Global Seed Coating Market Trends and Outlook

Seed coating is a targeted material-application technique that enhances seed performance, plantability, and protection by applying a thin film, an encrusted layer, or a fully pelleted coating while preserving the seed's natural shape. Formulations combine polymers, binders, colorants, minerals, and functional additives to improve flowability, reduce dust, strengthen adhesion, and ensure smooth passage through mechanical planting equipment. Polymers act as the main film, colorants aid identification and compliance, and minerals adjust size and weight, particularly in encrusted or pelleted formats. Additional components such as surfactants, thickeners, anti-foaming agents, and solvents stabilize the mixture for consistent application. Film coating, encrusting, and pelleting support better handling, planting accuracy, and seedling establishment, contributing to more sustainable and efficient crop production.

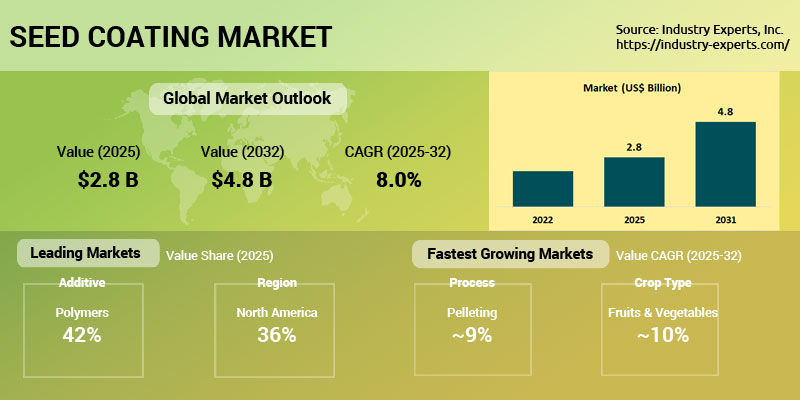

The global seed coating market is valued at US$2.8 billion in 2025 and expected to reach US$4.8 billion by 2032, reflecting an 8% CAGR from 2025 to 2032. Market growth is fueled by technological advances in controlled-release systems, nano-encapsulation, and bio-based materials, which improve germination, early vigor, and environmental safety. Rising demand for high-yield crops, expanding precision agriculture practices, and the integration of nutrients, biologicals, and active ingredients into coatings are driving adoption. Farmers view seed coating as a cost-effective alternative to multiple field applications, especially under climate and pest pressure. Increasing focus on sustainable and organic farming is also accelerating the development of biodegradable and biological coatings, while strong agricultural expansion in emerging markets and supportive government initiatives further broaden global uptake.

Seed Coating Regional Market Analysis

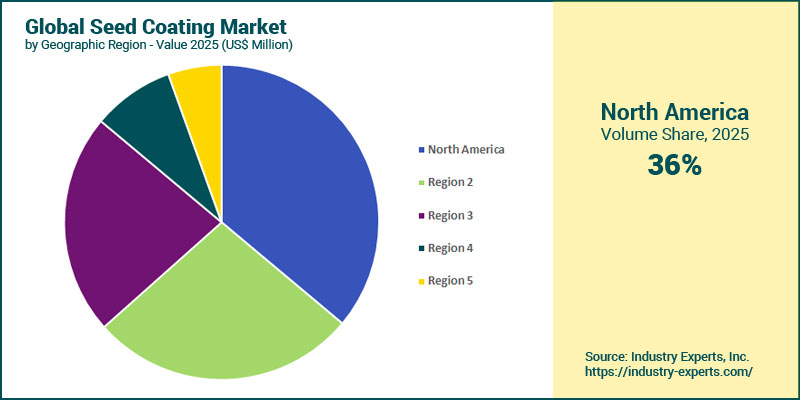

North America dominates the global seed coating market, with a 36% share in 2025. This leadership is supported by advanced agricultural infrastructure, the adoption of precision farming, and strong involvement from major seed and agrochemical companies. High-value crops such as corn, soybeans, and canola rely heavily on coatings to enhance germination, crop uniformity, and early pest protection. Extensive R&D activity, regulatory clarity, and established distribution networks further strengthen market penetration across the U.S. and Canada. Farmers are increasingly opting for coated seeds to enhance planting efficiency and minimize chemical inputs, all while promoting sustainable production systems. Conversely, the Asia Pacific region is projected to record the fastest growth in the seed coating market, with a CAGR of 9.6% from 2025 to 2032. This growth is driven by rising population, increasing food demand, and rapid adoption of modern farming practices in China, India, and Southeast Asia. Increasing awareness of the advantages of coated seeds, including better germination and enhanced protection against early pests, is boosting their adoption across the region. Government initiatives supporting agricultural productivity and investments in smart farming technologies further accelerate market growth.

Seed Coating Market Analysis by Additive

The polymers segment dominates the seed coating market, with a 42.4% share in 2025, due to its essential role in forming uniform and durable films that enhance adhesion, protect seeds, and enable controlled release of nutrients and active ingredients. Polymers enhance flowability, minimize dust, and allow precise application across various crops. Their low viscosity and water-based properties promote faster germination and protect seeds from stress during early growth. Their compatibility with chemical and biological inputs, ability to tailor coatings to crop and environmental conditions, and expanding use of biodegradable and water-soluble formulations reinforce their dominance. Innovations such as polymer-based controlled-release systems and eco-friendly materials further strengthen their adoption across sustainable and precision agriculture. In contrast, the Other Additives segment, which includes wetting and dispersing agents, anti-foaming agents, thickeners, and solvents, is anticipated to experience the highest growth rate, with a CAGR of 9.3% from 2025 to 2032. This growth is driven by the rising adoption of biological seed treatments, tightening environmental regulations, and increasing demand for formulation stability, viscosity control, and uniform coating performance in high-value crops. Its growth reflects the increasing complexity of modern coating systems and stricter environmental and dust-off regulations.

Seed Coating Market Analysis by Process

The film coating segment is the largest in the seed coating market with a 53% share in 2025, driven by its ability to apply a thin, uniform protective layer that enhances flowability, sowing precision, and dust reduction without altering seed size or weight. This process supports controlled delivery of nutrients, fungicides, and insecticides, improves germination, and preserves seed integrity, making it widely adopted across large-scale and precision farming systems. Its versatility, compatibility with diverse crops, and suitability for advanced agricultural practices reinforce its dominance, further strengthened by innovations in eco-friendly and biodegradable coating materials. Meanwhile, the pelleting segment is projected to grow the fastest at a CAGR of 9% from 2025 to 2032, supported by its capacity to transform irregular seeds into uniformly round units that improve handling, automated planting accuracy, and targeted delivery of active ingredients, particularly in high-value vegetable, flower, and horticultural crops.

Seed Coating Market Analysis by Crop Type

Cereals & grains hold the largest share of 44.2% in the seed coating market in 2025, reflecting their role as global staple crops cultivated extensively across Asia, North America, and Europe. High-volume production of wheat, rice, maize, and barley drives strong demand for coatings that enhance germination, uniform emergence, and early-season protection against pests and diseases. Seed coatings align well with large-scale cereal farming by enhancing precision sowing, seed flowability, and stress tolerance in challenging climates or nutrient-deficient soils. The importance of cereals and grains in ensuring global food security drives investments in advanced seed technologies that enhance productivity and resilience. Conversely, the fruits & vegetables segment is expected to grow the fastest at a 10% CAGR from 2025 to 2032, supported by rising global production, expanding demand for high-quality and organic produce, and increasing reliance on coatings to improve seed health, reduce pesticide needs, and enhance crop establishment in high-value horticultural systems.

Seed Coating Market Report Scope

This global report on Seed Coating analyzes the market based on additive, process, and crop type for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Historical Period: | 2022-2024 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 15+ |

Seed Coating Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- South America (Brazil, Argentina, and Rest of South America)

- Rest of World

Seed Coating Market by Additive

- Polymers

- Binders

- Colorants

- Minerals/Pumice

- Other Additives (Including Wetting & Dispersing Agents, Anti-Foaming Agents, Thickeners, Solvents, and others)

Seed Coating Market by Process

- Film Coating

- Encrusting

- Pelleting

Seed Coating Market by Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Other Crop Types (Including Forage and Turf Grasses, and others)

Seed Coating Market Frequently Asked Questions (FAQs)

The global Seed Coating market is likely to grow at a CAGR of 8% during the 2025-2032 analysis period.

North America is the largest region in the global seed coating market, holding a 36% share in 2025

Asia-Pacific is the fastest-growing region in the seed coating market, expanding at a CAGR of 9.6% during the forecast period of 2025-2032.

Polymers are the leading additive segment in the seed coating market, accounting for a 42.4% share in 2025.

Film coating is the largest segment in the seed coating market, accounting for 53% of the market share in 2025.

The factors driving demand for the seed coating market are the need to improve germination, strengthen early-season crop protection, support precision agriculture practices, reduce overall chemical inputs, and increase yields across large-scale and high-value crop systems.

The global market size for Seed Coating is estimated at US$2.8 billion in 2025 and US$4.8 billion by 2032.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Additive Outline

- Seed Coating Defined

- Seed Coating Additives

- Polymers

- Binders

- Colorants

- Minerals/Pumice

- Other Additives (Including Wetting & Dispersing Agents, Anti-Foaming Agents, Thickeners, Solvents, and Others)

- Seed Coating Technologies

- Film Coating

- Encrusting

- Pelleting

- Seed Coating Crop Types

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Other Crop Types (Including Forage and Turf Grasses, and others)

2. Key Market Trends

3. Key Market Players

- BASF SE

- Brett Young Seeds Ltd

- Centor Oceania

- Chromatech Incorporated

- Clariant International Ltd

- Corteva Agriscience

- Germains Seed Technology

- Incotec Group

- Michelman Inc.

- Milliken & Company

- Precision Laboratories LLC

- Sensient Technologies Corporation

- Smith Seed Services

- Syensqo SA/NV

- Syngenta AG

4. Key Business & Additive Trends

5. Global Market Overview

- Global Seed Coating Market Overview by Additive

- Seed Coating Additive Market Overview by Global Region

- Polymers

- Binders

- Colorants

- Minerals/Pumice

- Other Additives

- Global Seed Coating Market Overview by Process

- Seed Coating Process Market Overview by Global Region

- Film Coating

- Encrusting

- Pelleting

- Global Seed Coating Market Overview by Crop Type

- Seed Coating Crop Type Market Overview by Global Region

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Other Crop Types

PART B: REGIONAL MARKET PERSPECTIVE

- Global Seed Coating Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Seed Coating Market Overview by Geographic Region

- North American Seed Coating Market Overview by Additive

- North American Seed Coating Market Overview by Process

- North American Seed Coating Market Overview by Crop Type

- Country-Wise Analysis of the North American Seed Coating Market

- The United States

- United States Seed Coating Market Overview by Additive

- United States Seed Coating Market Overview by Process

- United States Seed Coating Market Overview by Crop Type

- Canada

- Canadian Seed Coating Market Overview by Additive

- Canadian Seed Coating Market Overview by Process

- Canadian Seed Coating Market Overview by Crop Type

- Mexico

- Mexican Seed Coating Market Overview by Additive

- Mexican Seed Coating Market Overview by Process

- Mexican Seed Coating Market Overview by Crop Type

7. Europe

- European Seed Coating Market Overview by Geographic Region

- European Seed Coating Market Overview by Additive

- European Seed Coating Market Overview by Process

- European Seed Coating Market Overview by Crop Type

- Country-Wise Analysis of European Seed Coating Market

- Germany

- German Seed Coating Market Overview by Additive

- German Seed Coating Market Overview by Process

- German Seed Coating Market Overview by Crop Type

- France

- French Seed Coating Market Overview by Additive

- French Seed Coating Market Overview by Process

- French Seed Coating Market Overview by Crop Type

- The United Kingdom

- United Kingdom Seed Coating Market Overview by Additive

- United Kingdom Seed Coating Market Overview by Process

- United Kingdom Seed Coating Market Overview by Crop Type

- Italy

- Italian Seed Coating Market Overview by Additive

- Italian Seed Coating Market Overview by Process

- Italian Seed Coating Market Overview by Crop Type

- Spain

- Spanish Seed Coating Market Overview by Additive

- Spanish Seed Coating Market Overview by Process

- Spanish Seed Coating Market Overview by Crop Type

- Rest of Europe

- Rest of Europe Seed Coating Market Overview by Additive

- Rest of Europe Seed Coating Market Overview by Process

- Rest of Europe Seed Coating Market Overview by Crop Type

8. Asia-Pacific

- Asia-Pacific Seed Coating Market Overview by Geographic Region

- Asia-Pacific Seed Coating Market Overview by Additive

- Asia-Pacific Seed Coating Market Overview by Process

- Asia-Pacific Seed Coating Market Overview by Crop Type

- Country-Wise Analysis of the Asia-Pacific Seed Coating Market

- Japan

- Japanese Seed Coating Market Overview by Additive

- Japanese Seed Coating Market Overview by Process

- Japanese Seed Coating Market Overview by Crop Type

- China

- Chinese Seed Coating Market Overview by Additive

- Chinese Seed Coating Market Overview by Process

- Chinese Seed Coating Market Overview by Crop Type

- India

- Indian Seed Coating Market Overview by Additive

- Indian Seed Coating Market Overview by Process

- Indian Seed Coating Market Overview by Crop Type

- South Korea

- South Korean Seed Coating Market Overview by Additive

- South Korean Seed Coating Market Overview by Process

- South Korean Seed Coating Market Overview by Crop Type

- Rest of Asia-Pacific

- Rest of Asia-Pacific Seed Coating Market Overview by Additive

- Rest of Asia-Pacific Seed Coating Market Overview by Process

- Rest of Asia-Pacific Seed Coating Market Overview by Crop Type

9. South America

- South American Seed Coating Market Overview by Geographic Region

- South American Seed Coating Market Overview by Additive

- South American Seed Coating Market Overview by Process

- South American Seed Coating Market Overview by Crop Type

- Country-Wise Analysis of the South American Seed Coating Market

- Brazil

- Brazilian Seed Coating Market Overview by Additive

- Brazilian Seed Coating Market Overview by Process

- Brazilian Seed Coating Market Overview by Crop Type

- Argentina

- Argentine Seed Coating Market Overview by Additive

- Argentine Seed Coating Market Overview by Process

- Argentine Seed Coating Market Overview by Crop Type

- Rest of South America

- Rest of South American Seed Coating Market Overview by Additive

- Rest of South American Seed Coating Market Overview by Process

- Rest of South American Seed Coating Market Overview by Crop Type

10. Rest of World

- Rest of World Seed Coating Market Overview by Additive

- Rest of World Seed Coating Market Overview by Process

- Rest of World Seed Coating Market Overview by Crop Type

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

BASF SE

Brett Young Seeds Ltd

Centor Oceania

Chromatech Incorporated

Clariant International Ltd

Corteva Agriscience

Germains Seed Technology

Incotec Group

Michelman Inc.

Milliken & Company

Precision Laboratories LLC

Sensient Technologies Corporation

Smith Seed Services

Syensqo SA

Syngenta AG

RELATED REPORTS

Feed Acidulants - A Global Market Overview

Report Code: AGR023 | Pages: 391 | Price: $4500

Published

Jan 2026

Global Feed Enzymes Market - Product Types, Sources, Livestock and Forms

Report Code: AGR025 | Pages: 306 | Price: $4500

Published

Nov 2025

Global Potash Fertilizers Market - Product Types, Applications, Forms and Crop Types

Report Code: AGR041 | Pages: 306 | Price: $4500

Published

Nov 2025

Global Biological Seed Treatment Market - Sources, Functions and Crop Types

Report Code: AGR015 | Pages: 251 | Price: $4500

Published

Oct 2025