Global Distributed Generation (DG) Market Trends and Outlook

Distributed Generation (DG), also known as on-site or decentralized generation, involves small-scale, grid-connected or standalone power systems located close to consumption points. By harnessing renewable sources such as solar PV, wind, fuel cells, biomass, and small hydro, DG minimizes transmission losses, enhances resilience, and promotes sustainability. Rising adoption is supported by stricter emission targets, tax rebates like the US Investment Tax Credit, declining costs of solar, wind, and battery storage, and the growing role of microgrids and electric vehicles in grid modernization. DG provides tailored solutions for residential, commercial, and industrial users, improving efficiency and reducing dependence on centralized plants.

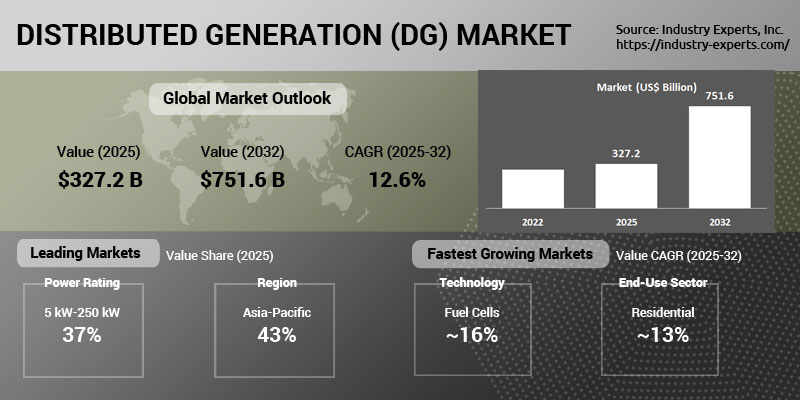

The global DG market is forecast to reach US$751.6 billion by 2032 from US$327.2 billion in 2025, growing at a CAGR of 12.6% between 2025 and 2032. Key growth drivers include industrialization, urbanization, and electrification trends that amplify energy demand, while ecological awareness, subsidies, and renewable mandates accelerate adoption. At the same time, barriers such as high upfront investment, long payback periods, storage and maintenance costs, and limited financing in developing regions constrain growth. Nevertheless, continued innovation in DERs, advanced storage, and distributed energy management platforms is expected to strengthen DG's role in achieving clean, reliable, and cost-effective power generation worldwide.

Distributed Generation (DG) Regional Market Analysis

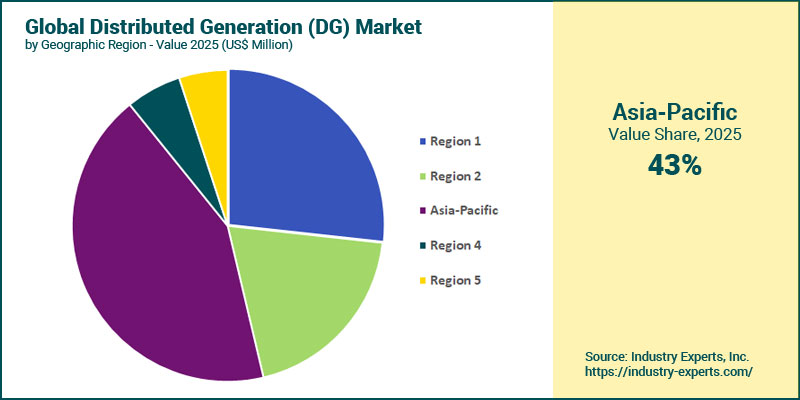

Asia-Pacific, with a 42.9% share in 2025, stands as the largest and fastest-growing regional market, projected to expand at nearly 15% CAGR through 2035. Population growth, industrial activity, and rapid urbanization are fueling demand for localized clean energy, particularly solar PV, wind, rooftop solar, and microgrids. Supportive regulations, subsidies, and renewable mandates-such as China's 2060 carbon neutrality goal-are reinforcing DG expansion, while rising EV penetration, smart grids, and hybrid systems further bolster adoption across the region.

Distributed Generation (DG) Market Analysis by Technology

Solar Photovoltaic (PV) cells dominate DG technologies with 42.9% share in 2025, driven by steep cost declines, modularity, and favorable policies such as net metering and feed-in tariffs. Global solar PV capacity surpassed 2.2 TW in 2024 with strong adoption across residential, commercial, and utility-scale applications. In contrast, Fuel Cells are expected to record the fastest CAGR of 15.6% during 2025-2032, supported by hydrogen investments, durability improvements, and their ability to provide continuous zero-emission power for critical infrastructure such as hospitals, data centers, and industrial microgrids.

Distributed Generation (DG) Market Analysis by Power Rating

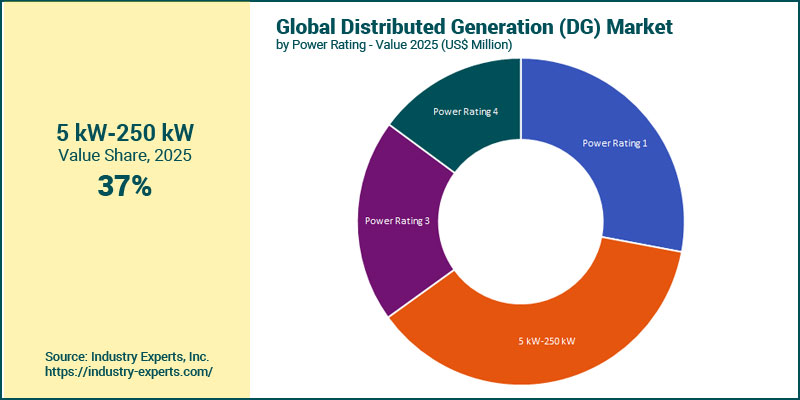

Systems in the 5 kW-250 kW range lead the DG market due to suitability for residential, commercial, and small industrial settings, benefiting from incentives like tax credits and net metering while offering cost-effectiveness and grid integration advantages. However, DG systems below 5 kW are projected to grow the fastest at a CAGR of 15.3% through 2032, driven by affordability, household-scale rooftop solar demand, and deployment in developing regions through microfinancing, subsidies, and compact storage-paired solar solutions.

Distributed Generation (DG) Market Analysis by Application

On-Grid applications dominate with 73.3% share in 2025 and are also forecast to post the fastest CAGR of 14.5% during 2025-2032. Policies such as ITC and PTC in the US, along with similar subsidies globally, are accelerating on-grid adoption by making distributed solar PV and fuel cells financially attractive. These systems support grid stability, reduce GHG emissions, and improve efficiency by enabling energy exchange with utilities and large-scale rooftop solar or wind integration.

Distributed Generation (DG) Market Analysis by End-Use Sector

The Industrial sector leads DG demand with 35% share in 2025, as manufacturing plants, data centers, and industrial parks seek reliable, cost-effective, on-site energy solutions supported by tax incentives and electrification programs. Meanwhile, the Residential sector is projected to register the fastest CAGR of 13.2% between 2025 and 2032, fueled by rooftop solar affordability, rising electricity prices, environmental awareness, and supportive policies enabling households to achieve energy independence and reduce carbon footprints.

Distributed Generation (DG) Market Report Scope

This global report on Distributed Generation (DG) analyzes the market based on Technology, Power Rating, Application and End-Use Sector for the period 2022-2032 with projections from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Analysis Period: | 2022-2032 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 20+ |

Distributed Generation (DG) Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (France, Germany, Italy, Russia, Spain, the United Kingdom and Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea and Rest of Asia-Pacific)

- South America (Argentina, Brazil and Rest of South America)

- Middle East & Africa

Distributed Generation (DG) Market by Technology

- Fuel Cells

- Micro Turbines

- Reciprocating Engines

- Solar Photovoltaic (PV) Cells

- Wind Turbines

- Other Technologies [Incl. Combustion Turbines, Combined Heat & Power (CHP), Gas & Steam Turbines and Micro-Hydropower]

Distributed Generation (DG) Market by Power Rating

- Below 5 kW

- 5 kW-250 kW

- 250 kW-1 MW

- Above 1 MW

Distributed Generation (DG) Market by Application

- Off-Grid

- On-Grid

Distributed Generation (DG) Market by End-Use Sector

- Commercial

- Industrial

- Residential

Distributed Generation (DG) Market Frequently Asked Questions (FAQs)

The global Distributed Generation (DG) market is anticipated to grow at a CAGR of 12.6% during the 2025-2032 analysis period.

Asia-Pacific is the largest global market for Distributed Generation (DG), with an estimated share of 42.9% in 2025.

Asia-Pacific is also likely to post the fastest CAGR of 15% for Distributed Generation (DG) demand over the 2025-2032 analysis period.

Solar Photovoltaic (PV) Cells account for the largest share of the Distributed Generation (DG) market, estimated at 42.9% in 2024.

Residential is the fastest growing application in the Distributed Generation (DG) market, with a forecast 2025-2032 CAGR of 13.2%.

Some of the key factors driving demand for Distributed Generation (DG) include rising electricity demand & urbanization, government policies & incentives, declining costs of renewables, environmental awareness & sustainability, technological advancements & shift towards electric vehicles (EVs) and availability of diverse energy sources.

PART A: GLOBAL MARKET PERSPECTIVE

1. Introduction

- Distributed Generation (DG) Outline

- Distributed Generation (DG) Defined

- Distributed Generation (DG) Technology

- Fuel Cells

- Micro Turbines

- Reciprocating Engines

- Solar Photovoltaic (PV) Cells

- Wind Turbines

- Other Technologies [Incl. Combustion Turbines, Combined Heat & Power (CHP), Gas & Steam Turbines and Micro-Hydropower]

- Distributed Generation (DG) Power Rating

- Below 5 kW

- 5 kW-250 kW

- 250 kW-1 MW

- Above 1 MW

- Distributed Generation (DG) Application

- Off-Grid

- On-Grid

- Distributed Generation (DG) End-Use Sector

- Commercial

- Industrial

- Residential

2. Key Market Trends

3. Key Market Players

- Alstom SA

- Ansaldo Energia SpA

- Ballard Power Systems, Inc.

- Bloom Energy Corp

- Capstone Green Energy Corp

- Capstone Turbine Corp

- Caterpillar Energy Solutions GmbH

- Cummins, Inc.

- Destinus Energy

- Doosan Enerbility

- Doosan Fuel Cell Co Ltd

- E.ON SE

- ENERCON Global GmbH

- First Solar, Inc.

- FuelCell Energy, Inc.

- General Electric

- Mitsubishi Electric Corp

- Mitsubishi Power Americas, Inc.

- Rolls-Royce plc

- Schneider Electric

- Sharp Corp

- Siemens Energy AG

- Suzlon Energy Ltd

- Toyota Turbine and Systems, Inc.

- Vestas Wind Systems A/S

4. Key Business & Product Trends

5. Global Market Overview

- Global Distributed Generation (DG) Market Overview by Technology

- Distributed Generation (DG) Technology Market Overview by Global Region

- Fuel Cells

- Micro Turbines

- Reciprocating Engines

- Solar Photovoltaic (PV) Cells

- Wind Turbines

- Other Technologies [Incl. Combustion Turbines, Combined Heat & Power (CHP), Gas & Steam Turbines and Micro-Hydropower]

- Global Distributed Generation (DG) Market Overview by Power Rating

- Distributed Generation (DG) Power Rating Market Overview by Global Region

- Below 5 kW

- 5 kW-250 kW

- 250 kW-1 MW

- Above 1 MW

- Global Distributed Generation (DG) Market Overview by Application

- Distributed Generation (DG) Application Market Overview by Global Region

- Off-Grid

- On-Grid

- Global Distributed Generation (DG) Market Overview by End-Use Sector

- Distributed Generation (DG) End-Use Sector Market Overview by Global Region

- Commercial

- Industrial

- Residential

PART B: REGIONAL MARKET PERSPECTIVE

- Global Distributed Generation (DG) Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Distributed Generation (DG) Market Overview by Geographic Region

- North American Distributed Generation (DG) Market Overview by Technology

- North American Distributed Generation (DG) Market Overview by Power Rating

- North American Distributed Generation (DG) Market Overview by Application

- North American Distributed Generation (DG) Market Overview by End-Use Sector

- Country-wise Analysis of North American Distributed Generation (DG) Market

- The United States

- United States Distributed Generation (DG) Market Overview by Technology

- United States Distributed Generation (DG) Market Overview by Power Rating

- United States Distributed Generation (DG) Market Overview by Application

- United States Distributed Generation (DG) Market Overview by End-Use Sector

- Canada

- Canadian Distributed Generation (DG) Market Overview by Technology

- Canadian Distributed Generation (DG) Market Overview by Power Rating

- Canadian Distributed Generation (DG) Market Overview by Application

- Canadian Distributed Generation (DG) Market Overview by End-Use Sector

- Mexico

- Mexican Distributed Generation (DG) Market Overview by Technology

- Mexican Distributed Generation (DG) Market Overview by Power Rating

- Mexican Distributed Generation (DG) Market Overview by Application

- Mexican Distributed Generation (DG) Market Overview by End-Use Sector

7. Europe

- European Distributed Generation (DG) Market Overview by Geographic Region

- European Distributed Generation (DG) Market Overview by Technology

- European Distributed Generation (DG) Market Overview by Power Rating

- European Distributed Generation (DG) Market Overview by Application

- European Distributed Generation (DG) Market Overview by End-Use Sector

- Country-wise Analysis of European Distributed Generation (DG) Market

- France

- French Distributed Generation (DG) Market Overview by Technology

- French Distributed Generation (DG) Market Overview by Power Rating

- French Distributed Generation (DG) Market Overview by Application

- French Distributed Generation (DG) Market Overview by End-Use Sector

- Germany

- German Distributed Generation (DG) Market Overview by Technology

- German Distributed Generation (DG) Market Overview by Power Rating

- German Distributed Generation (DG) Market Overview by Application

- German Distributed Generation (DG) Market Overview by End-Use Sector

- Italy

- Italian Distributed Generation (DG) Market Overview by Technology

- Italian Distributed Generation (DG) Market Overview by Power Rating

- Italian Distributed Generation (DG) Market Overview by Application

- Italian Distributed Generation (DG) Market Overview by End-Use Sector

- Russia

- Russian Distributed Generation (DG) Market Overview by Technology

- Russian Distributed Generation (DG) Market Overview by Power Rating

- Russian Distributed Generation (DG) Market Overview by Application

- Russian Distributed Generation (DG) Market Overview by End-Use Sector

- Spain

- Spanish Distributed Generation (DG) Market Overview by Technology

- Spanish Distributed Generation (DG) Market Overview by Power Rating

- Spanish Distributed Generation (DG) Market Overview by Application

- Spanish Distributed Generation (DG) Market Overview by End-Use Sector

- United Kingdom

- United Kingdom Distributed Generation (DG) Market Overview by Technology

- United Kingdom Distributed Generation (DG) Market Overview by Power Rating

- United Kingdom Distributed Generation (DG) Market Overview by Application

- United Kingdom Distributed Generation (DG) Market Overview by End-Use Sector

- Rest of Europe

- Rest of Europe Distributed Generation (DG) Market Overview by Technology

- Rest of Europe Distributed Generation (DG) Market Overview by Power Rating

- Rest of Europe Distributed Generation (DG) Market Overview by Application

- Rest of Europe Distributed Generation (DG) Market Overview by End-Use Sector

8. Asia-Pacific

- Asia-Pacific Distributed Generation (DG) Market Overview by Geographic Region

- Asia-Pacific Distributed Generation (DG) Market Overview by Technology

- Asia-Pacific Distributed Generation (DG) Market Overview by Power Rating

- Asia-Pacific Distributed Generation (DG) Market Overview by Application

- Asia-Pacific Distributed Generation (DG) Market Overview by End-Use Sector

- Country-wise Analysis of Asia-Pacific Distributed Generation (DG) Market

- China

- Chinese Distributed Generation (DG) Market Overview by Technology

- Chinese Distributed Generation (DG) Market Overview by Power Rating

- Chinese Distributed Generation (DG) Market Overview by Application

- Chinese Distributed Generation (DG) Market Overview by End-Use Sector

- India

- Indian Distributed Generation (DG) Market Overview by Technology

- Indian Distributed Generation (DG) Market Overview by Power Rating

- Indian Distributed Generation (DG) Market Overview by Application

- Indian Distributed Generation (DG) Market Overview by End-Use Sector

- Japan

- Japanese Distributed Generation (DG) Market Overview by Technology

- Japanese Distributed Generation (DG) Market Overview by Power Rating

- Japanese Distributed Generation (DG) Market Overview by Application

- Japanese Distributed Generation (DG) Market Overview by End-Use Sector

- South Korea

- South Korean Distributed Generation (DG) Market Overview by Technology

- South Korean Distributed Generation (DG) Market Overview by Power Rating

- South Korean Distributed Generation (DG) Market Overview by Application

- South Korean Distributed Generation (DG) Market Overview by End-Use Sector

- Rest of Asia-Pacific

- Rest of Asia-Pacific Distributed Generation (DG) Market Overview by Technology

- Rest of Asia-Pacific Distributed Generation (DG) Market Overview by Power Rating

- Rest of Asia-Pacific Distributed Generation (DG) Market Overview by Application

- Rest of Asia-Pacific Distributed Generation (DG) Market Overview by End-Use Sector

9. South America

- South American Distributed Generation (DG) Market Overview by Geographic Region

- South American Distributed Generation (DG) Market Overview by Technology

- South American Distributed Generation (DG) Market Overview by Power Rating

- South American Distributed Generation (DG) Market Overview by Application

- South American Distributed Generation (DG) Market Overview by End-Use Sector

- Country-wise Analysis of South American Distributed Generation (DG) Market

- Argentina

- Argentine Distributed Generation (DG) Market Overview by Technology

- Argentine Distributed Generation (DG) Market Overview by Power Rating

- Argentine Distributed Generation (DG) Market Overview by Application

- Argentine Distributed Generation (DG) Market Overview by End-Use Sector

- Brazil

- Brazilian Distributed Generation (DG) Market Overview by Technology

- Brazilian Distributed Generation (DG) Market Overview by Power Rating

- Brazilian Distributed Generation (DG) Market Overview by Application

- Brazilian Distributed Generation (DG) Market Overview by End-Use Sector

- Rest of South America

- Rest of South American Distributed Generation (DG) Market Overview by Technology

- Rest of South American Distributed Generation (DG) Market Overview by Power Rating

- Rest of South American Distributed Generation (DG) Market Overview by Application

- Rest of South American Distributed Generation (DG) Market Overview by End-Use Sector

10. Middle East & Africa

- Middle East & Africa Distributed Generation (DG) Market Overview by Technology

- Middle East & Africa Distributed Generation (DG) Market Overview by Power Rating

- Middle East & Africa Distributed Generation (DG) Market Overview by Application

- Middle East & Africa Distributed Generation (DG) Market Overview by End-Use Sector

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Alstom SA

Ansaldo Energia SpA

Ballard Power Systems, Inc.

Bloom Energy Corp

Capstone Green Energy Corp

Capstone Turbine Corp

Caterpillar Energy Solutions GmbH

Cummins, Inc.

Destinus Energy

Doosan Enerbility

Doosan Fuel Cell Co Ltd

E.ON SE

ENERCON Global GmbH

First Solar, Inc.

FuelCell Energy, Inc.

General Electric

Mitsubishi Electric Corp

Mitsubishi Power Americas, Inc.

Rolls-Royce plc

Schneider Electric

Sharp Corp

Siemens Energy AG

Suzlon Energy Ltd

Toyota Turbine and Systems, Inc.

Vestas Wind Systems A/S

RELATED REPORTS

Micro Batteries - A Global Market Overview

Report Code: ENU026 | Pages: 398 | Price: $4950

Published

Aug 2025

Aircraft Fuel Cells - A Global Market Overview

Report Code: ENU006 | Pages: 412 | Price: $4950

Published

Jul 2025

Battery Energy Storage Systems (BESS) - A Global Market Overview

Report Code: ENU005 | Pages: 470 | Price: $5040

Published

Jun 2025

Biolubricants – A Global Market Overview

Report Code: ENU014 | Pages: 332 | Price: $3960

Published

Feb 2025