Global Animal Feed Additives Market Trends and Outlook

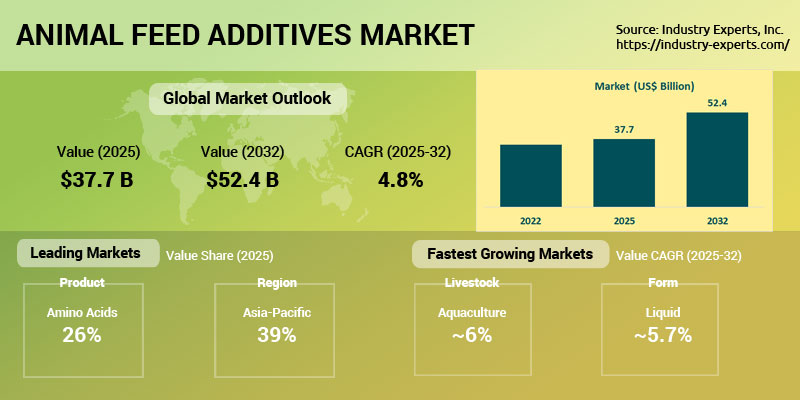

The global animal feed additives market is poised for steady growth, expanding from US$37.7 billion in 2025 to US$52.4 billion by 2032, registering a CAGR of 4.8%. Rising demand for protein-rich foods such as meat, milk, and eggs is driving adoption of feed additives that enhance nutrient absorption, immunity, and feed efficiency across livestock species. Key categories include amino acids, vitamins, minerals, enzymes, probiotics, prebiotics, acidifiers, and antioxidants, all playing essential roles in improving growth, reproduction, and disease resistance. Increasing awareness of animal welfare and sustainable farming practices is further encouraging the use of natural and eco-friendly additives as alternatives to antibiotics.

Technological advancements, including biotechnology innovations and precision feeding systems, are strengthening the market by optimizing nutrient utilization and reducing costs. Meanwhile, global challenges such as antimicrobial resistance, climate change, and frequent disease outbreaks highlight the growing reliance on additives to improve livestock resilience. Regulatory frameworks supporting food safety and consumer demand for transparent, high-quality, and sustainable products further shape industry growth. Emerging opportunities in Asia-Pacific, rising aquaculture demand, and the growing pet nutrition market also position feed additives as a vital component in the evolution of modern livestock and aquaculture farming.

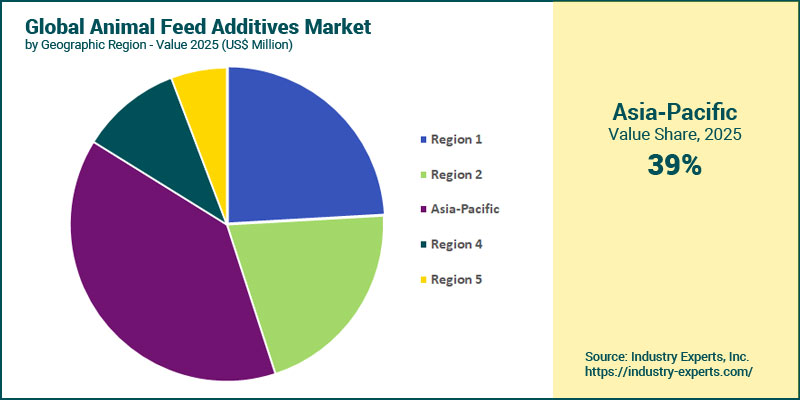

Animal Feed Additives Regional Market Analysis

The Asia-Pacific region dominates the global animal feed additives market, accounting for 38.8% share in 2025 and projected to grow at the fastest CAGR of 5.3% through 2032. This growth is driven by rising meat, dairy, and poultry consumption from population growth, urbanization, and higher incomes. China dominates production and consumption, while India, Indonesia, Thailand, and Vietnam are rapidly expanding feed output. Factors such as increased awareness of animal welfare, protein-rich diets, government support, technological advancements, and the push for productivity and self-sufficiency further drive adoption. Meanwhile, North America is the second-largest market, propelled by rising meat demand, stringent quality regulations, and growing awareness of animal welfare and food safety. Intensive poultry and swine farming has driven the adoption of feed additives to enhance growth, feed efficiency, and performance. Availability of raw materials and a shift toward sustainable, premium feed solutions further support market growth, with innovations and regulatory support sustaining long-term expansion.

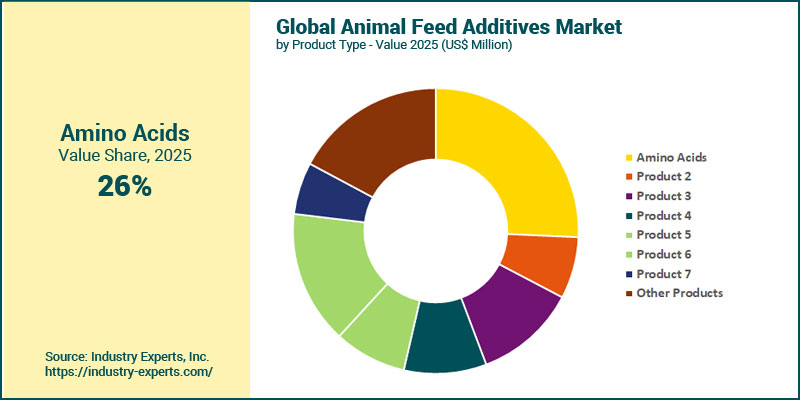

Animal Feed Additives Market Analysis by Product

The amino acids segment leads the animal feed additives market in 2025, holding a 25.7% share, due to its critical role in promoting growth, enhancing immunity, and supporting overall health. Amino acids, including lysine, methionine, threonine, and tryptophan, are essential for muscle development, tissue repair, reproduction, and metabolic functions, and are particularly important in poultry, swine, and aquaculture feeds. Their inclusion in feed optimizes nutrient profiles, improves feed efficiency, reduces disease risks, and lowers overall production costs, making them indispensable in intensive livestock farming. In contrast, the vitamins segment is projected to record the fastest CAGR of 5.75% during the forecast period 2025-2032. Vitamins, supplied in premixes or small quantities, are crucial for growth, immunity, reproduction, and lactation in livestock such as cattle, sheep, and goats. Vitamins A and E are the most widely used, ensuring proper development and productivity where natural feed sources are insufficient. The rising focus on animal health and high-quality production underpins the growing adoption of vitamin-based feed additives.

Animal Feed Additives Market Analysis by Livestock

The poultry segment is the largest within the animal feed additives market, capturing a 36% share in 2025. This growth is driven by increasing global demand for chicken meat and eggs, along with urbanization and rising incomes. Additives such as enzymes, vitamins, antioxidants, and acidifiers improve growth, feed efficiency, immunity, and product quality, while disease outbreaks and consumer demand for antibiotic-free products further boost adoption. Poultry's scalability and intensive farming practices enable efficient additive use, supporting productivity and animal welfare. On the other hand, the aquaculture segment is projected to grow the fastest, with a CAGR of 5.6% from 2025 to 2032. This growth is driven by an increase in fish and shrimp farming, a rising demand for sustainably produced seafood, and the necessity for enhanced growth, survival, and disease resistance. These trends create significant opportunities for feed additive manufacturers across both sectors.

Animal Feed Additives Market Analysis by Form

In 2025, the dry form dominates the animal feed additives market, with a 67.7% share due to its long shelf life, ease of storage, and convenient handling, making it ideal for large-scale feed production. Available as powders, granules, and pellets, dry additives ensure uniform mixing, accurate dosing, and stability during transport, reducing spoilage and maintaining nutrient effectiveness. Their flexibility enables the blending of various ingredients, enhancing precision nutrition and cost-efficiency for livestock producers. Conversely, Liquid additives are anticipated to grow the fastest with a CAGR of 5.7% from 2025 to 2032. They offer benefits such as precise dosing, enhanced palatability, quicker absorption, and improved nutrient distribution. Both forms play complementary roles, with dry types preferred for bulk handling and storage, while liquids gain traction for precision feeding and intensive livestock systems.

Animal Feed Additives Market Report Scope

This global report on Animal Feed Additives analyzes the market based on product, livestock, and form for the period 2022-2032 with projection from 2025 to 2032 in terms of value in US$. In addition to providing profiles of 15+ major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

Key Metrics

| Analysis Period: | 2022-2032 | |

| Base Year: | 2025 | |

| Forecast Period: | 2025-2032 | |

| Units: | Value market in US$ | |

| Companies Mentioned: | 15+ |

Animal Feed Additives Market by Geographic Region

- North America (The United States, Canada, and Mexico)

- Europe (Germany, France, the United Kingdom, Italy, Spain, and Rest of Europe)

- Asia-Pacific (Japan, China, India, South Korea, and Rest of Asia-Pacific)

- South America (Brazil, Argentina, and Rest of South America)

- Rest of World

Animal Feed Additives Market by Product

- Amino Acids

- Antibiotics

- Vitamins

- Feed Enzymes

- Minerals

- Feed Acidifiers

- Antioxidants

- Other Products (Including Binders, Pigments, Flavors, Phytogenics, Lipids, Mycotoxin Detoxifiers, Prebiotics & Probiotics, Preservatives, and Others)

Animal Feed Additives Market by Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others (Pet Animals, Equines, and Other Exotic Animals)

Animal Feed Additives Market by Form

- Dry

- Liquid

Animal Feed Additives Market Frequently Asked Questions (FAQs)

The global Animal Feed Additives market is likely to grow at a CAGR of 4.8% during the 2025-2032 analysis period.

The largest region in the global Animal Feed Additives market is Asia-Pacific, accounting for 38.8% share in 2025.

The fastest-growing region in the global Animal Feed Additives market is Asia-Pacific, with a projected CAGR of 5.3% during 2025-2032.

The leading product in the Animal Feed Additives market is amino acids, holding the largest market share of 25.7% in 2025.

The largest livestock segment for Animal Feed Additives is poultry, representing a 36% market share in 2025.

The demand for the Animal Feed Additives market is driven by rising global protein consumption, population growth, urbanization, disease prevention needs, animal welfare awareness, and the adoption of advanced feed technologies.

The global market size for Animal Feed Additives is estimated at US$37.7 billion in 2025 and US$52.4 billion by 2032.

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- Product Outline

- Animal Feed Additives Defined

- Animal Feed Additive Products

- Amino Acids

- Antibiotics

- Vitamins

- Feed Enzymes

- Minerals

- Feed Acidifiers

- Antioxidants

- Other Products (Including Binders, Pigments, Flavors, Phytogenics, Lipids, Mycotoxin Detoxifiers, Prebiotics & Probiotics, Preservatives, and Others)

- Animal Feed Additive Livestock

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others (Pet Animals, Equines, and Other Exotic Animals)

- Animal Feed Additive Forms

- Dry

- Liquid

2. Key Market Trends

3. Key Market Players

- Adisseo France SAS

- Ajinomoto Co., Inc.

- Alltech, Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Elanco Animal Health Incorporated

- Evonik Industries AG

- Kemin Industries, Inc.

- Novonesis

- Novus International, Inc.

- Nutreco N.V.

- Phibro Animal Health Corporation

4. Key Business & Product Trends

5. Global Market Overview

- Global Animal Feed Additives Market Overview by Product

- Animal Feed Additives Product Market Overview by Global Region

- Amino Acids

- Antibiotics

- Vitamins

- Feed Enzymes

- Minerals

- Feed Acidifiers

- Antioxidants

- Other Products

- Global Animal Feed Additives Market Overview by Livestock

- Animal Feed Additives Livestock Market Overview by Global Region

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

- Global Animal Feed Additives Market Overview by Form

- Animal Feed Additives Form Market Overview by Global Region

- Dry

- Liquid

PART B: REGIONAL MARKET PERSPECTIVE

- Global Animal Feed Additives Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. North America

- North American Animal Feed Additives Market Overview by Geographic Region

- North American Animal Feed Additives Market Overview by Product

- North American Animal Feed Additives Market Overview by Livestock

- North American Animal Feed Additives Market Overview by Form

- Country-Wise Analysis of the North American Animal Feed Additives Market

- The United States

- United States Animal Feed Additives Market Overview by Product

- United States Animal Feed Additives Market Overview by Livestock

- United States Animal Feed Additives Market Overview by Form

- Canada

- Canadian Animal Feed Additives Market Overview by Product

- Canadian Animal Feed Additives Market Overview by Livestock

- Canadian Animal Feed Additives Market Overview by Form

- Mexico

- Mexican Animal Feed Additives Market Overview by Product

- Mexican Animal Feed Additives Market Overview by Livestock

- Mexican Animal Feed Additives Market Overview by Form

7. Europe

- European Animal Feed Additives Market Overview by Geographic Region

- European Animal Feed Additives Market Overview by Product

- European Animal Feed Additives Market Overview by Livestock

- European Animal Feed Additives Market Overview by Form

- Country-Wise Analysis of European Animal Feed Additives Market

- Germany

- German Animal Feed Additives Market Overview by Product

- German Animal Feed Additives Market Overview by Livestock

- German Animal Feed Additives Market Overview by Form

- France

- French Animal Feed Additives Market Overview by Product

- French Animal Feed Additives Market Overview by Livestock

- French Animal Feed Additives Market Overview by Form

- The United Kingdom

- United Kingdom Animal Feed Additives Market Overview by Product

- United Kingdom Animal Feed Additives Market Overview by Livestock

- United Kingdom Animal Feed Additives Market Overview by Form

- Italy

- Italian Animal Feed Additives Market Overview by Product

- Italian Animal Feed Additives Market Overview by Livestock

- Italian Animal Feed Additives Market Overview by Form

- Spain

- Spanish Animal Feed Additives Market Overview by Product

- Spanish Animal Feed Additives Market Overview by Livestock

- Spanish Animal Feed Additives Market Overview by Form

- Rest of Europe

- Rest of Europe Animal Feed Additives Market Overview by Product

- Rest of Europe Animal Feed Additives Market Overview by Livestock

- Rest of Europe Animal Feed Additives Market Overview by Form

8. Asia-Pacific

- Asia-Pacific Animal Feed Additives Market Overview by Geographic Region

- Asia-Pacific Animal Feed Additives Market Overview by Product

- Asia-Pacific Animal Feed Additives Market Overview by Livestock

- Asia-Pacific Animal Feed Additives Market Overview by Form

- Country-Wise Analysis of the Asia-Pacific Animal Feed Additives Market

- Japan

- Japanese Animal Feed Additives Market Overview by Product

- Japanese Animal Feed Additives Market Overview by Livestock

- Japanese Animal Feed Additives Market Overview by Form

- China

- Chinese Animal Feed Additives Market Overview by Product

- Chinese Animal Feed Additives Market Overview by Livestock

- Chinese Animal Feed Additives Market Overview by Form

- India

- Indian Animal Feed Additives Market Overview by Product

- Indian Animal Feed Additives Market Overview by Livestock

- Indian Animal Feed Additives Market Overview by Form

- South Korea

- South Korean Animal Feed Additives Market Overview by Product

- South Korean Animal Feed Additives Market Overview by Livestock

- South Korean Animal Feed Additives Market Overview by Form

- Rest of Asia-Pacific

- Rest of Asia-Pacific Animal Feed Additives Market Overview by Product

- Rest of Asia-Pacific Animal Feed Additives Market Overview by Livestock

- Rest of Asia-Pacific Animal Feed Additives Market Overview by Form

9. South America

- South American Animal Feed Additives Market Overview by Geographic Region

- South American Animal Feed Additives Market Overview by Product

- South American Animal Feed Additives Market Overview by Livestock

- South American Animal Feed Additives Market Overview by Form

- Country-Wise Analysis of the South American Animal Feed Additives Market

- Brazil

- Brazilian Animal Feed Additives Market Overview by Product

- Brazilian Animal Feed Additives Market Overview by Livestock

- Brazilian Animal Feed Additives Market Overview by Form

- Argentina

- Argentine Animal Feed Additives Market Overview by Product

- Argentine Animal Feed Additives Market Overview by Livestock

- Argentine Animal Feed Additives Market Overview by Form

- Rest of South America

- Rest of South American Animal Feed Additives Market Overview by Product

- Rest of South American Animal Feed Additives Market Overview by Livestock

- Rest of South American Animal Feed Additives Market Overview by Form

10. Rest of World

- Rest of World Animal Feed Additives Market Overview by Product

- Rest of World Animal Feed Additives Market Overview by Livestock

- Rest of World Animal Feed Additives Market Overview by Form

PART C: GUIDE TO THE INDUSTRY

PART D: ANNEXURE

1. RESEARCH METHODOLOGY

2. FEEDBACK

Adisseo France SAS

Ajinomoto Co., Inc.

Alltech, Inc.

Archer Daniels Midland Company (ADM)

BASF SE

Cargill, Incorporated

DSM-Firmenich AG

DuPont de Nemours, Inc.

Elanco Animal Health Incorporated

Evonik Industries AG

Kemin Industries, Inc.

Novonesis

Novus International, Inc.

Nutreco N.V.

Phibro Animal Health Corporation

RELATED REPORTS

Feed Acidulants - A Global Market Overview

Report Code: AGR023 | Pages: 391 | Price: $4500

Published

Jan 2026

Global Seed Coating Market - Additives, Processes and Crop Types

Report Code: AGR044 | Pages: 262 | Price: $4500

Published

Nov 2025

Global Feed Enzymes Market - Product Types, Sources, Livestock and Forms

Report Code: AGR025 | Pages: 306 | Price: $4500

Published

Nov 2025

Global Potash Fertilizers Market - Product Types, Applications, Forms and Crop Types

Report Code: AGR041 | Pages: 306 | Price: $4500

Published

Nov 2025

Global Biological Seed Treatment Market - Sources, Functions and Crop Types

Report Code: AGR015 | Pages: 251 | Price: $4500

Published

Oct 2025