asia-Pacific Polyols (Sugar Alcohols) Value Market Share (%) by Geographic Region – China, India, Japan, South Korea and Rest of Asia-Pacific

Chart 303: Asia-Pacific Polyols (Sugar Alcohols) Market Analysis (2014-2022) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others in Metric Tons

Chart 304: Glance at 2014, 2017 and 2022 Asia-Pacific Polyols (Sugar Alcohols) Volume Market Share (%) by End-Use Application – Confectionery, Food & Beverages, Personal Care and Others