Published Date: Jan 2026

Report Code: CHM026

Pages: 488

Charts: 418

Global Aramid Fibers Market Trends and Outlook

Aramid fibers, comprising para-aramid and meta-aramid chemistries, are high-performance aromatic polyamides valued for their exceptional strength-to-weight ratio, heat resistance, flame resistance, and dimensional stability. First commercialized in the 1960s and 1970s as products such as Nomex, Kevlar, and Twaron, aramid fibers have since become essential materials in ballistic protection, high-temperature filtration, frictional materials, electrical insulation, optical fiber reinforcement, tire and rubber reinforcement, and advanced composites. Their unique mechanical, thermal, and chemical characteristics continue to expand their relevance across aerospace, defense, industrial manufacturing, automotive, telecommunications, and energy sectors.

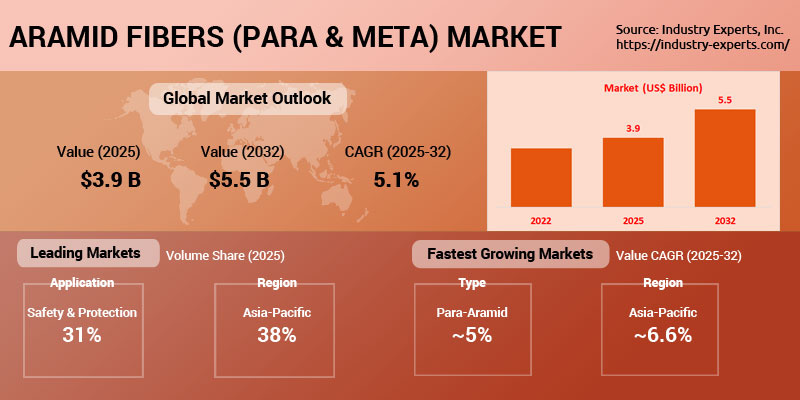

The global aramid fibers market reached about US$3.9 billion in 2025, supported by rising safety regulations, rapid telecom infrastructure upgrades, defense modernization efforts, and increased adoption of high-performance materials across industrial and mobility applications. Para-aramid maintained a strong lead due to its superior strength and broad functional uses, while meta-aramid sustained its role in thermal insulation and high-temperature protection. Significant application momentum was observed in Safety & Protection, friction materials, filtration media, and optical fiber cables, reflecting both regulatory pressures and investments in critical infrastructure.

By 2032, global demand is projected to reach 200 thousand metric tons and US$5.5 billion, growing at a 5.8% CAGR in volume and 5.1% CAGR in value from 2025 to 2032. Asia-Pacific remains both the largest and fastest-growing region, driven by industrial expansion, EV-related material needs, and accelerating fiber-optic deployments, while capacity additions across China and South Korea continue to reshape global supply dynamics. Ongoing technological advancements in aramid spinning, surface modification, chemical stabilization, and application-specific performance enhancement are expected to further strengthen market penetration and broaden end-use adoption over the forecast period.

Global Aramid Fibers Production Capacity Trends and Forecasts

The global aramid fiber industry recorded a combined 188 thousand metric tons of installed production capacity in 2025 and expected to reach 200 thousand metric tons by 2030, with para-aramid accounting for a dominant share. The competitive landscape is defined by a mix of long-established Western and Japanese producers, such as DuPont, Teijin, Kolon Industries, Toray Advanced Materials, Kamenskvolokno and Kermel, alongside rapidly expanding Chinese manufacturers including Yantai Tayho, Sinochem, and Sinopec Yizheng. While DuPont remains the largest single producer with stable capacity in both para- and meta-aramid, capacity additions between 2020 and 2025 were overwhelmingly led by Asian players. Teijin increased its para-aramid capacity to 36.5 thousand tons, Kolon more than doubled to 15.3 thousand tons, and several Chinese firms collectively expanded capacity by over 20 thousand tons, reflecting the accelerating shift of global supply toward Asia.

A significant structural change is emerging as China transitions from a capacity-limited segment to a surplus-driven competitive force. Domestic para-aramid production has grown sharply, supported by companies such as Yantai Tayho, Sinochem International, Jiangsu Shengbang, and Qingdao Polybeautify, with plans to further scale by 2030. This expansion has intensified price-based competition, particularly in 2024-2025 when new Chinese capacity outpaced demand growth. International producers, including DuPont and Teijin, responded with aggressive pricing to defend market share, leveraging their economies of scale and brand strength. However, the resulting price pressure has significantly eroded industry profitability, prompting strategic restructuring among global leaders. Teijin's announced closure of its Arnhem para-aramid pulp production facility in early 2025, driven by high costs and Asian competition, underscores the shifting economics of the sector. Meanwhile, DuPont's strategic decision to divest its Kevlar and Nomex businesses reflects a broader realignment as Western firms reallocate capital and exit asset-heavy segments under margin pressure.

Aramid Fibers Regional Market Analysis

Asia-Pacific clearly leading at 37.6% share of the global aramid fibers demand in terms of value in 2025. This strong position reflects rapid industrialization, expanding automotive manufacturing, large-scale telecom fiber deployment, and growing investments in safety, defense, and filtration technologies across China, India, Japan, and South Korea. North America stands as the second-largest and remains close behind, supported by robust defense spending, advanced aerospace production, and continuous demand for high-performance protective gear. Over the forecast period, Asia-Pacific also emerges as the fastest-growing region with a CAGR of 7.2%, fueled by capacity expansions, rising PPE adoption, and the broadening use of aramid fibers in EV components and next-generation communication networks.

Aramid Fibers Market Analysis by Product Type

In 2025, the global aramid fiber market is led prominently by Para-Aramid, which is dominant with 68.5% share. This leadership stems from its widespread use in high-performance applications such as ballistic protection, optical fiber cables, friction materials, and advanced composites where superior strength-to-weight ratios and heat resistance are critical. Meta-Aramid, valued at US$1.2 billion, supported by steady demand in electrical insulation, filtration media, and heat-resistant apparel. Over the forecast period, Para-Aramid is also expected to be the fastest-growing segment with a CAGR of 5.2%, driven by rising defense spending, growth in 5G fiber-optic networks, and strengthened automotive safety regulations. Meta-Aramid will benefit from industrial heat-protection requirements and expansion in high-temperature filtration systems.

Aramid Fibers Market Analysis by Application

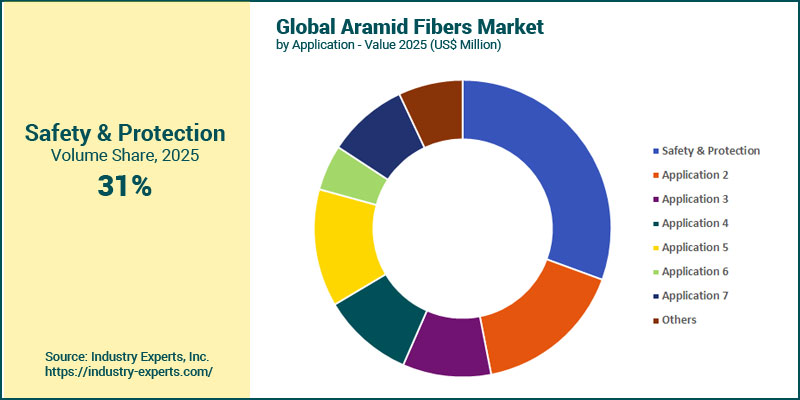

Safety & Protection standing out as the largest application at around 31% of total global aramid fibers demand in 2025. This dominance is reinforced by stringent global safety standards, heightened defense procurement, and accelerating adoption of high-performance protective gear across industrial, military, and firefighting sectors. Frictional Materials is the second-largest and remains structurally important due to continued growth in automotive and industrial braking systems. Over the forecast period, Filtration emerges as the fastest-growing segment with a CAGR of 6.6%, propelled by rising environmental regulations, expansion of high-temperature industrial filtration, and greater demand from chemical processing. Safety & Protection follows closely, supported by sustained investment in personal protective equipment (PPE) and defense readiness worldwide.

Aramid Fibers Market Report Scope

This global report on Aramid Fibers analyzes the market based on type and application for the period 2022-2032 with projections from 2025 to 2032 in terms of volume in metric tons and value in US$. This report also reveals historical and current aramid fibers installed production capacities and future expansions by all aramid fibers manufacturers across the globe. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of aramid fibers industry.

Key Metrics

| Historical Period: | 2022-2024 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Volume consumption in metric tons and Value market in US$ | |

| Companies Mentioned: | 21 |

Global Aramid Fibers Market by Geographic Region

- North America (United States and Canada)

- Europe (France, Germany, Italy, Spain, Russia, The United Kingdom and Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea and Rest of Asia-Pacific)

- Rest of World

Global Aramid Fibers Market by Product Type

- Para-Aramid Fibers

- Meta-Aramid Fibers

Global Aramid Fibers Market by Application

- Safety & Protection (Ballistic Protection, Cut Protection, Thermal Protection)

- Electrical Insulation

- Frictional Materials

- Optical Fiber Cables

- Tire Reinforcements

- Filtration

- Rubber Reinforcements (Automotive and Industrial Hoses, Conveyor and Power Transmissions Belts, Flow-lines and Umbilicals)

- Other Applications (Civil Engineering, Composites, Engineering Plastics, Ropes and Cables, Electrical Components etc.)

Global Aramid Fibers Installed Production Capacity

- Aramid Fibers Installed Production Capacity by Company

- Aramid Fibers Installed Production Capacity by Country and Region

- Para-Aramid Fibers Installed Production Capacity by Company

- Meta-Aramid Fibers Installed Production Capacity by Company

Aramid Fibers Market Frequently Asked Questions (FAQs)

In 2025, the global market stood at US$3.9 billion, with strong demand from safety, protection, friction materials, optical fiber cables, and filtration applications.

Para-aramid fibers account for nearly 68.5% of global market value in 2025, driven by their superior strength, high-temperature resistance, and broad usage in ballistic protection and reinforcement applications.

Asia-Pacific is the largest regional market with a 37.6% share, driven by industrial expansion, telecom fiber deployment, automotive growth, and increasing investments in defense and PPE.

Safety & Protection is the leading application, contributing over 30% of total 2025 volumes due to rising global safety regulations, defense modernization, and widespread adoption of PPE.

Global aramid fiber consumption is projected to grow at a 5.8% CAGR, while market value will expand at a 5.1% CAGR between 2025 and 2032.

Key drivers include stricter regulatory standards for worker and fire safety, rising demand for ballistic protection, expansion of optical fiber networks, growth in high-temperature filtration, and increasing adoption in EV components and industrial reinforcements.

Major players include DuPont, Teijin, Yantai Tayho, Kolon Industries, Hyosung Advanced Materials, Sinopec Yizheng, Kamenskvolokno, Kermel, Toray Advanced Materials, AFChina Techtex, and other regional manufacturers expanding capacity.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Product Outline

- What are Aramid Fibers?

- Aramid Fiber Characteristics

- Advantages - Disadvantages

- Aramid Fiber Applications

- Types of Aramid Fibers

- Para-Aramid fibers

- Meta-Aramid fibers

- Production Process of Aramid Fibers

- End-Use Application Analysis

- Frictional Materials

- Market for Aramid fibers in Frictional Materials

- Safety & Protection

- Ballistic Protection

- Cut Protection

- Thermal Protection

- Market for Aramid fibers in Safety & Protection applications

- Tire Reinforcements

- Market for Aramid fiber in Tire Reinforcements

- Rubber Reinforcements

- Automotive and Industrial Hoses

- Conveyor and Power Transmissions Belts

- Flow-lines and Umbilicals

- Other Rubber Products

- Market for Aramid fibers in Rubber Reinforcements

- Optical Fiber Cables

- Market for Aramid fibers in Optical Fiber Cables

- Filtration

- Market for Aramid fibers in Filtration

- Electrical Insulation

- Market for Aramid fibers in Electrical Insulation

- Other Applications

- Civil Engineering

- Composites

- Engineering Plastics

- Ropes and Cables

- Electrical Components

- Market for Aramid fibers in Other Applications

2. KEY MARKET TRENDS

3. INDUSTRY LANDSCAPE

- Aramid Fiber Production Capacities

- Aramid Fiber Capacity Share by Company

- Para-Aramid Fiber Capacity Share by Company

- Meta-Aramid Fiber Capacity Share by Company

- Key Global Players

- AFChina Techtex

- Bluestar Chengrand

- DuPont

- Guangdong Charming

- Hebei Silicon Valley

- Huvis

- Hyosung Advanced Materials

- Jiangsu Shengbang New Materials

- Kamenskvolokno

- Kermel

- Kolon Industries

- Qingdao Polybeautify Sci-Tech

- Shandong Jufang New Materials

- Shenma Industrial

- Sinochem International

- Sinopec Yizheng

- Taekwang Industrial

- Teijin

- Toray Advanced Materials

- X-Fiper New Materials (SRO Group)

- Yantai Tayho

4. KEY BUSINESS & PRODUCT TRENDS

5. GLOBAL MARKET OVERVIEW

- Global Aramid Fiber Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by Global Region

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Global Aramid Fiber Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Aramid Fibers End-Use Application Overview by Global Region

- Safety & Protection Applications

- Volume Analysis

- Value Analysis

- Frictional Materials

- Volume Analysis

- Value Analysis

- Electrical Insulation

- Volume Analysis

- Value Analysis

- Filtration Applications

- Volume Analysis

- Value Analysis

- Optical Fiber Cables

- Volume Analysis

- Value Analysis

- Tire Reinforcements

- Volume Analysis

- Value Analysis

- Rubber Reinforcements

- Volume Analysis

- Value Analysis

- Other Applications

- Volume Analysis

- Value Analysis

PART B: REGIONAL MARKET PERSPECTIVE

- Global Aramid Fiber Market Overview by Geographic Region

- Volume Analysis

- Value Analysis

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- Market Overview by Geographic Region

- Volume Analysis

- Value Analysis

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by North American Region

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Major Market Players

- North American Aramid Fibers Market Overview by Country

- The United States

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Canada

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

7. EUROPE

- Market Overview by Geographic Region

- Volume Analysis

- Value Analysis

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by European Region

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Volume Analysis

- Major Market Players

- European Aramid Fibers Market Overview by Country

- France

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Germany

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Italy

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Russia

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Spain

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- The United Kingdom

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Rest of Europe

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

8. ASIA-PACIFIC

- Market Overview by Geographic Region

- Volume Analysis

- Value Analysis

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by Asia-Pacific Region

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Major Market Players

- Asia-Pacific Aramid Fibers Market Analysis by Country

- Japan

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- China

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- South Korea

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- India

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

- Rest of Asia-Pacific

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

9. REST OF WORLD

- Market Overview by End-Use Application

- Volume Analysis

- Value Analysis

- Market Overview by Product Type

- Volume Analysis

- Value Analysis

- Aramid Fibers Product Type Overview by End-Use Application

- Para-Aramid Fibers

- Volume Analysis

- Value Analysis

- Meta-Aramid Fibers

- Volume Analysis

- Value Analysis

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

- RESEARCH METHODOLOGY

- FEEDBACK

AFChina Techtex

Bluestar Chengrand

DuPont

Guangdong Charming

Hebei Silicon Valley

Huvis

Hyosung Advanced Materials

Jiangsu Shengbang New Materials

Kamenskvolokno

Kermel

Kolon Industries

Qingdao Polybeautify Sci-Tech

Shandong Jufang New Materials

Shenma Industrial

Sinochem International

Sinopec Yizheng

Taekwang Industrial

Teijin Aramid

Toray Advanced Materials

X-Fiper New Materials (SRO Group)

Yantai Tayho

Take Advantage of Year-end Discounts!

Click "Avail Offer", and email us to get the discount!

15% off

Offer ends Jan 31, 2026

RELATED REPORTS

Global Pigments & Dyes Market - Types, Formulations and Applications

Report Code: CHM216 | Pages: 342 | Price: $4500

Published

Jan 2026

Ultra-High Molecular Weight Polyethylene (UHMWPE) Fiber - A Global Market Overview

Report Code: CHM408 | Pages: 187 | Price: $3960

Published

Jan 2026

Polyphenylene Sulfide (PPS) Fiber - A Global Market Overview

Report Code: CHM409 | Pages: 149 | Price: $3960

Published

Jan 2026

Global High-Performance Fibers Market - Products and Applications

Report Code: CHM410 | Pages: 525 | Price: $4950

Published

Jan 2026