Global Blood Preparations Market Trends and Outlook

The global Blood Preparations market, valued at US$54 billion in 2025, is expected to reach nearly US$80.2 billion by 2032, growing at a steady 5.8% CAGR. Blood preparations include whole blood, components like red cells, plasma, and platelets, and plasma-derived therapies such as immunoglobulins, albumin, and coagulation factors. These products are essential in transfusions, critical care, immune deficiencies, bleeding disorders, and cardiovascular conditions. Pharmacological options, such as anticoagulants and fibrinolytics, further support the management of thrombosis, embolism, and other vascular issues, making blood preparations indispensable in both routine and emergency care.

Market growth is fueled by rising chronic and hematologic diseases, an aging global population, and increasing demand for complex surgical and trauma interventions. New technologies in blood collection, pathogen reduction, AI-based screening, and automated processing are improving safety, efficiency, and supply reliability. Strong global initiatives encouraging voluntary donation and stringent regulatory standards are also strengthening the ecosystem. While donor shortages and lingering concerns over transfusion-transmitted infections remain challenges, expanding healthcare access, greater diagnostic reach, and the growing use of plasma-derived therapies continue to push the market forward.

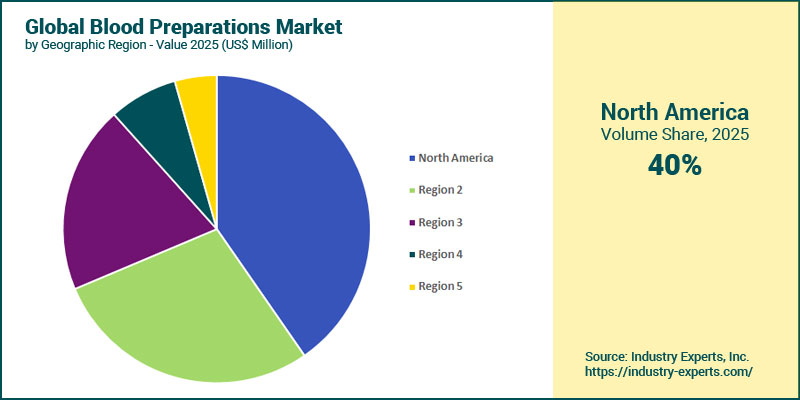

Blood Preparations Regional Market Analysis

North America dominates the global blood preparation market in 2025, accounting for 40.4%, driven by advanced healthcare infrastructure, strong demand for plasma-derived therapeutics, and a well-established network of blood banks and transfusion centers. The region benefits from a significant occurrence of cardiovascular and hematologic diseases, coupled with strong efforts from key companies such as CSL Behring, Grifols, and Baxter, along with strict FDA regulations that guarantee safety and quality. Technological advancements in plasma fractionation, blood substitutes, and pathogen reduction further enhance market growth. Favorable reimbursement frameworks and extensive donor networks strengthen the supply chain and clinical utilization of blood products. In contrast, the Asia-Pacific region is projected to record the fastest CAGR of 7.5% during the forecast period of 2025-2032. This growth is bolstered by the development of healthcare facilities, increased awareness regarding blood donation, and heightened government efforts to achieve self-sufficiency in plasma collection. Countries such as China, India, and Japan are leading regional progress through national blood programs and investment in advanced transfusion technologies. The increasing incidence of chronic diseases, trauma cases, and surgical procedures continues to fuel demand, positioning Asia-Pacific as the key growth hub in the coming years.

Blood Preparations Market Analysis by Product Type

Whole blood segment leads the global blood preparation market, with a share of 42.5% in 2025, driven by its indispensable role in emergency transfusions, surgeries, and trauma management. Its dominance is reinforced by wide availability, cost-effectiveness, and established collection and processing systems, particularly in developing regions where component separation technologies remain limited. Whole blood continues to serve as the foundation for preparing other blood components while maintaining strong clinical relevance in cases requiring simultaneous replacement of multiple elements. Rising rates of accidents, surgical procedures, and hematologic disorders further sustain demand. On the other hand, blood derivatives are expected to be the fastest-growing segment with a CAGR of 6.3% from 2025 to 2032. This growth is driven by the increasing use of plasma-derived products such as immunoglobulins, albumin, and coagulation factors for the treatment of immune, hepatic, and bleeding disorders. Ongoing advancements in plasma fractionation, recombinant protein development, and the expansion of therapeutic applications continue to accelerate this segment's growth, positioning blood derivatives as a key driver in the evolving blood preparation market.

Blood Preparations Market Analysis by Antithrombotic and Anticoagulants Type

Anticoagulants dominate the blood preparation market, holding a 61.9% share in 2025 due to their widespread use in preventing and treating thromboembolic conditions such as deep vein thrombosis, atrial fibrillation, and pulmonary embolism. Their dominance is supported by the increasing utilization of low-molecular-weight heparins (LMWHs) and direct oral anticoagulants (DOACs), which provide enhanced safety and convenience in dosing. The rise in cardiovascular disease cases, the growing number of older adults, and heightened awareness regarding the prevention of thrombosis all contribute to the market growth. Continuous R&D focused on improving anticoagulant efficacy and minimizing bleeding risks also drives innovation within this category. Meanwhile, platelet aggregation inhibitors are projected to record the fastest growth rate with a 6.2% CAGR from 2025 to 2032. The growth is fueled by the surge in interventional cardiology procedures and broader therapeutic use of drugs such as clopidogrel and ticagrelor in acute coronary syndromes.

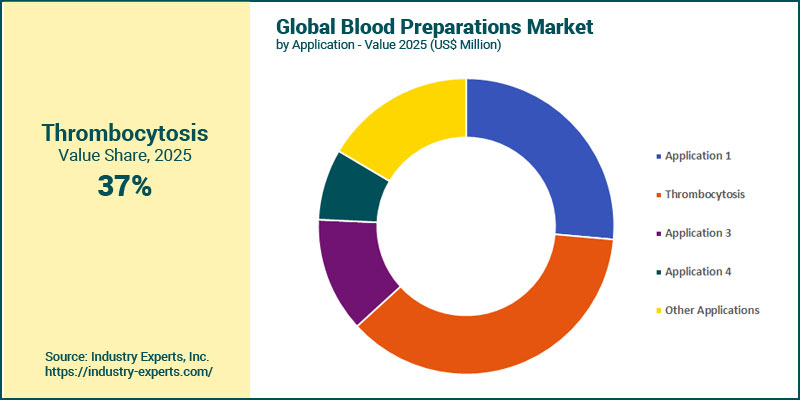

Blood Preparations Market Analysis by Application

Thrombocytosis application leads the blood preparation market, accounting for 36.8% of the share in 2025, driven by the rising prevalence of platelet abnormalities, myeloproliferative disorders, and the growing use of platelet-rich plasma and anticoagulant therapies to manage clotting complications. Its dominance is further supported by high diagnostic and therapeutic demand in hematology and oncology, alongside increasing awareness of thrombocytosis and advances in early detection technologies. The condition's link to serious complications such as stroke and myocardial infarction reinforces the need for effective anticoagulant and antithrombotic management. In contrast, the angina and blood vessel complications segment is anticipated to record the fastest CAGR of 6.6% from 2025 to 2032, driven by the global rise in cardiovascular diseases, sedentary lifestyles, and growing adoption of antiplatelet and anticoagulant drugs for long-term vascular protection. Expanding R&D in cardiovascular therapeutics and higher healthcare spending further strengthen this segment's growth trajectory.

Blood Preparations Market Analysis by End User

Hospitals lead the blood preparation market by end user, accounting for a 52.7% share in 2025. Their dominance stems from being the primary centers for transfusions, surgeries, and critical care procedures that demand immediate access to blood and plasma-derived products. Their advanced infrastructure, integrated diagnostic and transfusion services, and extensive blood inventories across departments such as oncology, cardiology, and trauma care sustain their dominance. Hospitals often operate in-house blood banks or partner with regional centers to ensure a consistent supply and compliance with stringent safety standards. Rising surgical volumes, emergency procedures, and chronic disease treatments further drive hospital demand for blood products. In contrast, blood banks are projected to register the fastest growth at a CAGR of 6.5% from 2025 to 2032, supported by increasing blood donation campaigns, expanding plasma collection capacity, and the adoption of automation and preservation technologies to enhance supply chain efficiency and product safety.

Blood Preparations Market Report Scope

This global report on Blood Preparations analyzes the market based on product type, antithrombotic and anticoagulants type, application, and end user for the period 2022-2032 with projections from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Historical Period: | 2022-2024 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 10+ |

Blood Preparations Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- South America (Brazil, Argentina, and Rest of South America)

- Rest of World

Blood Preparations Market by Product Type

- Whole Blood

- Blood Components

- Blood Derivatives

Blood Preparations Market by Antithrombotic and Anticoagulants Type

- Anticoagulants

- Platelet Aggregation Inhibitors

- Fibrinolytics

Blood Preparations Market by Application

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina and Blood Vessel Complications

- Other Applications (Including Surgical and Trauma Procedures, Transfusion Medicine and others)

Blood Preparations Market by End User

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Academic and Research Institutions

Blood Preparations Market Frequently Asked Questions (FAQs)

The global blood preparations market is likely to grow at a CAGR of 5.8% during the 2025-2032 analysis period.

North America is the largest region in the global blood preparations market, holding a 40.4% share in 2025.

The Asia-Pacific region is the fastest-growing, projected to record a CAGR of 7.5% from 2025 to 2032.

The leading product type in the blood preparations market is whole blood, accounting for a 42.5% share in 2025, driven by its essential role in emergency transfusions, surgical procedures, and trauma care.

The largest application segment in the blood preparations market is Thrombocytosis, accounting for 36.8% of the market share in 2025.

The demand for blood preparations is driven by the rising prevalence of blood and cardiovascular disorders, increasing surgical and trauma cases, growing use of plasma-derived therapeutics, advancements in anticoagulant and biologic drug development, and the expansion of transfusion and critical care infrastructure worldwide.

The global market size for Blood Preparations is estimated at US$54 billion in 2025 and US$80.2 billion by 2032.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Product Type Outline

- Blood Preparations Defined

- Blood Preparation Product Types

- Whole Blood

- Blood Components

- Blood Derivatives

- Blood Preparation Antithrombotic and Anticoagulants Types

- Anticoagulants

- Platelet Aggregation Inhibitors

- Fibrinolytics

- Blood Preparation Applications

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina and Blood Vessel Complications

- Other Applications (Including Surgical and Trauma Procedures, Transfusion Medicine and others)

- Blood Preparation End Users

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Academic and Research Institutions

2. Key Market Trends

3. Key Market Players

- Aspen Holdings

- AstraZeneca plc

- Baxter International Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- CSL Behring

- Grifols, S.A.

- LEO Pharma A/S

- Octapharma AG

- Pfizer Inc.

- Sanofi S.A.

4. Key Business & Product Type Trends

5. Global Market Overview

- Global Blood Preparations Market Overview by Product Type

- Blood Preparations Product Type Market Overview by Global Region

- Whole Blood

- Blood Components

- Blood Derivatives

- Global Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Blood Preparations Antithrombotic and Anticoagulants Type Market Overview by Global Region

- Anticoagulants

- Platelet Aggregation Inhibitors

- Fibrinolytics

- Global Blood Preparations Market Overview by Application

- Blood Preparations Application Market Overview by Global Region

- Thrombocytosis

- Pulmonary Embolism

- Renal Impairment

- Angina and Blood Vessel Complications

- Other Applications

- Global Blood Preparations Market Overview by End User

- Blood Preparations End User Market Overview by Global Region

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Academic and Research Institutions

PART B: REGIONAL MARKET PERSPECTIVE

- Global Blood Preparations Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Blood Preparations Market Overview by Geographic Region

- North American Blood Preparations Market Overview by Product Type

- North American Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- North American Blood Preparations Market Overview by Application

- North American Blood Preparations Market Overview by End User

- Country-Wise Analysis of the North American Blood Preparations Market

- The United States

- United States Blood Preparations Market Overview by Product Type

- United States Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- United States Blood Preparations Market Overview by Application

- United States Blood Preparations Market Overview by End User

- Canada

- Canadian Blood Preparations Market Overview by Product Type

- Canadian Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Canadian Blood Preparations Market Overview by Application

- Canadian Blood Preparations Market Overview by End User

- Mexico

- Mexican Blood Preparations Market Overview by Product Type

- Mexican Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Mexican Blood Preparations Market Overview by Application

- Mexican Blood Preparations Market Overview by End User

7. Europe

- European Blood Preparations Market Overview by Geographic Region

- European Blood Preparations Market Overview by Product Type

- European Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- European Blood Preparations Market Overview by Application

- European Blood Preparations Market Overview by End User

- Country-Wise Analysis of European Blood Preparations Market

- Germany

- German Blood Preparations Market Overview by Product Type

- German Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- German Blood Preparations Market Overview by Application

- French Blood Preparations Market Overview by End User

- France

- French Blood Preparations Market Overview by Product Type

- French Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- French Blood Preparations Market Overview by Application

- French Blood Preparations Market Overview by End User

- The United Kingdom

- United Kingdom Blood Preparations Market Overview by Product Type

- United Kingdom Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- United Kingdom Blood Preparations Market Overview by Application

- United Kingdom Blood Preparations Market Overview by End User

- Italy

- Italian Blood Preparations Market Overview by Product Type

- Italian Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Italian Blood Preparations Market Overview by Application

- Italian Blood Preparations Market Overview by End User

- Spain

- Spanish Blood Preparations Market Overview by Product Type

- Spanish Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Spanish Blood Preparations Market Overview by Application

- Spanish Blood Preparations Market Overview by End User

- Rest of Europe

- Rest of Europe Blood Preparations Market Overview by Product Type

- Rest of Europe Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Rest of Europe Blood Preparations Market Overview by Application

- Rest of Europe Blood Preparations Market Overview by End User

8. Asia-Pacific

- Asia-Pacific Blood Preparations Market Overview by Geographic Region

- Asia-Pacific Blood Preparations Market Overview by Product Type

- Asia-Pacific Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Asia-Pacific Blood Preparations Market Overview by Application

- Asia-Pacific Blood Preparations Market Overview by End User

- Country-Wise Analysis of the Asia-Pacific Blood Preparations Market

- Japan

- Japanese Blood Preparations Market Overview by Product Type

- Japanese Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Japanese Blood Preparations Market Overview by Application

- Japanese Blood Preparations Market Overview by End User

- China

- Chinese Blood Preparations Market Overview by Product Type

- Chinese Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Chinese Blood Preparations Market Overview by Application

- Chinese Blood Preparations Market Overview by End User

- India

- Indian Blood Preparations Market Overview by Product Type

- Indian Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Indian Blood Preparations Market Overview by Application

- Indian Blood Preparations Market Overview by End User

- South Korea

- South Korean Blood Preparations Market Overview by Product Type

- South Korean Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- South Korean Blood Preparations Market Overview by Application

- South Korean Blood Preparations Market Overview by End User

- Rest of Asia-Pacific

- Rest of Asia-Pacific Blood Preparations Market Overview by Product Type

- Rest of Asia-Pacific Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Rest of Asia-Pacific Blood Preparations Market Overview by Application

- Rest of Asia-Pacific Blood Preparations Market Overview by End User

9. South America

- South American Blood Preparations Market Overview by Geographic Region

- South American Blood Preparations Market Overview by Product Type

- South American Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- South American Blood Preparations Market Overview by Application

- South American Blood Preparations Market Overview by End User

- Country-Wise Analysis of the South American Blood Preparations Market

- Brazil

- Brazilian Blood Preparations Market Overview by Product Type

- Brazilian Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Brazilian Blood Preparations Market Overview by Application

- Brazilian Blood Preparations Market Overview by End User

- Argentina

- Argentine Blood Preparations Market Overview by Product Type

- Argentine Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Argentine Blood Preparations Market Overview by Application

- Argentine Blood Preparations Market Overview by End User

- Rest of South America

- Rest of South American Blood Preparations Market Overview by Product Type

- Rest of South American Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Rest of South American Blood Preparations Market Overview by Application

- Rest of South American Blood Preparations Market Overview by End User

10. Rest of World

- Rest of World Blood Preparations Market Overview by Product Type

- Rest of World Blood Preparations Market Overview by Antithrombotic and Anticoagulants Type

- Rest of World Blood Preparations Market Overview by Application

- Rest of World Blood Preparations Market Overview by End User

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Aspen Holdings

AstraZeneca plc

Baxter International Inc.

Boehringer Ingelheim International GmbH

Bristol-Myers Squibb Company

CSL Behring

Grifols, S.A.

LEO Pharma A/S

Octapharma AG

Pfizer Inc.

Sanofi S.A.

RELATED REPORTS

Global Bioburden Testing Market - Products, Types and Applications

Report Code: CDG014 | Pages: 307 | Price: $4500

Published

Jan 2026

Global Cancer Biomarkers Market - Types, Applications and Technologies

Report Code: CDG016 | Pages: 326 | Price: $4500

Published

Jan 2026

Global Autoimmune Disease Diagnostics Market - Products, Disease Types and Test Types

Report Code: CDG006 | Pages: 338 | Price: $4500

Published

Nov 2025

Blood Culture Test - A Global Market Overview

Report Code: CDG013 | Pages: 405 | Price: $4500

Published

Nov 2025